Dear Friends,

Hope you have a great Thanksgiving next week, if you’re American and you’re celebrating. And safe travels, if you’re traveling.

Today's Contents:

FTX + Crypto Ecosystem

Era of Belief → Era of Delivery

Good Reads: Sensible Investing & Trends

Song of the Week: Have You Ever Seen The Rain?

FTX + Crypto Ecosystem

I know. I am also already tired of FTX and everything. Still, there remains more to say.

But first, I love Twitter. It is one of the best resources for real time, citizen-journalism information. And I don’t think Twitter is going to die. I’m not sure the owner will matter that much for my experience of Twitter. Case in point: Twitter was great this week in revealing information regarding the SBF debacle. Nothing was more disappointing than the NYT’s puffiest-of-puff pieces that came out this week after it was clear the scale of the fraud.

It’s even more evident after this week that there is likely to be widespread impact from the FTX insolvency across the crypto ecosystems. I don’t think this impacts the thesis behind blockchain technology or web3, as I’ve said before. But it will impact many organizations that grew significantly over the last three years as the crypto ecosystems boomed. Below are a couple of citizen-journalism articles and threads that interested me this week.

3AC, DCG & Amazing Coincidences - Digital Currency Group owns Grayscale and Genesis. Grayscale issues the GBTC fund, which they have been trying to turn into an ETF. I always thought it seems like crazy expensive bitcoin exposure. Long story short: all three of these groups are highly interconnected and used each other for leverage stories and with the blow up of 3AC, it’s likely left a large hole in this ecosystem.

Multicoin and Solana

Is Silver Gate next?

The era of blind Belief is over; the era of Delivery is beginning.

Adjusting to the new reality is going to be hard for some. People are still making up metrics to justify their thinking. I saw two this week:

Belief Factor

Discounted Cashflow = (Cash Flow * Belief Rate) / interest rate. And, not to be rude, but belief is what exactly? The argument the writer made is that it is the inverse of the interest rate and built into the confidence in the cash flow. So, why break it out exactly? There is no analytical basis for anything other than running scenarios on the cash.

Discounted Value Flow

Token valuation: Discount Value Flow (instead of Discounted Cash Flow). How do you measure value? Some sort of made of value of the network divided by the volume of the transactions on the network?

This one doesn’t even pretend to have a relationship to cash.

No more magic money, mark-to-fantasy, and empty promises

There’s been a lot of exuberance the last couple of years. I’m not contesting the notion that belief is important. There’s nothing wrong, especially in the beginning or in times of change, in being a believer. In fact, it’s critical to get through the hard times.

But, belief has to be reinforced by results. Does the company / organization / government do what it says it’s going to do? Is it acting in ways that maximize the value for those who have invested capital or tax dollars? Does it translate into hard, cold cash?

The new era is upon us, and cash will rule. Another sighting on Twitter was a reminder that Gen Z has only known life with low interest rates and that the adjustment to an alternate future could be a shock.

Good Reads: Sensible Investing

TCI’s Letter to Alphabet. Chris Hohn says Alphabet needs to cut costs and manage employee spend. Clear, simple reasoning. Well-written. Could be applied to almost every technology company. (And, as discussed on Twitter, many are watching to see how the experiment in downsizing goes as precedent for other organizations to enact similar changes - or at least develop their own less chaotic variants on the same).

Andreessen Passed on FTX, and Made a Killing Selling Tokens. Reed Albergotti in Semafor.

TL/DR: a16z first crypto fund is already up 5x cash-on-cash with many tokens still outstanding because they were early and able to liquate enough of their tokens in big projects. I’m not shocked by this. Question is: What will the return be on the several billion that has been raised/invested by a16z subsequently?

Bird Tells SEC It Overstated Revenue For Two Years. Remember that scooter company? Have you seen their hardware strewn about on sidewalks? Well, Bird went public last year at $2.1B via SPAC and is now worth $50M, i.e., a -97% drop. Below is a nice tweet thread about the collapse and fraud.

Selfie & Song of the Week

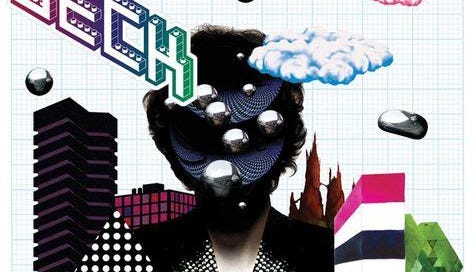

Cellphone’s Dead

Music video Here.

The Information was a college album for me - it came out in 2006. Cellphone’s Dead is one of the best songs. Back then ‘cellphone’ referred to a flip phone at best, let alone the mini-computers that we carry around today.

I hope during Thanksgiving week you can let your cellphone die a little.

Cellphone’s Dead by Beck

Toxic fumes and the burning plastic

Beats are broken, bones are spastic

Boombox talking with a southern accent (Hi!)

Voodoo curses, bible tongues

Voices coming from the mangled lungs

Give me some grits, some get-down shit

Don't need a good reason to let anything rip

Radio's cold, soul is infected

(One by one I'll knock you out)

God is alone, hardware defective

(One by one I'll knock you out)

Selfie of the week:

I spy Mt. Rainier. Do you?

Thanks for reading, friends. Please always be in touch.

As always,

Katelyn