High and Dry

w.194 | AI Tutors, Millennial Homeowners, Airbnb, Raw Japanese Denim, AI & Deflation

Dear Friends,

Happy long weekend if you are celebrating. It was cold today in NYC, although nice enough for two hours of conversation on a terrace. That said, I am surely not alone in being ready for summer and sun.

The news from San Francisco about the murder of Bob Lee was a harsh reminder of the risks facing each of us who live in urban areas with persistent homelessness, drug use, and mental illness on the streets. It feels random and as though something awful could happen to anyone. One of my friends said he carries a medical trauma kit with him that can save lives. I guess it’s come to this, or always traveling with a wingman?

Today's Contents:

Macro Thoughts: AI & Deflation

Good Reads: Sensible Investing

Song of the Week: High and Dry

Macro Thoughts: AI and Deflation

Earlier this week, I had a conversation with my friend Nick Ducoff (ex-founder turned VC at G20) about the impact of AI on inflation. Below are the notes from the conversation:

In the medium-term, inflation is likely to come down, driven by the highly deflationary impact of technology. Implementing technology and labor right-sizing might take another 12 or 18 months, but it’s already in the works.

AI is already making it easier and cheaper to build software. Some companies are reporting that their developers are already 50% more productive. This leverage percentage is likely to increase with each new release. And competition will drive down the price of these tools significantly. The increase in competition for software products causing downward pressure is a significant consideration for those investing in software companies.

There will be more layoffs in the knowledge economy. Displacement of labor happens before replacement. The era of high salaries, fierce competition from employers for candidates, and infinite perks is ending. The first round of layoffs has happened, but there will be more. This doesn’t mean knowledge work will be gone forever, but we are entering a different era, and this cycle will likely last several years.

Those of us like me, who graduated in 2008, remember it well. As a new entrant to the workforce, you were grateful to have a seat and the opportunity to learn. You worked hard because it was a privileged position. I expect this attitude to return; while it may come more quickly for new graduates, I am curious about those who spent the last five years in the altered reality we have now exited.

Winners will be larger companies, not smaller ones. Existing distribution, locked-in customers, and network effects will matter in the next few years. Large, innovative companies will be able to make productivity upgrades and find ways to increase their margins. Hubspot will be the AI-Hubspot. Companies will make themselves more profitable. Large companies will probably engage in M&A to consolidate in industry and add bolt-on accretive businesses.

Interest rates may remain high for years. High-interest rates price capital and will help existing companies that can leverage large balance sheets.

Agree? Disagree? Let me know.

Good Reads: Sensible Investing

JP Morgan Letter To Shareholders. An important point on interest rates:

"When you analyze a stock, you look at many factors: earnings, cash flow, competition, margins, scenarios, consumer preferences, new technologies and so on. But the math above is immovable and affects all."

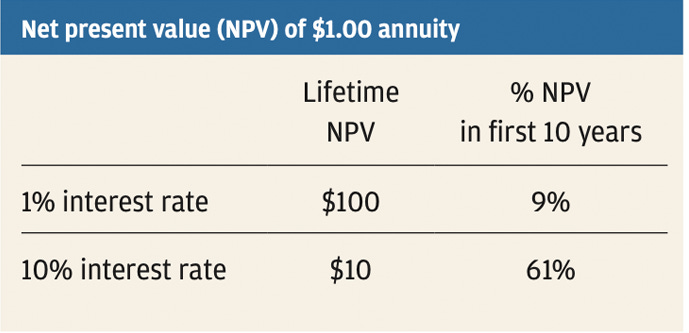

The lifetime value of higher interest rates is much smaller ($10 vs $100), and your return timeline in the first ten years is brought forward significantly.

We already knew this, of course, but seeing the math penned out like this is compelling.

AI Tutors Will Be Held Back By Culture. I have been in endless discussions and pitches about AI tutors, Generative AI, and direct-to-consumer education. This piece nails the societal issues necessary for technology to achieve learning outcomes.

In other words: the main bottleneck in education, now that tutoring is becoming cheap, is culture design.

Cultures and tutoring systems are complements. The more powerful AI tutors become, the more valuable cultures that support learning will be. (Teaching and tutoring systems, on the other hand, are substitutes, which implies that we can expect teaching to lose value over the coming decade). There is an opportunity here to direct resources away from things AI systems can automate, such as teaching, and into the more ambitious project of building better cultural infrastructure.

To be clear: I’m not saying that AI tutors, or other kinds of software, can replace humans. Most of us need the support and community of others to push ourselves to excellence and to find meaning in the projects we pursue. But soon, we will be able to spend less precious human time on basic tutoring; instead, the emotional labor we do to support each other can be invested in a more leveraged way.

Millennial Homeowners Outnumber Renters for the First Time. As Michael Billings points out ‘If they overlaid the median home price in those cities, it tells the story.’

Jim Chanos’ Short-Only Fund, Ursus, Came Out on Top in 2022. It’s amazing how much his AUM has shrunk over the years leading up to 2022. He’s super bearish on data centers.

How We Change The Internet. Direct relationships are the future.

I’m a Substack fan and writer. It’s not perfect, but I like what they are trying to do. This week, they laid out their vision and, uh, Twitter (Elon) did not like it. Within a few hours, they banned Substack links on the Twitter platform. It’s fascinating to see this play out, and I expect this to be only the beginning. Garbage Day weighs in with There’s Always Some Idiot Ruining Your Favorite Website.

Problems at Airbnb. This is a paid article from The Bear Cave. Maybe the ‘sharing economy’ has reached its peak.

One of my superpowers is identifying talent destined for greatness early. Sadly, this is often un-investable in my particular strategy. The minute I saw Edwin on the internet, I knew he would be a hit. So, I made friends early and locked in my subscription.

Two problems with Airbnb:

(1) Professional Hosts are going direct to customers. Owning the customer relationship allows professional hosts to avoid Airbnb’s ~17% platform fee, control any refund/dispute process, communicate directly and seamlessly with customers, market aggressively for repeat business, and not be at the whims of Airbnb’s algorithm.

(2) Weakness among individual/non-professional hosts. Low-interest rates and the pandemic propelled many novice investors into the Airbnb short-term rental market. Now, many are beginning to regret that decision.

Song of the Week: High and Dry

Here on YouTube.

I read an article this week about a man whose wife passed after a battle with cancer, and her last request was that this song be played at her funeral, which I thought was an interesting choice. I’ve always liked High and Dry, which I interpret as a dedication to doing the inner work of self-reflection and not giving up on yourself.

“High and Dry” by Radiohead

Flying on your motorcycle

Watching all the ground beneath you drop

You'd kill yourself for recognition

Kill yourself to never ever stop

You broke another mirror

You're turning into something you are not

Don't leave me high

Don't leave me dry

Selfie of the Week

This week, I hung out with my writing coach, Adam Delehanty, IRL. He’s kind of a genius. Adam has great style (is that a raw Japanese denim jacket?!) and an under-appreciated Twitter game.

When I’m not avoiding his persistent messages to finish my manifesto, I ponder answers to his provoking questions and narrative structures. We’ll talk much more about coaching and coaches next week, but I’m proud of myself for asking for and accepting help.

Thanks for reading, friends. Please always be in touch.

As always,

Katelyn