Dear Friends,

Happy November! It’s been a hectic week abroad, but working while in transit has become one of my superpowers. While my thoughts tend to wander while at home, there is something about being on an airplane - going places - that sharpens the mind. I had little internet access, plenty to think about, and enough perspectives to share. Onto the good for this week!

Today's Contents:

Sensible Investing: Trends

Thoughts from FII 8

Song of the Week: GhettoMusick

Sensible Investing: Trends

Bond Market Flashes Warning Signs from Morgan Stanley. It's not the best article, but it raises an argument that many have flagged about increases in the bond market. It appears the market is pricing in an expectation of future inflation.

We think deflationary goods pricing and falling energy prices have flattered broader inflation readings, causing many investors to overlook the lingering pressures of resilient housing prices and wages. There have also been corresponding moves in inflation expectations and election odds, with bond owners signaling that former President Donald Trump’s proposals on tariffs and immigration could be inflationary. Ongoing inflation could become a drag on growth and may compel the Fed to dial back monetary easing, likely putting further upward pressure on rates and weighing on stock valuations.

How Gen Z Ended Up in So Much Debt linked to PDF from Bloomberg.

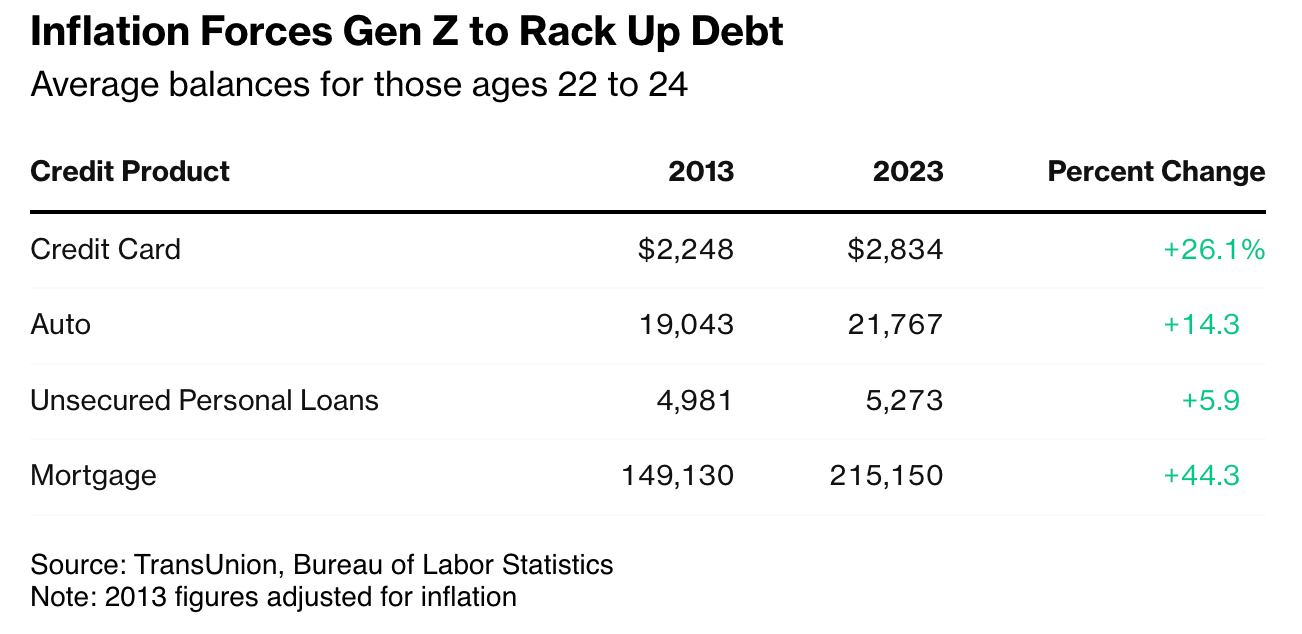

Now, those aged 18 to 29 are carrying $1.12 trillion of debt, according to the Federal Reserve Bank of New York. While that only makes up 6.3% of the total $17.8 trillion in US consumer debt, it’s still a huge burden to carry at an early point in their financial development.

Today, about one in seven Gen Z credit card users are maxed out while many others are falling behind on payments, according to the New York Fed. While newer credit card users tend to have lower credit limits, young people are utilizing more of what’s available: the debt-to-income ratio for twenty-somethings in 2023 hit 16%, compared to just under 12% for those at the same age in 2013, TransUnion found.

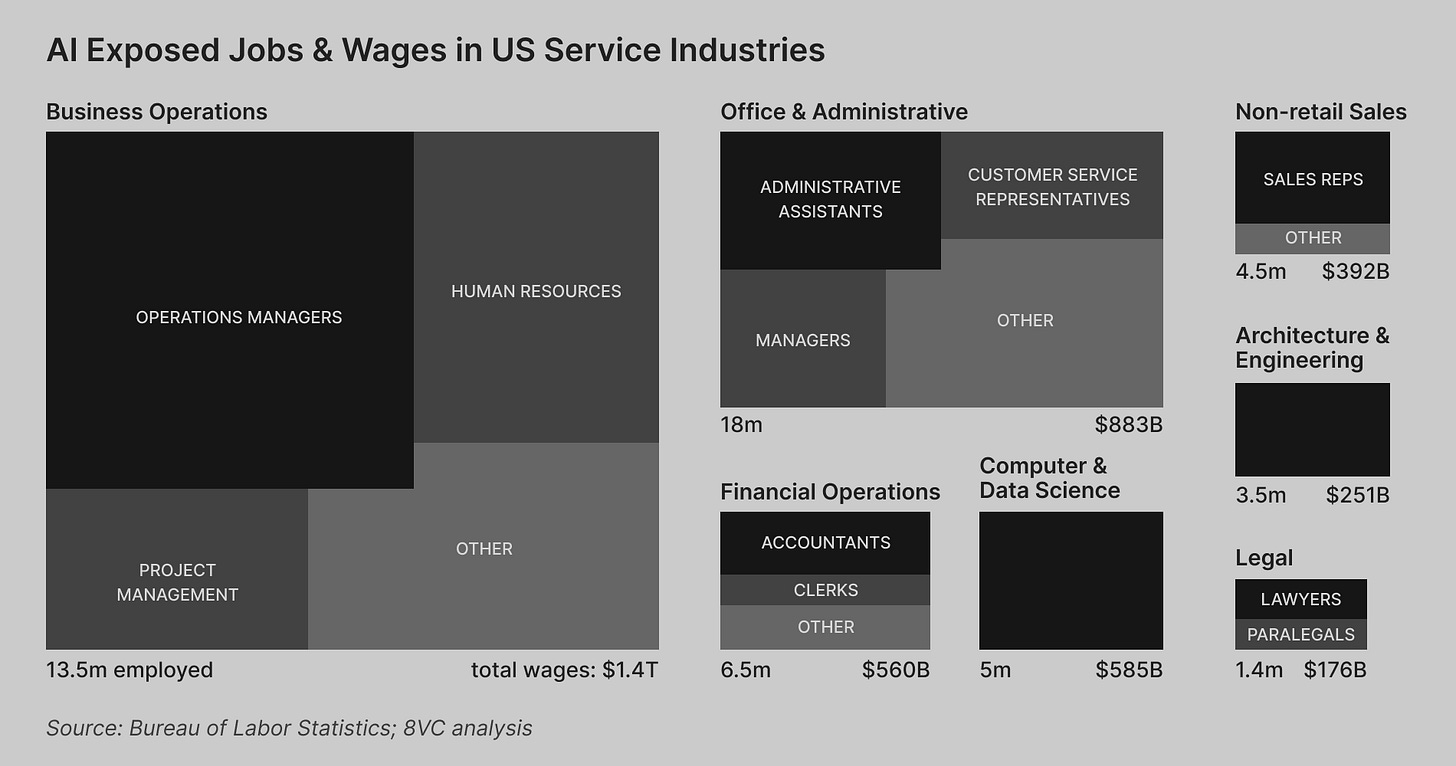

The AI Services Wave: Lessons from Palantir in The New Age of AI from 8VC. Now, a consensus view is that with the arrival of LLMs, mere “services firms” have become much more exciting businesses.

Thoughts from FII 8

FII is a conference sponsored by the Public Investment Fund (PIF), one of the largest sovereign wealth funds in the world with nearly $1T AUM. It’s a Davos/WEF-like event that attracts global CEOs and asset managers and is an opportunity for Saudi Arabia to invite the world in.

A few themes as I reflect on my four days there:

Most people did not want to discuss any regional conflict. There was no mention at all save for he last keynote from the Saudi Foreign Minister, who was incredibly impressive. He was firm and diplomatic. He made it clear that KSA's policy is the establishment of a Palestinian State and expressed frustration with the ‘credibility’ of the international order.

The startup ecosystem and general business attitude have accelerated significantly since I was last in Riyadh in February 2020, i.e., before the world shut down. Tech companies have continued to grow. Endeavor, a global fund, has 14 portfolio companies in the Kingdom; Antler and 500 Startups both have a local presence as well.

There is a lot of excitement about the launch of the Saudi Stock Exchange as a vehicle for modernization and liquidity. Right now, only a few companies float, and there are a series of restrictive elements like taxes, but the appetite exists to change this. The significant wealth sources in the Kingdom can make this work if they want (and seem likely do to so soon).

I felt totally comfortable as a solo professional during my stay. I wore only Western clothes and was buttoned up. Not surprisingly, there is little to no crime. Taxi drivers were mostly Saudi, spoke good English, and were keen to chat. One shared a song recommendation for the newsletter (always be sourcing!). The only thing that I might grumble about is the traffic, but compared to the average Asian metropolis, it was a breeze.

Most of the interest is in new energy infrastructure, resilient supply chains, AI’s (unproven) ability to improve productivity, and the emerging market consumer. There is also talk of healthcare and education in a world of aging populations and low birth rates.

Saudi is investing big into sports. That was already apparent from their deals in soccer and golf and is still going strong.

There was not a significant US corporate presence. It felt more European and regional. Trump was the candidate with more support across the Gulf. There seemed to be frustration that the Biden administration did not serve the interests of the Arab world well, and there was much more optimism for Trump.

The startup work ethic is high. When I visited one office in the evening around 6:30 p.m., young hustlers of both genders were working collaboratively. This is relatively new and is a sight that always leaves me in an optimistic mood.

Saudi Arabia has an ambitious 2030 agenda, and they are executing well against their goals. The city was booming with new economic activity outside the oil sector and many new real estate developments. They seem well on their way if the goal is to be the next Dubai.

I knew plenty of people attending the event but also made new friends. There were many startup people from the US and many international VCs that I’ve been friends with for years. It’s nice to show up to a new event in a relatively new city and feel at home.

Song of the Week: GhettoMusick

Here on YouTube, they drive around delivering packages in the music video, but instead of FedEx, it’s FedUp.

This song is a masterpiece, and Speakerboxxx is probably one of the best albums of its time.

The main intellectual contributions come from the verses, but the cheery interludes of “feeling great, feeling good, how are you?” is a nice, ironic offset. It also can be used as a litmus test in conversation to determine if your counterparty is on your wavelength enough to get the reference.

The line "If it don't stank like they stank, then they can't swallow that down" implies that the artist refuses to conform to society's expectations or compromise their artistry for popularity.

Another impactful lyric is "A lawyer couldn't object or disrespect the technique, sweat me, wipe off the sweat." This line cleverly juxtaposes the legal world with the world of hip-hop, emphasizing the value of individuality and the ability to persevere in the face of adversity. It suggests that success can be achieved outside of conventional paths.

The chorus, "Find a way to get in, to fit in," suggests that individuals sometimes need to work twice as hard to succeed in society. The line "Your battleship is sunk" indicates that despite setbacks, it is possible to rise above and become victorious.

“Ghetto Musick” by Outkast

Find a way to get in, to fit in

You get on, you get out, without a doubt

GhettoMusick

I just want you to know how I feel (How I feel)

Feeling good, feeling great

How I feel, oh, I

Feeling great, feeling good, how are you, you?Selfie of the Week & Debrief from FII 8 in Riyadh

Conducting global business is the best form of international relations. Not only are you building genuine, long-term economic ties with countries - it has been shown to bring peace. Unlike working for the state as a diplomat, you can also show up as your authentic self (opinions and all, as long as they are highly complimentary of the host country), and people love it. I’ve missed my days working globally more than anticipated.

Thanks for reading, friends. Please always be in touch.

As always,

Katelyn

Nice to read your perspective on SA, I've never been and feel like it's usually portrayed only in caricature