Bless The Telephone

w.248 | Aging Population, Digital Workers, Bluesky, SE Asia Debrief, Trinity of VC

Dear Friends,

I'm sorry for all the link mix-ups last week. I was on a plane, and the internet was not that great - or non-existent - in certain airspace (India). Problem solves this week as I have returned to the US and am writing this with two feet on the ground. Reprising the links from last time:

Ed Tower’s Boglehead winner on active management.

Moreover, thanks for all the support on adding the “How I Invest” section last week; ~96% of readers voted ‘yes!’ so it was a landslide. That said, I have no edition this week. I can write about this topic like I can write about song lyrics. It’s nice when it’s easy. I’m going to skip this week because my follow-up list from various travels is too long - but stay tuned!

Today's Contents:

Sensible Investing: Trends

Singapore and SE Asia Trek

Song of the Week: Bless The Telephone

Sensible Investing: Trends

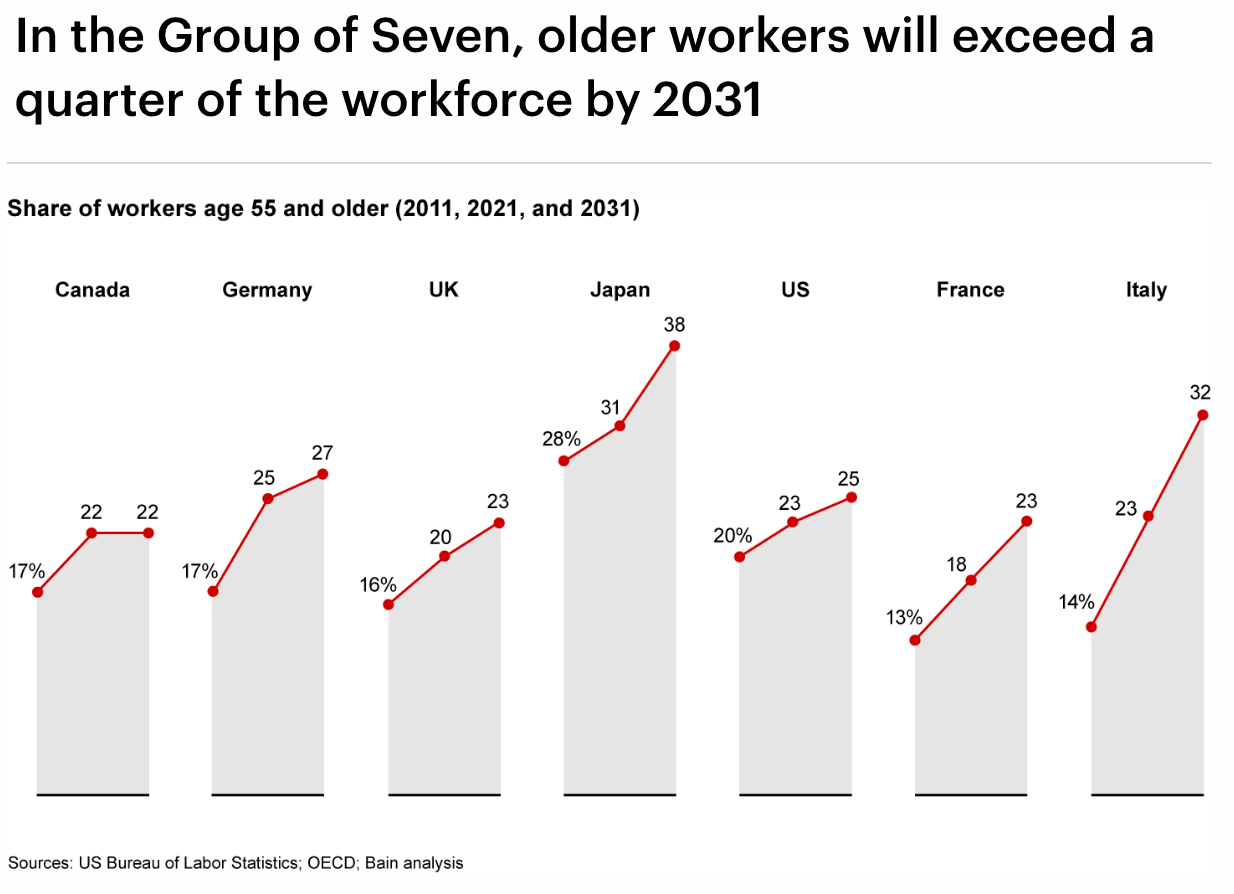

Better with Age: The Rising Importance of Older Workers. Some 150 million jobs will shift to older workers by the decade's end. Here’s how to get ready. Research from Bain.

H/T Diana Wu David, CEO of The Future Proof Lab. Diana is always in the mix and at the bleeding edge. I have known her for over a decade, which seems crazy! She’s an 18-year veteran of the Financial Times in various corporate and innovation roles.

One of the best things about my time at Pearson was that Pearson owned the FT. I positioned myself on the task force to build bridges and find opportunities for the corporate entity to work with the fiercely independent and intellectual publication.

11x Manifesto: The End of Software. The Beginning of Digital Workers. Good writing and vision statement from a fast-growing startup led by an ex-McKinsey consultant.

The Unholy Trinity of Venture Capital: Allocators, Agglomerators, and Absorbers by Kyle Harrison. I’ve thought many things similar to Harrison. He references Marks and Buffett and how ‘the game’ has changed with the massive influx of money that is now concentrated in a few massive firms. It reminds me of this Doug Leone quote: “Write your values in ink and your strategy in pencil” because change is the only constant, and the VC game is in a state of change.

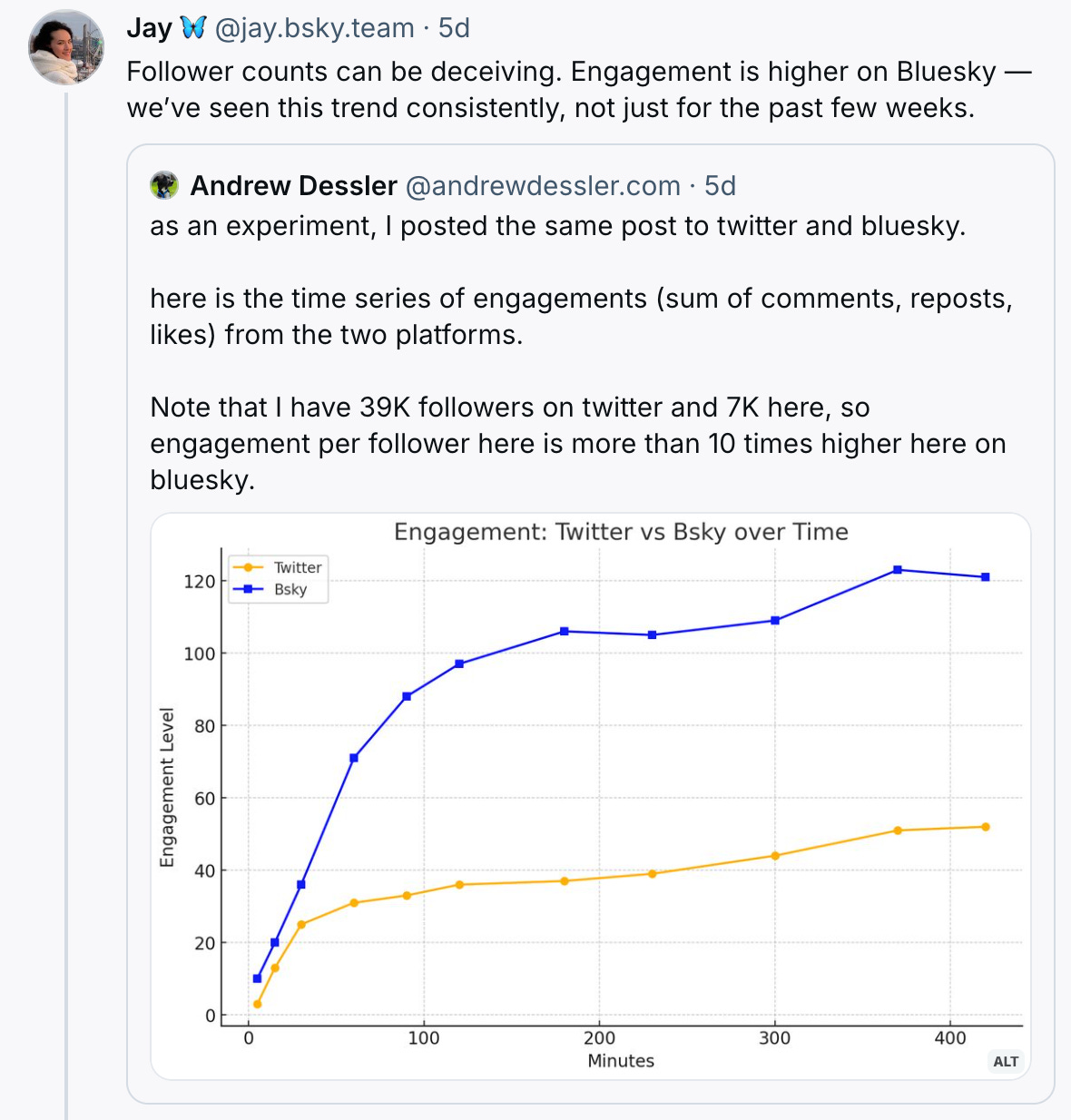

Bluesky's The New Twitter Probably in Garbage Day (a publication I enjoy reading):

Bluesky's Success is a Rejection of Big Tech's Operating System. No bad adtech, no AI, no throttling links. Bluesky is booming because it's everything big tech is not.

Boosted by Trump’s election and frustration at the degradation of the experience on X, many users have sought a new experience with Bluesky. At this moment, the user count is 18.5 million after having added millions of new users this week. You can watch a live update here.

Bluesky is just like Twitter/X, but you can control the algorithm of what you are shown, and it runs on a decentralized protocol. You can sign up here and learn how to transfer your Twitter following over here. The other real benefit is you don’t need to sign in to look at a thread or post, and it doesn’t punish you for linking to external content.

I am an investor because it fits our ‘ownership’ thesis, and I was impressed by Jay (CEO) when I met her several years ago. I’d love to see her win.

Cheap Stock Investor - The End. Just a data point, and we are not market timers. This blogger has been investing for 15 years and just closed up shop. His reasoning:

I am in the process of liquidating all of my CSI stock positions. I sold a bunch last week.

I am obviously out of tune with this market. Value stocks are being shunned for stocks trading at PE’s of 20 and up. PE’s of 50 and more are common. Either this is finally the “new economy baby” like they were touting back in 1999, or this is the biggest bubble I have seen in my 50 years of being in the market fueled by reckless government spending and total disregard for any risk in the market or economy. So I am folding up my tent and will stop posting any regular updates after next week. I ended up with an 85% win rate since 2015. I am 72 now and will just be mostly buying CD’s! Good luck to all of you in your investing.

Singapore and South East Asia Trek

I spent the last week in Singapore, partially for an event organized by Kauffman Fellows. It’s been seven years or so since I visited the region. When I was leading Pearson’s corporate VC, we invested in companies in the Philippines and Indonesia and looked extensively at Vietnam. I found the city unchanged on the surface but deepened culturally. It no longer feels like a city of ex-pats but like a multicultural metropolis that is comfortable in its skin. Briefly:

Singapore is massively benefiting from the “Hong Kong exodus.” As Hong Kong has pulled more into China, many people and businesses have migrated here.

Is the US losing relevance? Someone asked me, ‘What did people think about Trump’s election in Singapore?’ My response: ‘They didn’t.’

Singapore has over 1,400 family offices and is home to nearly 60 percent of family offices in the Asia-Pacific region. The HK exodus helped. American expatriates have also set up shop, with Ray Dalio and Eduard Saverin being prominent examples.

Investment in China feels pretty cool, and there is a sentiment that it is open only to investors within China.

India seems hot (maybe too hot?!) compared to SE Asia and gets more investment attention.

Distribution does not necessarily lead to monetization in emerging markets. The average consumer is still pretty poor and price-conscious. Additionally, businesses need to cover several SE Asia countries to scale, and these markets are not homogenous at all. Makes one grateful to invest in the US.

Southeast Asia: Resetting Expectations is a Lightspeed report that puts cold water on the region, given that it has disappointed the last ten years. The ‘we are not giving up on the region’ section at the end wasn’t convincing.

However, the best presentation was by Nick Nash (ex-Mck & KF Fellow!), who was the president at SEA (the biggest success story in the region) and took them public (~$60Bn market cap). He now founded Asia Partners, a late-stage growth equity fund.

He is talking up his book, but it was compelling! It’s a reversion-to-the-mean thesis with the cautionary tale of over-inflated P/E’s in US mega caps. Here is the Asia Partners public 2023 report, which is 332 pages and has quite a bit of overlap. It’s excellent analysis.

Like Saudi Arabia, Singapore is also trying to set up a more vibrant stock exchange to increase liquidity. However, this seems to have less momentum. Singapore’s monetary authority has set up a review group in a bid to revive its equities market. What would it take to revive Singapore’s stock market?

Singapore’s AI Landscape in Fortune.

Singapore’s $25 Billion R&D Budget White Paper.

Grab built its own map in Southeast Asia, and is now going after Google. The super-app uses its own drivers and cameras to create hyperlocal maps in eight countries. H/T Varun Dutt of Off-Piste Investing. Varun is a long-time virtual friend who transitioned from setting up universities in Sub-Saharan Africa to becoming a value investor in Asian equities. I was thrilled to meet IRL for the first time!

Song of the Week: Bless The Telephone

Here on YouTube.

Or at least bless Facetime Video while traveling.

The song “Bless The Telephone” by Labi Siffre is a heartfelt and emotionally resonant piece that touches the depths of the human soul. Released in 1972 as part of his album “Crying, Laughing, Loving, Lying,” this soulful and introspective track delves into the complex emotions surrounding the need for connection and communication. Siffre, a talented singer-songwriter and poet, skillfully weaves lyrics that explore vulnerability, longing, and the longing for human connection.

Labi Siffre is a genius you probably haven’t heard of. He has so many funky beats and great lyrics.

“I’ve Got The…” was sampled into Eminem's breakthrough song “My Name Is.” The key rhythm is heard at 2:15 of I’ve Got The. Jay-Z found it.

That would have been a great song of the week, too—the same sentiment as Bless The Telephone.

Siffre, who is openly gay, said in an interview that he refused permission for the sample until the sexist and homophobic lyrics were removed from "My Name Is.”

Obviously, there are two versions - explicit and not - but a valent attempt.

“Bless The Telephone ” by Labi Siffre

Strange how a phone call can change your day

Take you away

Away from the feeling of being alone

Bless the telephoneSelfie of the Week

One highlight this week was catching up with Geoffrey See, an international man of mystery. I’ve known Geoffrey for almost a decade. He’s a serial entrepreneur, global traveler, and thoughtful friend.

He’s most famous for founding Choson Exchange, a non-profit that trains founders and entrepreneurs in North Korea. The only quest I’ve heard that is perhaps more insane than reforming the education system of Pakistan.

Thanks for reading, friends. Please always be in touch.

As always,

Katelyn