Dear Friends,

I hope it has been a good week. It’s officially “summer” hot in Austin, and while that is intense, I will survive. So, that’s good.

**I’m going to try something new this week. On Monday night at 9pm ET/6pm PT me and my friend Arvind are going to discuss this week’s All In Podcast episode live on YouTube on our Avalanche VC channel here.**

I watched the new Spider-Man: Across the Spider-Verse movie in the theater this week—a few observations.

First, I’ll admit bedtime is early for me these days. I took a nap through much of the movie, so I can’t speak to the plot.

Second, the animation is incredible. Fast-moving, attention-grabbing, artistic.

Third, the pace of the graphic change is exhausting. Am I getting old, or is it all too much? Is this going to happen more as AI enables even faster-moving graphics?

Fourth, is fast-moving animation a strategy to appeal to the next generation, i.e., those people brought up on Cocomelon? Here is an interesting thread on how they optimize everything to capture the attention of early minds.

Fifth, Alamo Drafthouse is a great cinema experience.

Today's Contents:

Good Reads: Sensible Investing

Tweets

Song of the Week: Let Go

Good Reads: Sensible Investing

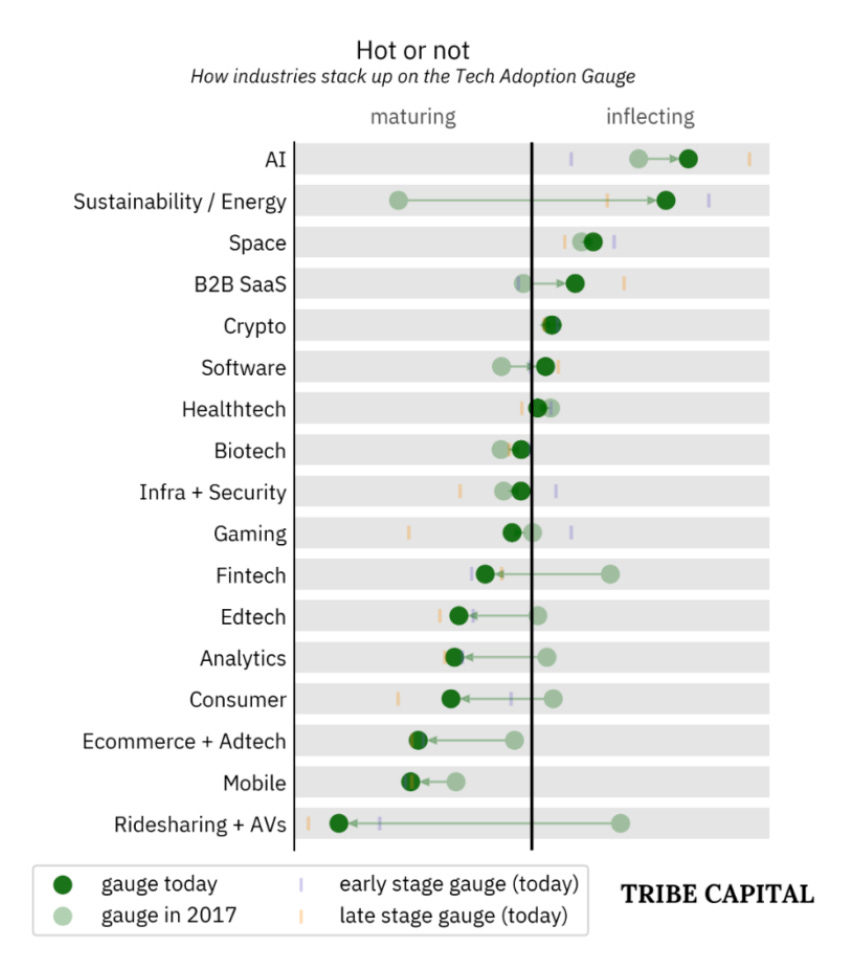

Introducing our Tech Adoption Gauge – AI and Sustainability is at an inflection point.

The article is an analysis by Tribe Capital with a quantitative measure of technology S-curves to determine which industries are inflecting or maturing based on data. I’m not sure that I buy the analysis because it’s highly biased by the venture industry funding booms itself. The chart below shows their analysis:

The New Language Model Stack. How companies are bringing AI applications to life.

A must-read from Sequoia. It starts with ‘Nearly every company in the Sequoia network is building language models into their products’ and ends with “It’s still early.”

The Unbundling of “Growth” Equity from General Catalyst. A new product launch from the firm is a reflection of an evolving market driven by the existence of interest rates.

With the rise in interest rates, the days of free-flowing late-stage capital are gone; the cost of feeding the customer acquisition machine through repeated equity raises has become slower, more painful, and more expensive. Now, more than ever, we believe there is a need for a source of capital that is not beholden to equity valuations and allows companies to continue to invest in growth without negatively impacting their balance sheet.

What Happened to Tandem (virtual office). Founder shutdown stories are gold, and this one doesn’t disappoint. It’s well-written and full of specifics.

We didn’t find a venture-scale market, perhaps because most people value the autonomy of remote work more than they miss the quick-syncs and high-paced collaboration of in-office work.

When our runway ended last year, instead of shutting down, we spun out an LLC and gave it over to two of our team to run. Feature velocity has slowed, but they’re able to focus on stability and incremental growth experiments.

Tandem is default alive and has even grown a little, so the story isn’t over yet.

The NCAA Has a ‘Hot Girl’ Problem. The Cavinder Twins, the emerging oligarchs of women’s college basketball, aren’t the best players. But they might be the best-looking. Pair that article with the Tweet below.

My take: the free market is the most honest reflection of what society-at-large values.

Tweet Round Up

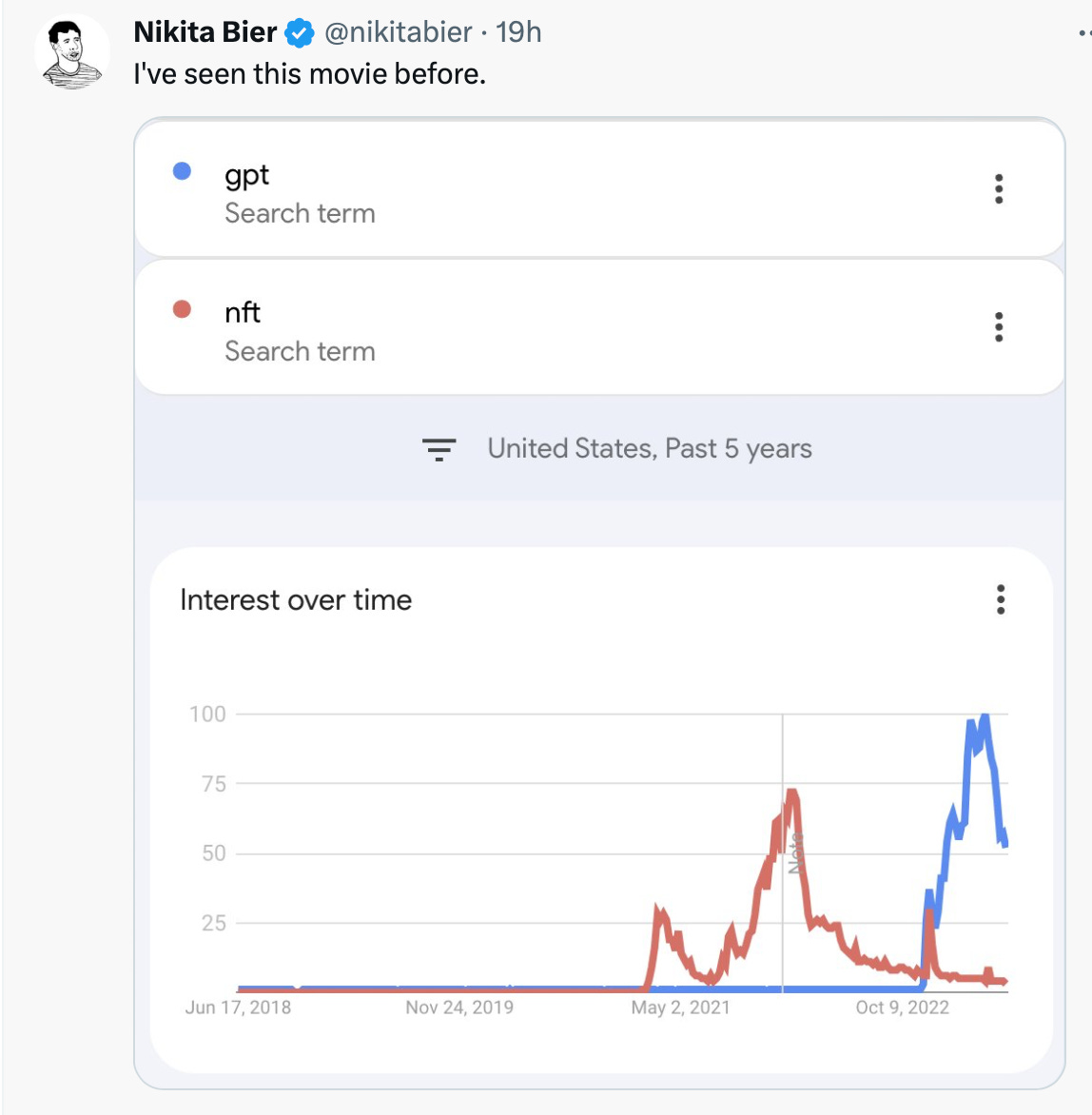

Where are we in the generative AI hype cycle? From Nikita:

Sad but true:

Here is the link to Ship of Fools.

Song of the Week: Let Go

Video on YouTube.

This is a classic from the movie Garden State. I always like the song and the message.

“Let Go” by Frou Frou

Excuse me, too busy

You're writing your tragedy

These mishaps you bubble wrap

When you've no idea what you're like

So let go, so let go, hmm, jump in

Oh, well, whatcha waiting for? It's alright

'Cause there's beauty in the breakdownSelfie of the Week

This pic is from a few weeks back when I went to Austin adult Skate Night at Playland. Highly recommend.

Thanks for reading, friends. Please always be in touch.

As always,

Katelyn