50 Ways to Leave Your Lover

w.253 | Attention, Permission Structures, Predictions, Capital, Carvana, & 2025

Dear Friends,

Welcome back—time marches on. I hope you were able to unplug. I had a bunch of end-of-year work, but pushing through to the end always feels good, along with time with friends and family.

Today's Contents:

Sensible Investing: Trends

2025 Predictions

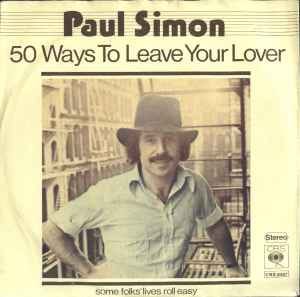

Song of the Week: 50 Ways To Leave Your Lover

Sensible Investing: Trends

Capital Will Matter More Than Ever After AGI By L Rudolf L. Labor-replacing AI will shift the relative importance of human vs. non-human factors of production, which reduces the incentives for society to care about humans while making existing powers more effective and entrenched.

69 Theses: Predictions, Lessons, and Longs for 2025. I usually avoid these lists, but this one is short, punchy, and specific. Mostly, crypto and AI talk from those who believe in a decentralized world. I liked this lesson:

Hemingway: “Old men do not grow wise, they grow careful.” Careful is the last thing we want to be as AI disrupts our jobs, social lives, economy, politics and the economy. Let everyone around you grow careful. Do whatever you must do to be bold and grow into the uncertainty.

Attention is What Makes Us Human: Dispatch from a Burning Warehouse. There was already much discussion about the attention economy, but this article does a nice job of pulling out the implications. My take is that attention and ‘consideration’ are two different things. It’s one thing to attend to something; it’s another to consider it. Consideration is thoughtful and deliberate. More active. So I aim for consideration.

When we fall in love with someone’s mind, it has far less to do with what they create and more to do with what they direct their attention toward. A relationship with Claude could satisfy me for a time on the level of output—I type, Claude types. When we are not speaking, I don’t know what Claude is paying attention to. Claude doesn’t either. I don’t look down on people that enjoy these relationships. What could possibly be more human than confusing information with attention? But the opposite of memory isn’t forgetting, it’s never having paid attention at all.

Rapid Onset Political Enlightenment: How Barack Obama built an omnipotent thought-machine and how it was destroyed in TabletMag. This is a looooong read but an interesting one in light of how information is shared today and how you may be influenced accordingly.

Permission structures, a term taken from advertising, was Axelrod’s secret sauce, the organizing concept by which he strategized campaigns for his clients. Where most consultants built their campaigns around sets of positive and negative ads that promoted the positive qualities of their clients and highlighted unfavorable aspects of their opponents’ characters and records, Axelrod’s unique area of specialization required a more specific set of tools.

To succeed, Axelrod needed to convince white voters to overcome their existing prejudices and vote for candidates whom they might define as “soft on crime” or “lacking competence.”

2035: An Allocator Looks Back Over the Last 10 Years—a reverse perspective from Cliff Asness written as a sarcastic letter to the investors of today.

Carvana: A Father-Son Accounting Grift For The Ages - Short report by Hindenburg Research. I love reading these reports. It’s a good reminder of the importance of real analysis and the purported fraud sitting in plain sight.

Even before considering the findings of our investigation, Carvana is exorbitantly valued, trading at an 845% higher sales multiple relative to online car peers CarMax and AutoNation, and a 754% premium on a forward earnings basis. The company has ~$4.8 billion in net debt and is junk-rated by ratings agencies.

Obviously The Future - 2025 Predictions

I wrote 14 predictions in 2024, and I still stand by ALL of them.

In learning, I feel like I’ve talked school choice, alternative education, and efficacious edutainment, AI-whatever into the ground. It’s about watching it unfold, and the winners will be those who sell and implement well. Always has been, always will be.

In earning, this one is hard to capture because so many trends are more effective practices for how people should run organizations and businesses. Those who see this work individually and organizationally will find greater success. The tools of enablement? Tricky to have a moat.

In owning, I didn’t make any predictions about government and the public sector. That will be a big change this year. The popular discourse has woken up to the business of government, and there will be much more focus on efficiency, delivery, and decision-making. Last year, I said that owning digital assets and platform control gains importance; I’d double or triple down on this one. This category is the most exciting.

This year, I will go broader. Not all of these are in the first inning, but they are certainly in early innings and will see an uptick in momentum this year.

We are in a period of significant inflection, which is exciting. As always, comments, thoughts, and intelligent disagreement are encouraged.

Big Picture

The Overton window expands.

With Elon Musk supporting Trump's winning election campaign, the Overton window will open significantly in 2025. Ideas previously unspeakable or off-limits have now been brought to the table. Jokes, like DOGE, have become serious. The crypto ecosystem is likely to be a huge beneficiary of this, and stablecoins may very well eat payments. Prediction markets (politically gambling) are likely to continue with fewer regulations. The new defense technology companies have significant allies in the White House. It’s within the realm of conversation (and therefor possiblilty) that the US pulls off territorial expansion. Maybe Greenland, maybe beyond.

Long-term demographic trends are becoming pronounced.

The dependency ratio worldwide is rising as birth rates are declining and the aging population lives longer. Government deficit spending cannot continue at its current rate to fill the pension and benefits gaps, especially as the need for support for young families becomes more pronounced. Many implications here that will surely take more than this year to play out.

Software productivity has accelerated, and computing power is increasing exponentially.

AI and LLM adoption is happening for both enterprise and consumer, but we are still in the early innings, particularly for legacy markets. Software development is always first and has shown significant productivity increases. This year, the market will realize how easy it is to commodify the LLMs and how quickly the leader can be replaced. This year might be the year quantum computing breaks through (or at least achieves the next breakthroughs that render commercial use cases possible - and raise plenty of other questions, especially in cybersecurity). The other implication is the need for dramatically cheaper energy, so innovation and push for nuclear capacity and other highly efficient energy sources will be a major point.

Inflation is here to stay.

The incoming Trump administration's policy proposals —threats of tariffs, deportation and tightening up illegal immigration, and re-shoring American manufacturing—are all inflationary. Bond markets are beginning to price higher inflation expectations, as the 10-year rate increased despite the cut in the federal funds rate in December.

For 2025:

Decentralized everything. Crypto, media, security, businesses, regulation, etc. The world is now too complex, fast-moving, and fragmented for top-down action and leadership. Systems and platforms that crowdsource and process collective intelligence into action have an opportunity to win big. Prediction markets shown themselves to be more reliable than polls. Citizen journalists have broken more significant and closer to the truth stories than the traditional media.

New Schooling: The room where it happens. While the world is transfixed on the potential of AI tutors, most people are still sleeping on the most significant unit of change: schools. Driven by the expansion of school choice and the inability of the existing system to produce the desired results, there is a demand for high-quality, independent schools. In all its forms, schooling is where learning happens, and the implementation of tools is the hinge point. New models will pop up from microschools, podschools, homeschools, and niche private schools of every vertical. Some of the biggest education companies in the world are direct delivery models.

The AI opportunity in education will continue to be the efficiency of systems (vertical SaaS 3.0) in all administrative functions like financial aid, grading, scheduling, admissions, enrollment, payroll, and credential validation, etc. AI in learning will flourish, but the breakout products will either be micro-niche (e.g., literacy tools for ESL learners age 3-6), or they will be best-in-class mainstream consumer technology (e.g., OpenAI, YouTube)

Lossless collaboration software for ease of knowledge transfer. It’s estimated that 90% of knowledge economy time and insight is lost. This is the endless meetings with too many people. Insight is never fully recorded. Information and data are sitting in silos or behind gates that never get put together. The opportunity for AI-driven analytics software is to increase productivity by decreasing losslessness. Glean is the enterprise early mover, but the concept is quickly expanding to all products.

Everyone is an Entrepreneur, or they must learn to think like one. The era of defined ‘career pathways’ is over. There is no guarantee that after years of study, a job or career (years of same job with upward progression) will be there on the other end to adequately cover the time or financial investment. There will be more ‘learn and earn’ arrangements where people learn quickly while on the job. People will pay for early job experience as a substitute for what they might have paid for the classroom; Ladder Internship is a good example - 8-week internship with a startup CEO where the intern pays $2,500. People will be savvier about monetizing their side hustles and online labor.

Government delivery is measured in outcomes. The last decade has seen an onslaught of government spending on big infrastructure and social programs. There’s now a spotlight on results. In many cases, they are severely lacking. Now, catalyzed by Elon and DOGE and the attention being placed on this topic on X and other platforms, people are demanding increased visibility and transparency for those outcomes. This should be a long-term net positive, particularly when it comes to public dollars.

Capital efficiency and small teams will dominate niche software businesses. SaaS markets will become increasingly competitive with increased software development and sales productivity. These businesses may raise no capital or take on one-and-done seed rounds underwritten more like growth equity economics than power-law ventures. Josh Mohrer recapped his 2024 as an indie hacker building Wave, a personal AI note-taker, with some big numbers:

Josh, if you take on capital as you grow the team, you know where to find me!

There are more predictions ahead - but I’m going to finish those on Obviously The Future and share the link next week.

Song of the Week: 50 Ways to Leave Your Lover

Here on YouTube.

"Excellent song" that has "very clever lyrics" and an "easy to listen to melody."[6] Cash Box said that it is "a clever, commercial song about the elasticity of love, how easy it is to pull away and equally easy to snap back with it.”

This is a good New Year’s song for anyone needing to make a change (not necessarily love life-related!). Just find a way to do it. There are tomes written on these subjects of behavior modification, but sometimes, it’s just about seeing the truth, conjuring the courage, and taking action. Just get yourself free.

“50 Ways to Leave Your Lover ” by Paul Simon

You just slip out the back, Jack

Make a new plan, Stan

You don't need to be coy, Roy

Just get yourself freeSelfie of the Week

My accomplishments during the holidays were building the most challenging marble run construction our set allowed and locking in to keep all marbles in circulation. Ruthie (my niece) is a good little indexer. In 2024, her 529 account beat her aunt’s brokerage because her aunt loves clipping coupons and hoarding productive assets! Let’s chalk it up to having a very long time horizon and effective risk management through diversification and hedging and celebrate not paying fees :)

Thanks for reading, friends. Please always be in touch.

As always,

Katelyn

How do you *feel* when you think about the future? I feel an incredulous anxiety that I have never felt before when I think about anything beyond 2028