Everybody’s Gotta Learn Sometime

w.257 | Tariffs, AngelList Data, School Choice, DeepSeek, & Feedback Survey

Dear Friends,

Sometimes it’s hard to remember all that happened in a week. The collision between the American Airlines flight and the helicopter in D.C. is the standout tragedy. The DeepSeek market blip freakout was also notable. I won’t cover it here when there are sources like Semianalysis that detail the issues.

In the spirit of always learning and continuous improvement, please complete my reader feedback survey. It has six questions and should take <60 seconds to complete.

It’s been three years since the last one, and it was super valuable to me the previous time. As always, thank you for being here!

Today's Contents:

Sensible Investing

Everybody’s Gotta Learn…to Read Sometime

Song of the Week: Everybody’s Gotta Learn Sometime

Sensible Investing

Why Economists Hate Trump’s Tariff Plan VIDEO from WSJ. TL/DW - Definite downsides from increased costs and ambiguous upside.

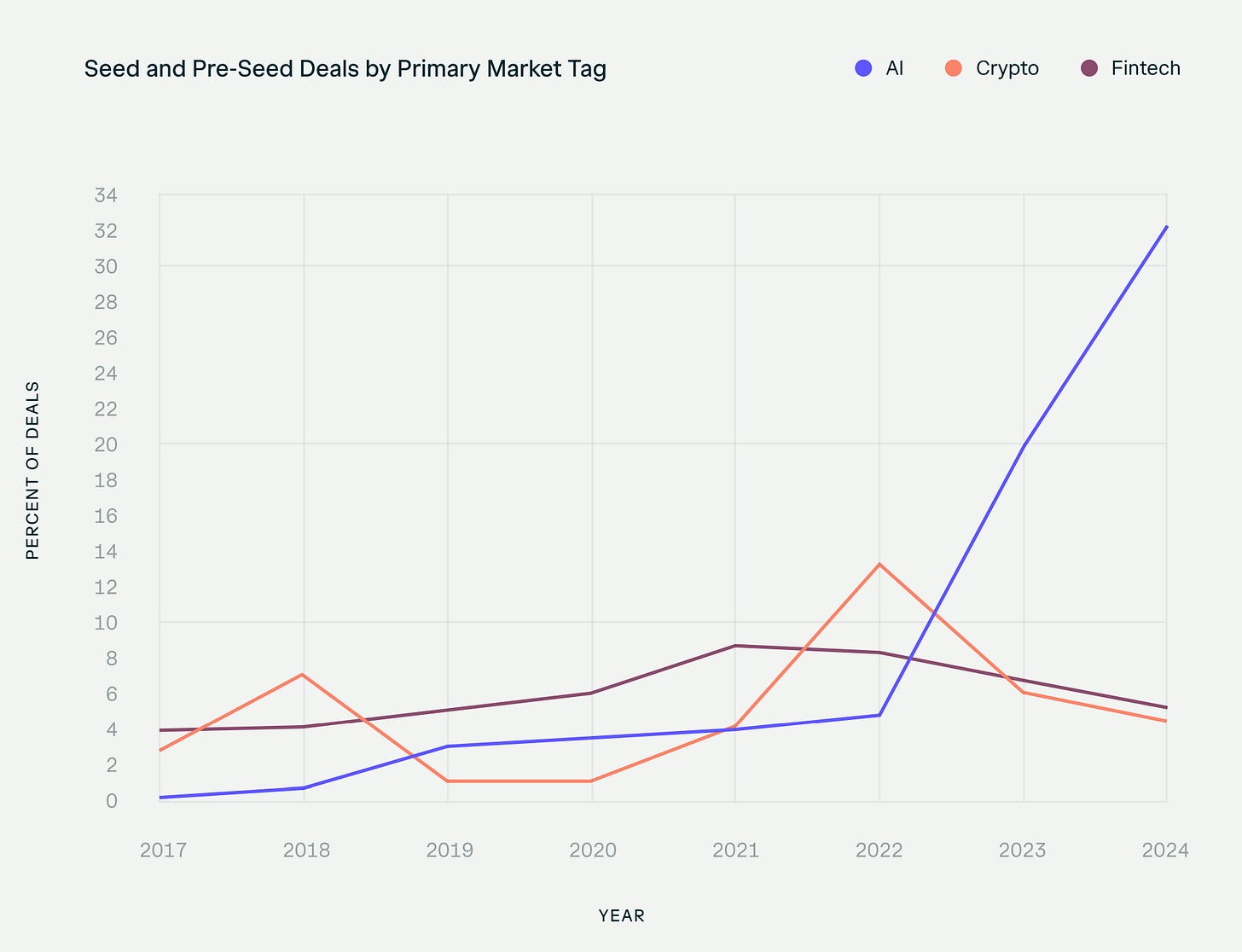

The State of U.S. Early-Stage Venture & Startups 2024 from AngelList.

Since 2020, I’ve invested and raised millions of dollars through the AngelList platform and am now in 22 startups and four funds (including one that I manage with 39 investments). Below are a few notes on the report.

First, every time you see the word ‘AI’ used generically, assume it means software/SaaS in its latest incarnation. This is noted in the long-form article.

Second, the real takeaway of the report is how CRAZY 2021 was for the venture industry. Everything got marked up. And if you invested in startups and/or funds in a hot industry, the assets were already expensive. Looking back, the previous vintages may not be as great as they still look on paper; time will tell, and, of course, this is an outlier business. But every fund benefited by being around before 2021 when everything surged up.

Bringing this closer to home, Avalanche is 2021 vintage and focused largely on EdTech (~50% of the portfolio), which is never hot, so our reasonable entry point valuations have meant the winners can return the fund and perform. As a contrast, my investments into Silicon Valley mainstream deals that are now high flyers at billion-plus valuations are at 1.5-2x markups because the entry price was so high.

AngelList (and private markets in general) suffer from stale pricing and a lack of downward pressure. AngelList, as your fund admin, will not mark down a deal unless proper government filing is complete and shared with AngelList. Early companies that only raised on SAFEs tend to be terrible at doing this paperwork; it can take two years plus for defunct startups to be shown as a zero on AngelList. Also, they only markup on priced rounds, so if you do a lot of pre-seed or even seed investing, there is a signal in SAFE caps that is not being factored in, particularly in the recent vintages.

I’ve pinpointed the end of the valuation inflection point (in 2022) in the chart below. The 2017 vintage peaked earlier because the later stage party (Series B) ended before the earlier stage.

Now, this does not show that “VC is dead” or that “recent vintages of VC funds are underperforming.” It only demonstrates how crazy 2021 to mid-2022 was for markups and valuations ahead of performance.

It’s important to note that the AngelList ecosystem of investments is unique because there are no institutional funds. It’s all solo GPs, SPVs, and small-time funds. These often have early exposure and invest broadly. Still, there may be a lot of missing data, so this information doesn’t reflect the larger ecosystem of all venture capital.

A final funny note: on page 21, they’ve dropped EdTech and GovTech entirely from the list of 21 categories. This makes sense because they don’t have any data on the sector. The only two funds that operate in the space, Avalanche and Transcend, aren’t on AngelList, and no one does SPVs into EdTech or GovTech deals.

Everybody’s Gotta Learn…to Read Sometime

If you read this newsletter, you are in the upper echelons of readers.

Sadly, the reality is that your fellow Americans are barely literate.

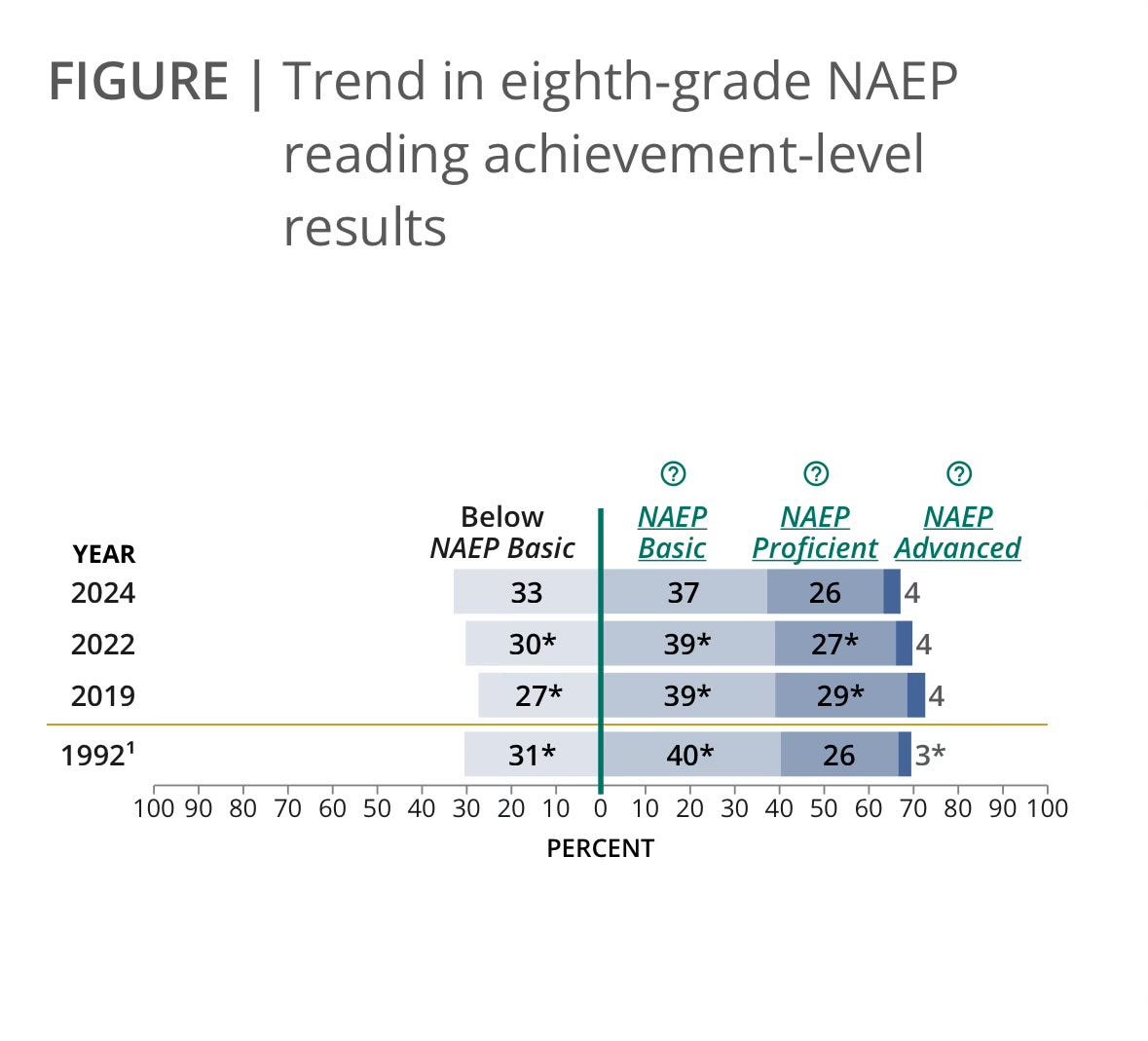

The National Assessment of Educational Progress (NAEP), often called The Nation’s Report Card, is the largest nationally representative and continuing assessment of what students in public and private schools in the United States know and can do in various subjects. The 2024 results were released this week. You would not want to take them home to your parents.

31% percent of fourth-grade students performed at or above the NAEP Proficient level on the 2024 NAEP reading assessment, which was two percentage points lower compared to 2022 and 4 percentage points lower than 2019.

33% of eighth graders perform below basic. Learning progress is down, yes, but mostly stagnant over three decades.

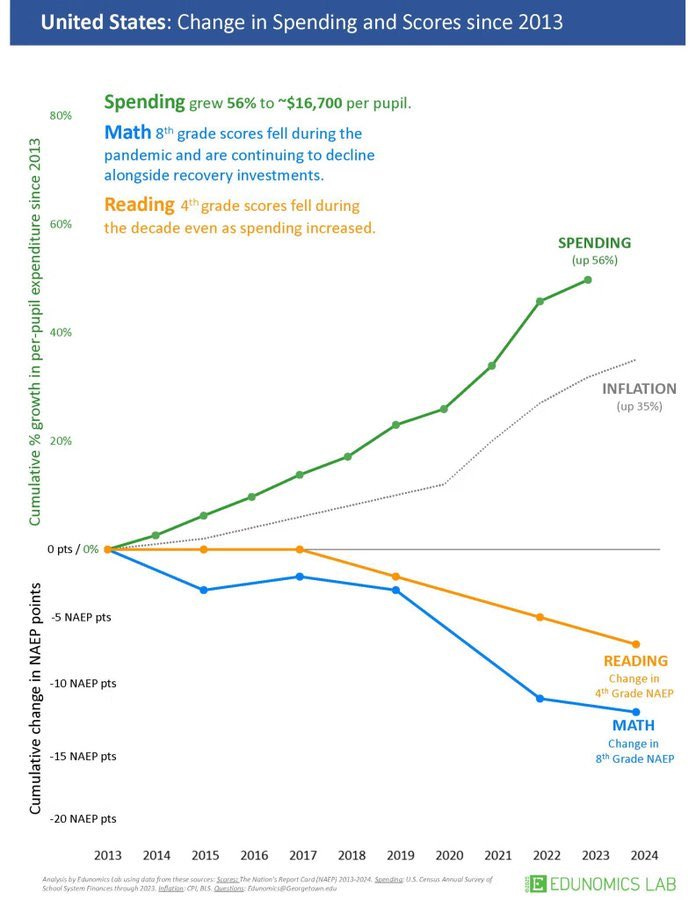

Maybe this is just the best we can do. But we shouldn’t be increasing spending without getting better results, which is what is happening from what you can see in the chart below. For a state-by-state basis click here from the Edunomics Lab.

Big Week for School Choice

President Trump signed an executive order, Expanding Educational Freedom and Opportunity for Families, saying the Department of Education must prioritize school choice in discretionary grant programs. It is mostly a signal of intent.

Tennessee passed a Universal School Choice Bill this week, and full ESA legislation in Texas looks extremely promising as it progresses through the state legislature.

School choice has long been a wish of conservatives, and after COVID-19, parent support surged. The success of school choice is all about implementation. If implemented well, school choice, vouchers, and ESAs can be game-changers. If implemented poorly, they won’t make a difference. For instance, Florida has full school choice but ranks at the bottom of the NAEP charts; Florida needs a better supply of schools.

But, the status quo is failure, and failure is indefensible.

A couple of other points worth mentioning, points which people devote whole careers to researching:

The US does not have a strong social safety net. Public schools have become a catch-all front-line social services layer; in many instances, teaching and learning have become secondary outcomes.

No school system ever outperforms the quality of its human capital at all levels.

There is a limited relationship between dollars invested and learning outcomes produced.

Ability and IQ are more deterministic than is socially acceptable to discuss. Good Kid Productions released a documentary on Charles Murray’s work on this topic.

In EdTech, You Either Bet On Teachers Or You Have To Build One. No one has built one yet. That is a nice article by Dan Meyer. He’s a practical EdTech writer, and this is a lesson everyone who doesn’t bet on teachers has to learn.

Song of the Week: Everybody’s Gotta Learn Sometime

Here on YouTube. Beck’s version.

This is an old song by a group called The Korgis, but the best arrangement is one that Beck did for the movie Eternal Sunshine of the Spotless Mind (a top 10 movie for me).

I like the repetition of the titular line. It’s a pleasant listen on a long reflective walk.

“Everybody’s Gotta Learn Sometime“ by The Korgis and Beck

Change your heart Look around you Change your heart Will astound you Everybody's gotta learn sometime Everybody's gotta learn sometimeSelfie of the Week

I’m looking forward to this week of 70 degrees and sun in Austin!

Thanks for reading, friends. Please always be in touch.

As always,

Katelyn