Dear Friends,

Greetings from up north. Thanks for all the motivation to write an essay on "It’s a Wonderful Life." Despite the skip week, I’m sorry to report that I haven’t finished it. Things and stuff, as I’m sure you are familiar with.

Hope you and your family have a lovely holiday season!

Today's Contents:

Sensible Investing: Trends

How I Invest: Is this a Top?

Song of the Week: Joy

Sensible Investing: Trends

Self-Sabotaging Innovation: The Art of Doing Dumb Sh*t from Matt Klein’s newsletter.

The essay starts with an interesting list of things from the CIA’s guide on How to Sabotage a Workplace. Basically, it’s a ton of terrible business practices.

In an era where AI and software can automate more and more, we should ask: “How much of our work exists because we ‘think’ we have to do it?” and get to the other side as soon as possible.

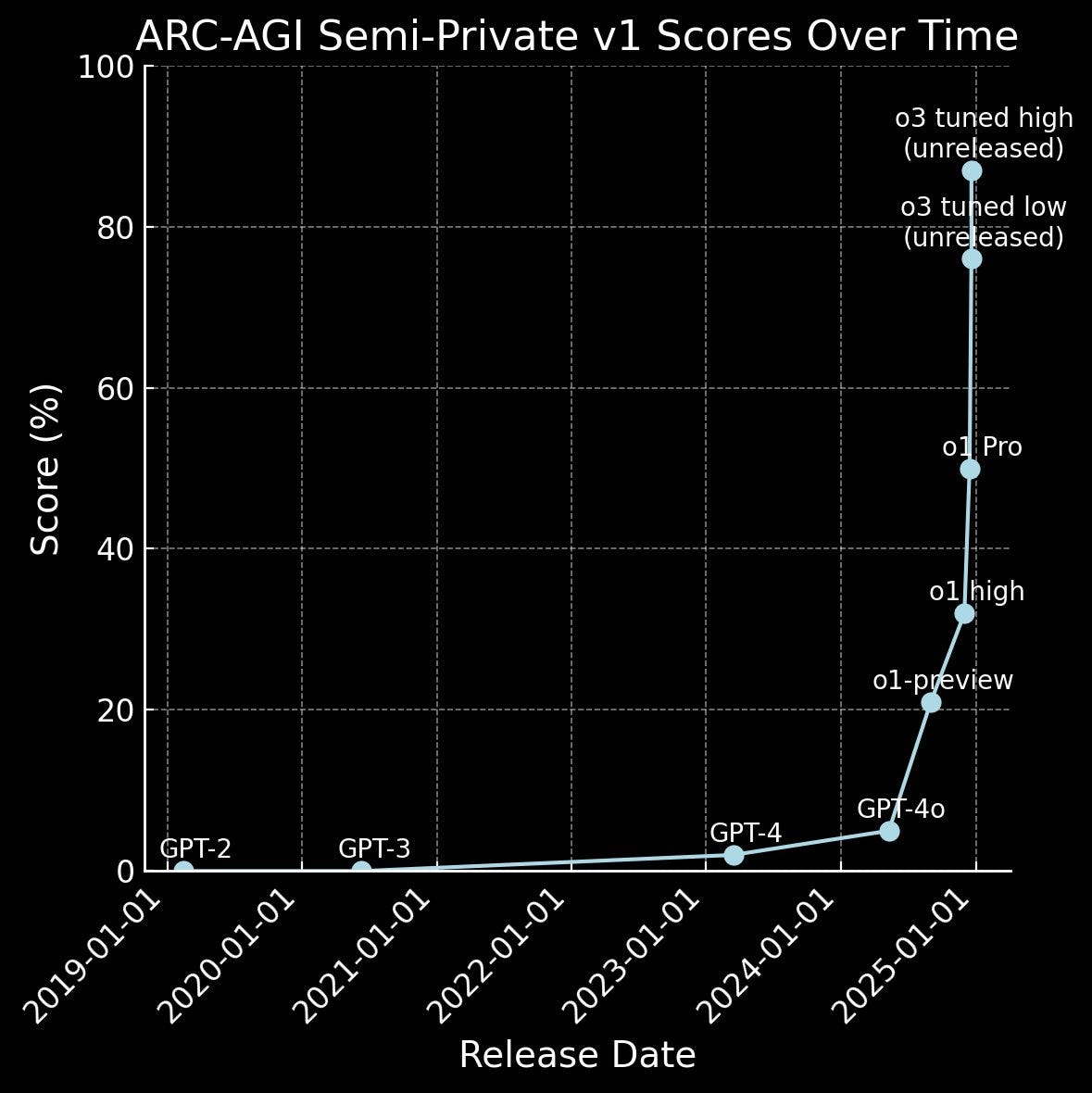

In an era of the below chart (if you know, you know, and if you don’t, you should figure out, probably), the human elements of efficiency will be the lynchpin of productivity.

It’s Best to be Early to the Ontological Shock of AI, which is a profound disruption of one's fundamental understanding of reality. This causes a cascading reassessment of basic assumptions about what is real, possible, or “natural” in the world.

AI is Making Philippine Call Center Work More Efficient, for Better and Worse. BPO workers say AI tools are monitoring their calls, assisting them with customers, and scoring their performance.

The Philippines is probably the leading place to witness the impact of AI on jobs. Right now, it’s a productivity driver, but most employees will be replaced entirely when possible.

“AI is supposed to make our lives easier, but I just see it as my boss,” BPO worker in the Philippines.

Our 2024 Hedge Fund Analyst Christmas List - The Bear Cave (Edwin Dorsey) curated the best resources for professional investors.

Bloomberg 2024 Jealousy List. One of my annual favorites lists. But this year, there weren’t many on here that caught my eye, and I have shared none here, which is unusual. There are many cultural pieces on issues I have limited interest in—things out of my control.

There were two highlights on the list, though:

The Number. John Lanchester on the Bureau of Labor Statistics in the Washington Post.

I was immediately captivated by his language and humor, by his ability to begin the piece with a sentence about a volcano on Vanuatu and end with a profound statement about the consumer price index as an Enlightenment value.

What Goes Up. Does the rise of index funds spell catastrophe?

This is one of those scary, if true, arguments. I will quote extensively from this one because we like ETFs, indexing, and passive investing in this newsletter. But things change, and we should always be prepared for low-probability outlier events with massive impacts (i.e., avalanches).

It’s the best-written version of Michael Green's thesis. Green is a fund manager notable for an immensely profitable trade he orchestrated for Peter Thiel worth nearly $250M and his (occasionally combative) warnings about the boom in passive investing.

In that spirit, read on:

“It actually turns out that they’re not passive at all,” Green says of index funds. “What they are is active managers with the world’s simplest quantitative strategy. Did you give me cash? If so, then buy. Did you ask for cash? If so, then sell.”

This isn’t just a language quibble. Green believes index funds aren’t merely measuring the market, they’re now a major force of distortion—and their power is only accumulating.

If the music is playing, you have to dance? Right?

Green’s ultimate doomsday scenario is merely that—despite how swiftly passive investing is rising, and how many nest eggs are still left to snatch—indexing will one day reach its peak. Maybe this will be caused by a generational shift. Maybe the market will simply become saturated.

Regardless, it’s inevitable: at some point in the future, net flows will become negative. The passive-investing market will be, more or less, a roller coaster gliding over its crest. What then?

If index funds do have “the world’s simplest quantitative strategy,” their one input—investors taking out more money than they’re putting in—would set the beginnings of a mass-selling event in motion. Green points out that while active managers normally keep a cash buffer of around 5 percent to soften outflows (or to jump at new opportunities), passive funds don’t. This could hasten the sell-off, turning profit-taking into panic—a visceral plunge that would only be exacerbated by the inherent inelasticity and correlation of a passive market.

In this way, in every way, its collapse would be like that of no other bubble we’ve ever seen. Yes, there could be a nearly immediate evaporation of capital, including a great many households’ savings; worldwide panic leading to, and then exacerbated by, bank runs; an incomprehensible cascade of bankruptcies, foreclosures, and liquidations; distrust of the banking system, the dollar, and one another; and even an earthquake in the global political order. But more than any of that—all of which we’ve experienced before—the failure of passive investing would strip away every last pretense that the market is a collective good.

Cato Institute Report to the Department of Government Efficiency (DOGE): What’s happening with the DOGE? This list of recommendations is worth a read.

Our Source of Truth on Marketplaces from Forerunner. Nice marketplace scorecard in the back of the deck - pages 40-43. H/T Colin Gardiner in Take Rate, his marketplace newsletter.

The Island of Eternal Life. One reporter's journey to the private, tech-forward Central American territory at the center of the movement to cure death. This is a long-form article about Próspera and Vitalia City.

Another “legal innovation” is Próspera’s policy of medical reciprocity. Próspera claims to be the first place in the world to allow doctors with valid medical licenses from any developed country to practice there, a departure in policy from that of countries like the United States or Canada, where you’ll meet cab drivers or other service workers who have had to abandon their medical credentials because it wasn’t recognized by their host country. The main medical hub on the island, called the GARM clinic, offers a “time-share” program called ‘WeTreat’ modeled on the rental model of WeWork. Patients and doctors can fly down to receive drugs or therapies that aren’t available elsewhere. Take, for example, a $25,000 telomere treatment developed by MiniCircle that rejuvenates the protective caps at the ends of chromosomes, supposedly to reduce muscular recovery time so you can make outsized gains in the gym.

I considered attending this event last year, but my invitation came late, and I regret not rearranging to attend. Although they are eager to expand and welcome new people this year, I fear it will not be the same.

The first year of a new conference/event/gathering is always the best. Best weirdo people, best alpha, best thinking, because it is raw and not yet streamlined and commercialized. I want to be your guinea pig, not your customer.

Sales of Bibles Are Booming, Fueled by First-Time Buyers and New Versions (article in the WSJ, paywall). Publishers attribute a 22% jump in Bible sales this year to rising anxiety, a search for hope, and/or highly focused marketing and designs.

We will discuss 2025 trends next week; I’ll preview this one. The search for meaning and religion is real and accelerating. I met up with an old college friend who is a tech founder who recently converted to Catholicism after years of being an atheist and a childhood as a Southern Baptist. There is something real here.

How I Invest: Is this a Top?

While we are not market timers, the discussion of ‘Are we back in some sort of bubble'?’ has become increasingly prominent. One of my friends and I have been going back and forth on various top behaviors. Note that the Greed-Fear Index is reading extreme fear.

His contributions:

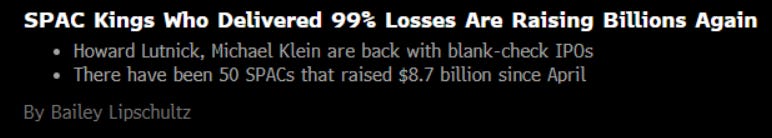

Was playing back our conversation over dinner/drinks and think I may have mentioned my returns 5 times. One of the strongest top signals is when people feel compelled to talk about their investment returns publicly…followed closely by watching someone on a live stream don a full body latex suit and lock himself in a cage and stay there until the Discord channel bid his crypto shitcoin up to $25M (true story!). There's a signal here.

My contributions:

A non-GP at a venture fund admits over drinks that the advertised MOICs on deck are fiction. "Says it’s a 3x but probably not above 1x.” That seems about right for many non-institutional funds presentations docs—massive cherry-picking of metrics and track records. There’s a causal acceptance of this - ‘everyone is doing it, so you have to play the game.’

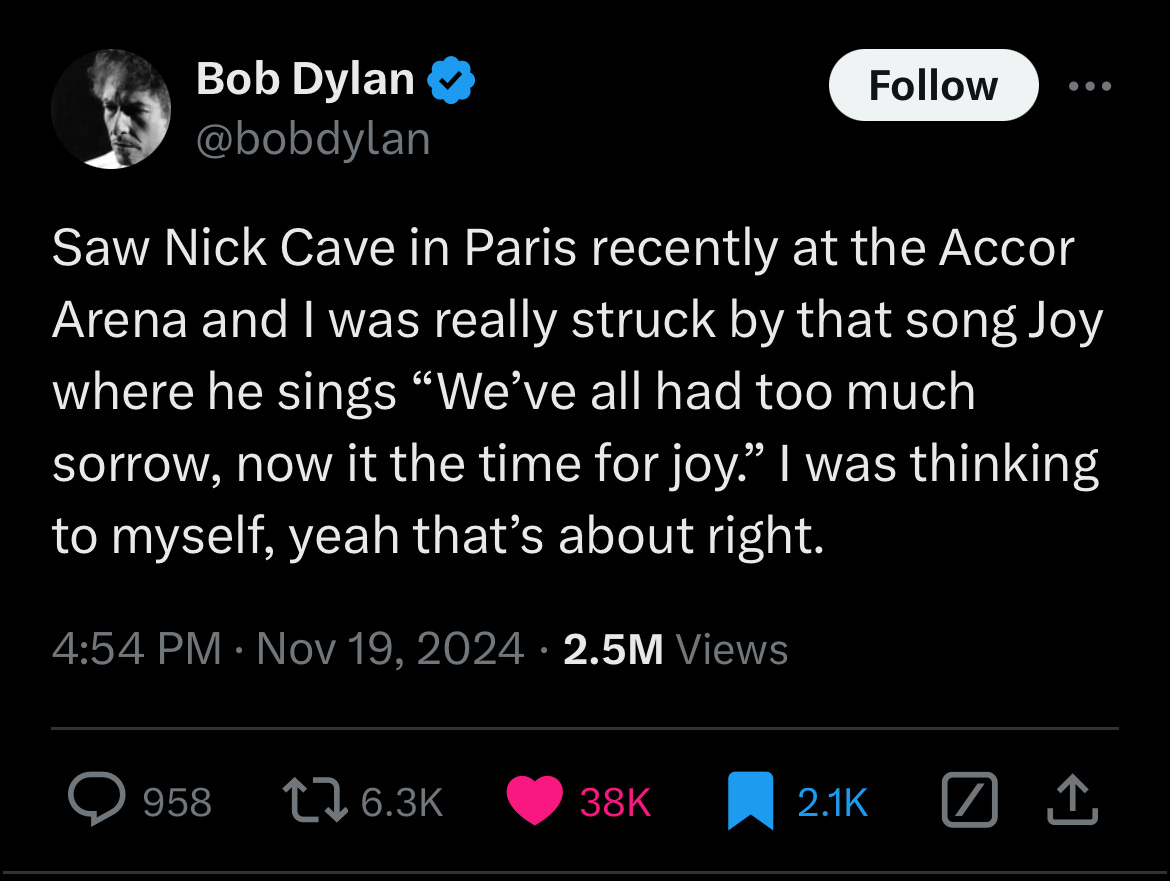

Song of the Week: Joy

Here on YouTube.

"Joy" is a powerful and evocative track that speaks to the complexities of the human experience. It's a testament to the resilience of the human spirit and the enduring power of hope, even in the face of profound sadness.

H/T and much 🤍 to Danny Stedman, who sent this track to me and Jessica Millstone. When I dug further, I already liked and bookmarked the shoutout from Dylan for further investigation.

Beautiful song. I recommend listening to it and adding it to your holiday playlist.

“Joy“ by Nick Cave

I saw a movement around my narrow bed

A ghost in giant sneakers, laughing stars around his head

Have mercy on me

Sat down on the narrow bed, this flaming boy

Who sat down on the narrow bed, this flaming boy said

"We've all had too much sorrow, now is the time for joy"Selfie of the Week

I spent some time in Denver with my friend Sasha Shtern. Sasha is incredibly entrepreneurial, having started ventures in sectors ranging from Blockchain to energy markets and robotics. His latest venture is Goally, a tablet/platform that builds executive functioning skills in neurodiverse kids.

Sasha is all-in on Denver, where he has lived most of his life. He often brings together Denver- and Colorado-based entrepreneurs and investors for provocative discussions about technology and the future. People like Sasha are essential to improving the local community and evoking a modern George Bailey.

Sasha also produced these Overview vests (probably his least ambitious venture) as an expression of appreciation for space travel, scientific exploration, engineering innovation, and preservation of the earth. Modeled below.

The overview effect is a cognitive shift reported by some astronauts while viewing the Earth from space. Researchers have characterized the effect as "a state of awe with self-transcendent qualities, precipitated by a particularly striking visual stimulus." The most prominent common aspects of personally experiencing the Earth from space are appreciation and perception of beauty, unexpected and even overwhelming emotion, and an increased sense of connection to other people and the Earth as a whole. The effect can cause changes in the observer's self concept and value system, and can be transformative.

Thanks for reading, friends. Please always be in touch.

As always,

Katelyn