Dear Friends,

First, an observation. I’ve had a more challenging time getting my hands on the primary source reports recently, but I’m doing my best. As the number of creators continues to increase, we will see how the distribution of novel versus derivative changes - and what premium novel work will have.

Five years ago this weekend, I was hiking the Annapurna circuit with a group of friends in Nepal. Sadly, on Day 8 of the trek, my friend’s dad had a massive heart attack and passed quickly. One of the last sentiments he expressed to me as we hiked, laughed, and chatted was to keep a gentle grasp on this fleeting life for the gift that it is. This time, every year, I reflect on that.

Today's Contents:

Sensible Investing: Trends

How I Manage My Own Money - Part 2

Song of the Week: Because The Night

Sensible Investing: Trends

State of AI Report 2024 produced by AI investor Nathan Benaich and Air Street Capital.

AI Begins Its Ominous Split Away from Human Thinking—an easy-to-digest explanation of how o1 (the reasoning model) from OpenAI works.

In many ways, o1 is pretty much the same as its predecessors – except that OpenAI has built in some 'thinking time' before it starts to answer a prompt. During this thinking time, o1 generates a 'chain of thought' in which it considers and reasons its way through a problem.

o1, unlike previous models that were more like the world's most advanced autocomplete systems, really 'cares' whether it gets things right or wrong. And through part of its training, this model was given the freedom to approach problems with a random trial-and-error approach in its chain of thought reasoning.

But o1 is still primarily trained on human language. That's very different from truth – language is a crude and low-res representation of reality. Put it this way: you can describe a biscuit to me all day long, but I won't have tasted it.

So what happens when you stop describing the truth of the physical world, and let the AIs go and eat some biscuits? We'll soon begin to find out, because AIs embedded in robot bodies are now starting to build their own ground-up understanding of how the physical world works.

Reflections on Palantir: A retrospective of an eight-year stint. By Nabeel S. Qureshi. This is a great, behind-the-scenes look at the work of a Forward Deployment Engineer at Palantir. It reminds me of my first job as a Business Analyst at McKinsey, which was admittedly less technical. As VCs rush in to fund the many flavors of ‘tech-enabled services,’ getting the culture and training of the client-serving, front-office folks will be the key. Modern best practice looks like what is described here.

I’ve been thinking about the many flavors of this new rebrand of professional services mixed with technology and will publish an article on it in Obviously The Future soon.

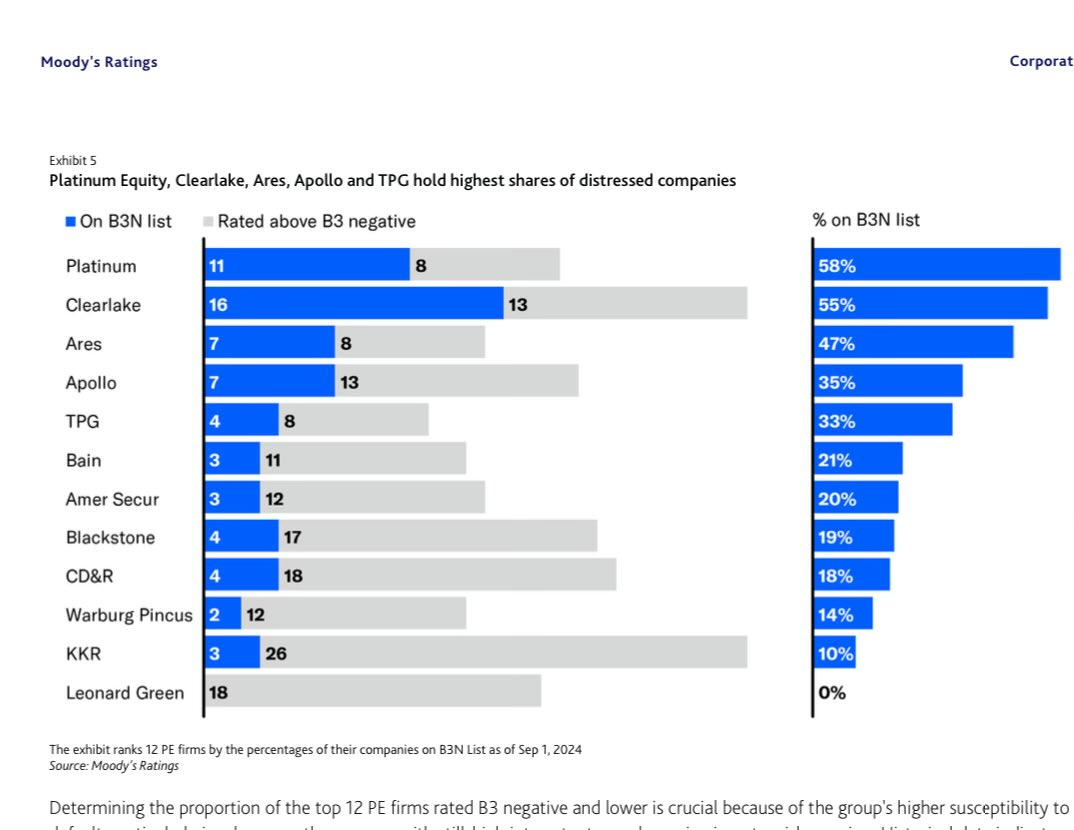

Report on Distress in PE Land. The report is by Moody’s but is behind their super subscriber paywall. If someone wants to send it to me, that’d be great. Linked is a summary on X with a bunch of charts, which notes:

As a former restructuring banker and current private equity associate, this is the sexiest thing I have read in months. So excited to dive in —→ 1) Large-Cap Private Equity Recent Defaults 2) PE shops with the most default deals 3) PE shops with the most dividend recapitalizations 4) PE shops with the most distressed deals 5) Upgrades and Downgrades across PE Shops 6) Approach to Leverage across PE shops 7) Downgrade odds across PE vs non PE companies.

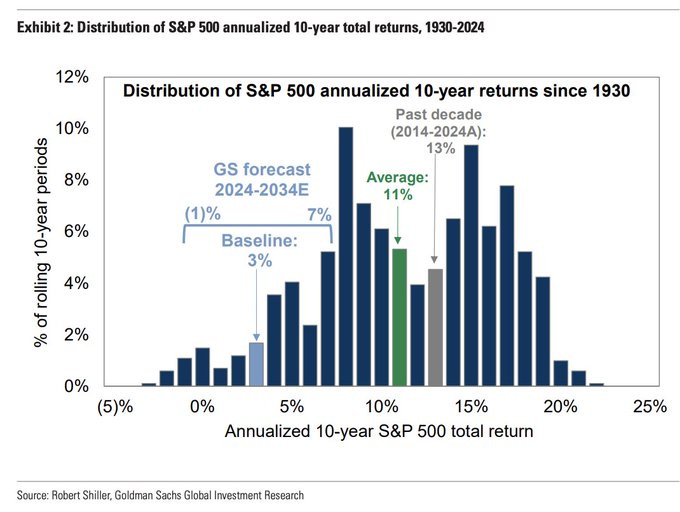

From a Recent Goldman Report. We estimate the S&P 500 will deliver an annualized nominal total return of 3% during the next ten years (7th percentile since 1930) and roughly 1% on a real basis.

Now, obviously, nobody knows anything, and they’ve said this last year too.

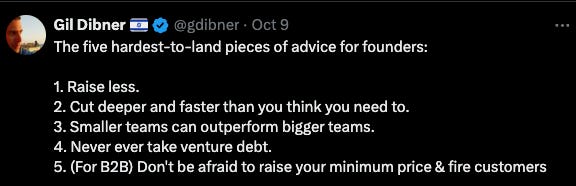

This rings true to me, and I have had many conversations with founders about each of these items.

How I Manage Money - Part 2.

As I started writing this, I ballooned into a rabbit hole, as this is proving to be a more complicated exercise than I had anticipated. It’s a personal topic worthy of proper consideration and writing, so that I will do it right - to start, I’m breaking it into parts.

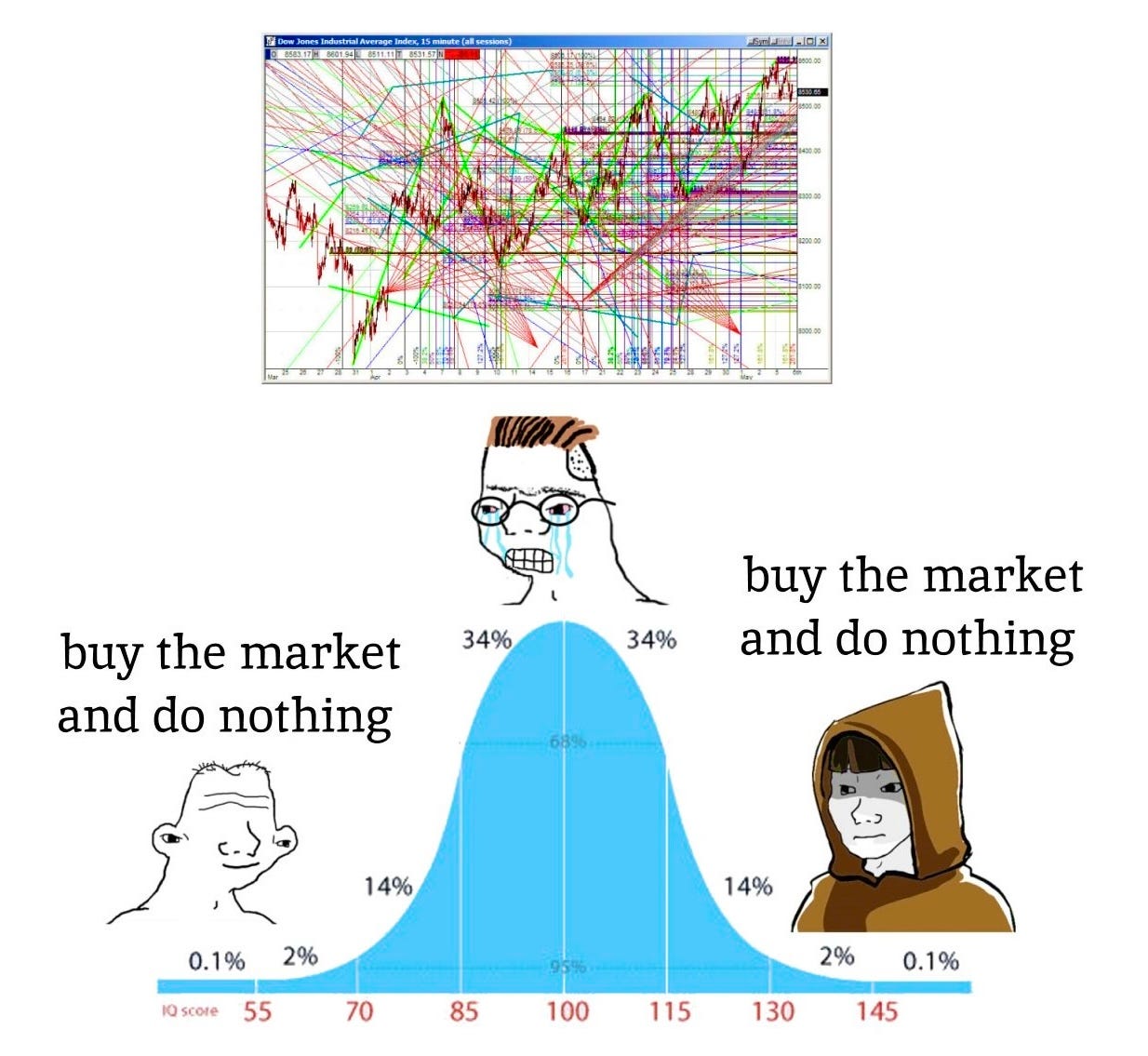

The big picture of my investing journey looks like the meme below (not that I ever did technical analysis, lol). Good news? I’m now solidly on the right-hand side.

But let’s talk about the non-diversified portion—the pursuit of avalanches.

Morgan Housel is one of the best modern finance writers. His book The Psychology of Money is excellent. We have a similar personal investing outlook: finding a way to set it and forget it through low-cost diversification. I’ll get more into this next time.

All that said, it would be best to take the opposite action in pursuing wealth or achieving outside returns. You must concentrate and bet big when you have an asymmetric advantage and a massive tailwind is in your favor. This drives how I invest in venture and the concept behind Avalanche. Morgan Housel explains this well in this devastating but illuminating article, The Three Sides Of Risk.

Morgan Housel and I both grew up ski racing in high school. However, the risk of avalanches is low on the bluffs of Minnesota. In Tahoe, not so much.

In the article, Housel recounts a day of free skiing with his two childhood friends and ski teammates. At the end of the afternoon, Housel calls it quits while his two buddies go back up the hill.

Sadly, he never sees them alive again. The next day, rescuers in an avalanche field found his friends buried under six feet of snow.

We knew we were taking risks when we skied. We knew going out of bounds was wrong and we might get caught. But at 17 years old we figured the consequences of risk meant our coaches might yell at us. Maybe we’d get our season pass revoked for the year.

Never, not once, did we think we’d pay the ultimate price.

But once you go through something like that, you realize that the tail-end consequences – the low-probability, high-impact events – are all that matter.

Housel defines the three sides of risk, which are all relevant to avalanche finding and defining:

The odds you will get hit.

The average consequences of getting hit.

The tail-end consequences of getting hit.

If you search for avalanches, you look for the ‘textbook perfect avalanche conditions’ and aim to invest before then to maximize your chances of getting hit in a big way. What wipes out others will power you up.

The tail-end consequences are the flip side of the power law.

For the vast majority of my personal investing, I want to set it and forget it. I set up all the systems so I can spend my time and attention on avalanches and the people who can harness them.

Song of the Week: Because The Night

Here on YouTube.

Bruce Springsteen originally wrote the song, and then Jimmy Iovine told Patti Smith it’d be perfect for her. His persistence in getting her to listen to it and have him produce it showed conviction and taste. The song is now Patti Smith’s most popular (at least according to Spotify).

This story is told in The Defiant Ones, a fantastic four-part series about Dr. Dre and Jimmy Iovine's careers. It is about culture, business, art, and the personal and professional. I highly recommend it!

One of my friends insisted that we watch and analyze it together to learn how he thinks about venture investing. Critically examining the primary source influences of someone’s thinking is worthwhile before working with them.

“Because The Night” by Patti Smith

Come on now, try and understand

The way I feel under your command

Take my hand as the sun descends

They can't touch you now, can't touch you now

Can't touch you now

Because the night belongs to loversSelfie of the Week

Not every week is a good week, but this one was great.

I was on social event tear, which can always be daunting for an introvert such as myself. BUT! The key to these interactions is finding your best buddy who is the right amount of lovably obnoxiously extroverted and tag team events.

So, this week, I did just that with my friend Victor for a series of GP-LP events.

Victor Gutwein is the founder and managing partner of M25, the most active pre-seed fund in the Midwest. M25’s name comes from Jesus’ Parable of the Talents in Matthew 25:14-30. I love firms' names with smart meanings, and M25 certainly fits the bill!

Call out to the Ivy league endowment associate who popped out of a corner at 9:30pm positioning himself between me and the door and stated “Hi I’m x from y. I’d want to know everything about your investment strategy.”

Everything? :)

Founder energy. I’m bullish on him. Because the night belongs to hustlers.

Thanks for reading, friends. Please always be in touch.

As always,

Katelyn