I Can't Make You Love Me

w.164 | Shopify & Rakes, "Random Reward" Capitalism, Lessons from Julian Robertson

Dear Friends,

This week was the first time in a while that I didn’t run the air conditioning nonstop. Pleasant days in New York City while California roasted.

Also? The Queen died. Serena retired. Even with the longevity that both will be remembered for, time moves on.

Today's Contents:

Good Reads: Sensible Investing

Weekly Song: I Can’t Make You Love Me

Good Reads - Sensible Investing

Illusion of Knowledge. A new memo from Howard Marks is here. TL/DR: Nobody can predict the future, which makes forecasts (particularly macroeconomic forecasts) useless:

In order to produce something useful, you must have a reliable process capable of converting the required inputs into the desired output. The problem is that I don’t think there can be a process capable of consistently turning the large number of variables associated with economies and financial markets (the inputs) into a useful macro forecast (the outputs).

My thoughts: When I have conviction on something that is Obviously the Future, it is usually predicated on a phenomenon that is already happening but not yet mainstream.

Short selling report on FIGS. Here from Spruce Capital.

The Worker Productivity Hangover from Years of “Random Reward” Capitalism. Screenshot essay by Sam Lessin here. TL/DR: Mindset of ‘why work when outcomes feel random’.

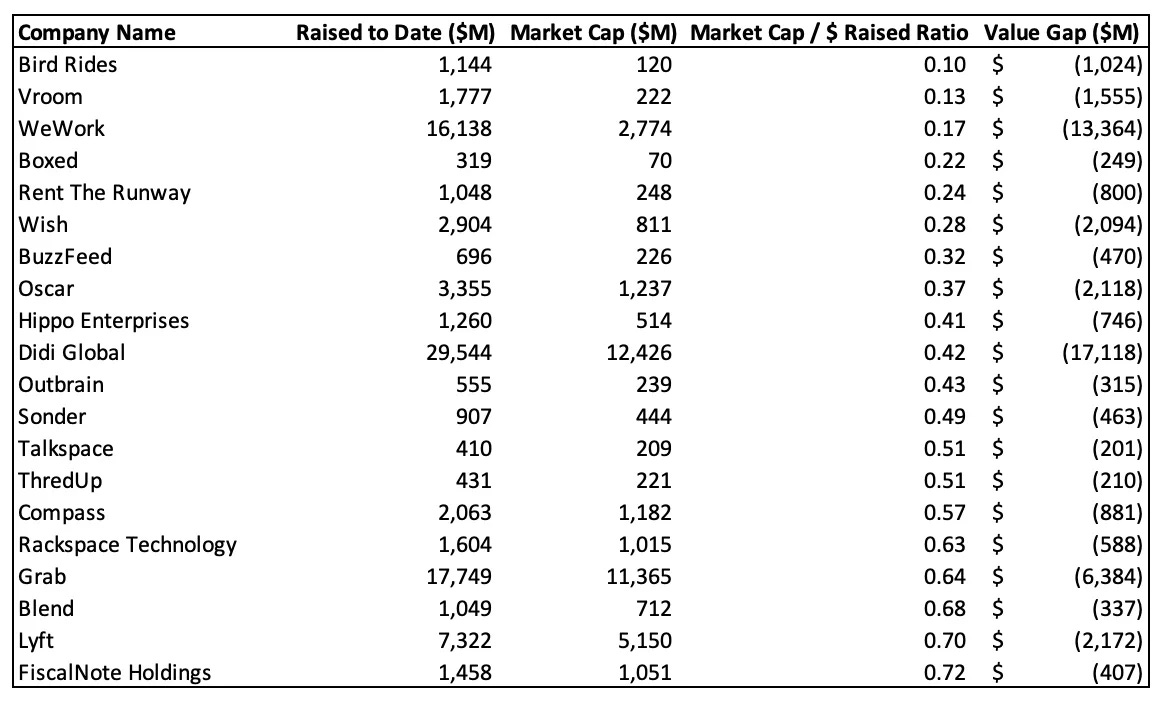

Startups and Value Creation and Destruction. An analysis of public company valuations versus their aggregate capital raise. Here. The worst offenders are below.

Liquid Venture Capital. Here from Sparkline Capital. I can’t decide if this is good or not. And, having been on the inside of big companies, I’m not sure they can innovate:

“We replicate venture capital returns using liquid small-cap public equities and find the underlying innovation premium also exists at large innovative firms”

Vanguard Forecasts 10-Year Annual Returns. Here.

5.1% of US stocks

7.6% for foreign stocks

3.6% for US aggregate bonds

3.1% from cash

2.5% inflation

Shopify: A Rake Not Far Enough. Here. TL/DR: Shopify’s take rate is 2.7% compared to Apple’s 30%. Shopify’s low take rate severely impacts its profitability and thus its ability to reinvest.

For many years, this has been the bull case on Shopify: that it would be able to grow faster than its competitors like BigCommerce and Demandware, lock up the “entrepreneurship” market for up-and-comers as well as the market for larger enterprise customers, and eventually, increase its take rate.

In fact, when running a discounted cash flow model on Shopify, the only way the stock price ever made sense was if the take rate increased.

What good is being missionary if you can’t make enough money to accomplish your mission?

The Tiger That Was a Wolf: Lessons From Julian Robertson. Here on Neckar’s substack.

When Robertson and Thorpe McKenzie launched Tiger in 1980, he was already 48! He started the fund at a time when valuations were low and declining interest rates would be a tailwind for decades.

I love a success story that doesn’t make me feel old :)

“As you have heard me say on many occasions, the key to Tiger’s success over the years has been a steady commitment to buying the best stocks and shorting the worst.”

Keep it simple, stupid.

Robertson’s strength was building an elite team, using his pattern recognition to filter ideas, and connecting everything to his exceptional network of contacts. Despite Tiger’s name, he was not a solo predator. The tiger was really a wolf.

Feels rare in an industry that prizes solo performers.

“Throughout the firm’s history, Tiger was a place where everyone was overpaid, knew they were overpaid, and were determined to continue to be overpaid.”

LOL. Sounds nice.

Song of the Week: I Can’t Make You Love Me

I like the honesty of ‘I Can’t Make You Love Me’. I also appreciate that the song diffuses the best way to deal with that situation, which is the opposite of the reaction that originally inspired the song (see below).

It’s such a sad state of affairs that Bonnie Rait didn’t want to record the song twice.

From Wikipedia:

The idea for the song came to the song writers while reading an article about a man arrested for getting drunk and shooting at his girlfriend's car. The judge asked him if he had learned anything, to which he replied, "I learned, Your Honor, that you can't make a woman love you if she don't."

Raitt recorded the vocal in just one take in the studio, later saying that it was so sad a song that she could not recapture the emotion: "We'd try to do it again and I just said, 'You know, this ain't going to happen.'"

“I Can’t Make You Love Me” by Bonnie Rait

'Cause I can't make you love me if you don't

You can't make your heart feel somethin' it won't

Here in the dark, in these final hours

I will lay down my heart and I'll feel the power

But you won't, no you won't

'Cause I can't make you love me, if you don't

Thanks for reading, friends. Please always be in touch.

As always,

Katelyn