Modern Girls & Old Fashion Men

Ten web3 lessons, The End of the World, Inverted Yield Curves, Softbank Vision Fund

Hi friends,

I’m sad to report that Inbox Zero remains far in the distance. That’s life now.

Happy birthday shoutout to my grandfather, who turned 90 yesterday. I am glad to report that he is a loyal reader of the Declarative Statements and will see this :)

Today's Contents:

Good Reads: Sensible Investing

Book Review: The End of the World is Just Beginning: Mapping the Collapse of Globalization

Obviously The Future: Web3 - It’s all still happening!

Weekly Song: Modern Girls and Old Fashioned Men

Good Reads: Sensible Investing

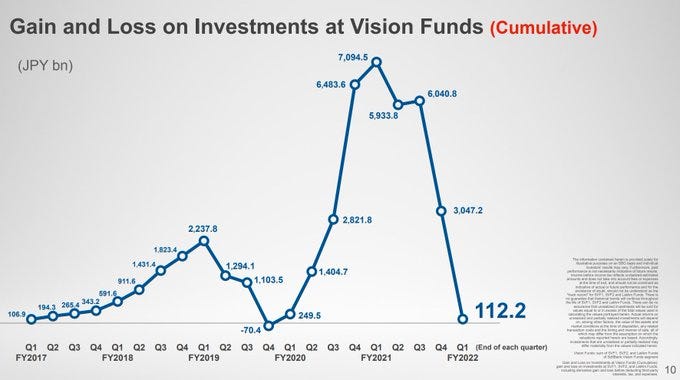

Softbank’s Q1FY2022 presentation is here. The graphic below says it all.

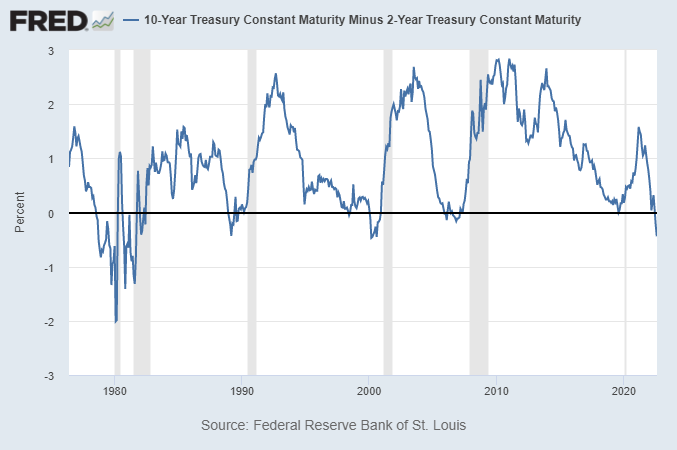

Just logging: Deepest 10-2 yield curve inversion since 2000. A few more basis points lower, and it'll be the deepest inversion since 1981.

Why the US Treasury sanctioned crypto's most famous cash mixer Tornado Cash: Peer-to-peer music sites like Napster got taken down. But can you take down peer-to-peer money? Here in Crypto Uncomplicated.

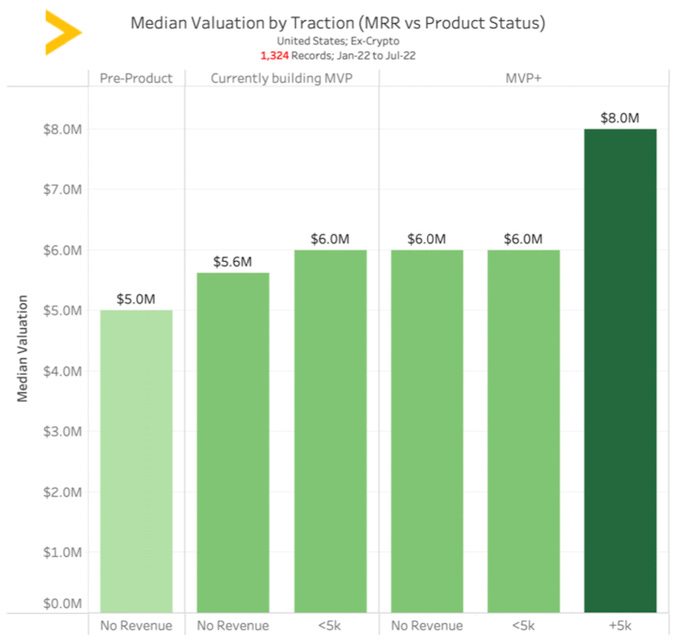

Insights into pre-seed startup valuations. Will Bricker, principal at Hustle Fund, writes a thread using their data here. TL/DR: the biggest boosts you get in valuation are from building something vs just an idea and executing your initial acquisition process multiple times (Duh!).

Book Review: The End of the World is Just the Beginning

By Peter Zeihan. Here.

I learned that The End of The World is Just the Beginning is the number five non-fiction best seller in America by walking through an airport. It’s quite a title. Does it live up to the hype? I’d say it was worth the read, but there are plenty of holes to poke.

Peter Zeihan is a self-proclaimed strategist who combines a study of demographics with knowledge of geopolitics to make economic predictions. His (bleak) view is that we’ve passed the special golden age of globalization that enabled cheap goods and services provided by the hegemony of the United States and favorable demographic tailwinds. It’s dark, but is it worth considering? I don’t know.

Why is it important? The energy and natural resources markets are critical to economic growth. Many people will make a lot of money in this sector over the next ten years. That won’t be me, at least directly. Yet it’s still good to know about the dynamics. My focus is on the demographics and the implication on labor markets and productivity. And, for that, demographics are destiny.

Here are the positives:

It’s easy to read for an academic book. He has irreverent quips and uses words like ‘anywho.’

It covers a lot of ground, including detail on the top producers and uses for all the major commodities, which is handy.

He has quippy sentences that sum up big phenomena, e.g.,

Re: China - “Every country puts a premium on political unification. Every country has fought internal wars to achieve it.”

Re: what Bretton Woods enabled - “All at once, anyone and everyone could trade for anything and everything.”

His points on demographics and capital are the strongest: For the last thirty years, the Baby Boomers have been highly productive, and they’ve put savings into investments driving down the cost of capital. But as they retire and begin to transfer assets to low-risk investments, it will raise the cost of capital and slow everything down. Tax revenue will also decrease as there are less mature workers generating income.

Potential blind spots:

He references the importance of technology and that the list of winners and losers evolves with technological development, but it isn’t central to his argument.

A book of this nature usually has 50+ pages of citations and sources. This book has none. Harper Collins wouldn’t publish a book without fact-checking, right?

There are probably many exaggerations. It’s easier to write, get attention, and sell books when you keep things simple and make bold scary claims.

A couple of key lines that stood out:

“The industrial technologies that reduce mortality and raise standards of living cannot be un-invented, but if trade collapses, these technologies can be denied.”

Scary word - “decivilize” - but he claims that’s what is at stake with a breaking of globalization. “Everything we know about human civilization is based on the simple idea of organization.”

“Every since Columbus sailed the ocean blue, human economics have been defined by the concept of more.”

By 2030, there will be twice as many retirees, in relative terms.

“Whatever new economic system or systems the world develops will be something we're unlikely to recognize as being viable today.”

“Formally, China’s birth rate isn’t simply the lowest since 1978, birth rates in Shanghai and Beijing are now the lowest in the world.” (I request a fact-check on that one).

“China imports more than 70% of its 14 million barrels of oil it needs every day; Taiwan, Korea, and Japan important more than 95%.”

Web3: It’s all still happening.

I co-wrote an essay this week with Eric Lavin on lessons we’ve learned from investing in 50+ web3 crypto projects between us. There is plenty to be cynical about with web3. We’ve all seen our share of shenanigans and blatant scams. And, no, I’m not going to shill you another coin or a specific project.

I’ve worked on describing the phenomena as simply as possible. I know I’m getting better because an LP told me last week that I was the first person who could describe crypto in a way that made sense. Here’s what I say:

Look, it’s not that different from today. It’s not a massive revolution, at least immediately. The technology is pretty buggy. The user interfaces are confusing. Most of the talking heads spew jargon or high school econ talking points. But, there are three reasons why I believe it’s here to stay:

1.) The kids get it, and the kids are the future. I’m 36. I’m not the future anymore. I might be a capital allocator for the future, but my tastes and preferences are solidly late millennial. So, what are the kids doing? They are spending time in immersive environments buying and selling digital goods and transacting globally online.

2.) It’s a little more fun and interactive.

3.) The tech infrastructure is now more or less in place, and it’s getting better. In some cases much better.

Okay, so after 50+ “investments” and a year of participating in web3, what have we learned:

There has to be value. The fundamentals of entrepreneurship do not change in web3. While the first rule of startups continues to be the need to achieve product-market fit, in web3 we’ve seen this rule skirted thanks to perverse incentives and opaque market movements.

Web3 and crypto are not consumer-friendly brands. Existing nomenclature has been more confusing than helpful. Crypto. Blockchain. DAO. Coin. Token. Utility. Is it a DAO? Is it not a DAO? Is it a company? Is it a DINO - DAO In Name Only? The labels don’t matter.

Incentive design matters. “Show me the incentive, and I will show you the outcome” as Charlie Munger famously quipped. This is no less true in the world of web3, where incentive design takes the form of so-called “tokenomics.” Memberships, points, and tickets are powerful incentives, particularly when gamified. Well-designed incentive systems look to be effective marketing mechanisms in the coming years.

Leadership is critical. Leaderless organizations don’t function. Not all web3 organizations are decentralized autonomous organizations (DAOs). Many models work. They all need a leadership team able to execute on the vision.

The barriers to entry for starting a web3 community are low but significant work is still required to instill strong governance. The paucity of barriers to entry is good for lowering the costs of entrepreneurship and fueling experimentation. However, this has a downside in the form of profiteers and copycats who enter the ecosystem looking to make a quick buck.

The balancing act with investors is being worked out. A major promise of the web3 movement was to democratize ownership and wealth. There are a few mega-investors in the space who have taken significant ownership of key projects. Participants have questioned whether this runs counter to web3’s ethos of democratized ownership.

Better tools are coming. DAOs are succeeding despite having no tools purpose-built for their use case. Purpose-built tools for decentralized organizations are critical for success.

The future belongs to digital natives. Young people all over the world readily participate in global online communities across games, social media, and the classroom. They don't give a second thought to using digital coins, tokens, and goods. A recent survey showed that 53% of children aged 6 to 8, and 68% of children aged 9 to 12, are playing Minecraft.

Digital money is here to stay. Although Bitcoin and Ethereum are down from their all-time highs, they have not plummeted to zero value. The total market capitalization for each is still massive, at $460B and $235B as of today. Major institutions are still behind the adoption of these digital currencies. The gimmicks have gone away (for now), but the infrastructure is already built.

Regulation is coming. The SEC has now moved against many of the ecosystem players who played fast and loose with their customers and capital providers. There may be more blow-ups like Luna and Celsius. Forthcoming regulation and case law clarity will play a greater role in both legitimizing and scaling the sector, even if it causes pain in the interim.

Weekly Song: Modern Girls & Old Fashioned Men

Music video here.

This duet is perfect. They sing over each other, simulating an argument between a couple. It’s not contentious, necessarily. Regina’s voice is on point (that’s the part I sing), and it feels like an apt performance for a 1920s NYC cocktail bar, and I do love that vibe.

"Modern Girls & Old Fashioned Men" by The Strokes and Regina Spektor

(Time) There's a few things that are gonna have to change

(I'm your son) Everyone has the same opinion

(Won't you please?) Your time is almost over

(Don't be mean) We won't get the chance to do this over

(That's alright) Right? Right? Right? Right? Right?

I don't belong

Thanks for reading, friends. Please always be in touch.

As always,

Katelyn