Mouthful Of Diamonds

w.250 | Trend Decks, Productivity, Math Learning, Writing Advice, RoW vs US

Dear Friends,

Happy Thanksgiving to everyone reading in the United States. We celebrated with four generations of my family around the table on Thursday and then around the television on Saturday for football, board games, and Secret Santa assignments.

One of my motivations for writing Declarative Statements is that every holiday I get to wait, watch, and find the exact moment to stare down my younger sister across the table, say, “As I’m sure you remember from my newsletter….” and smile. I anticipate this dopamine hit all year, and I can confirm it never disappoints.

I hope you can similarly own your moment of insufferability with a captive audience. One of the joys I have of being a big sister.

Today's Contents:

Sensible Investing: Trends

How I Invest: International vs US Equity Allocation

Song of the Week: Mouthful of Diamonds

Sensible Investing: Trends

Link to Every Trend Deck for 2025 that You Can Imagine. Probably 100. H/T to Tom Goodwin in his excellent newsletter, Nowism.

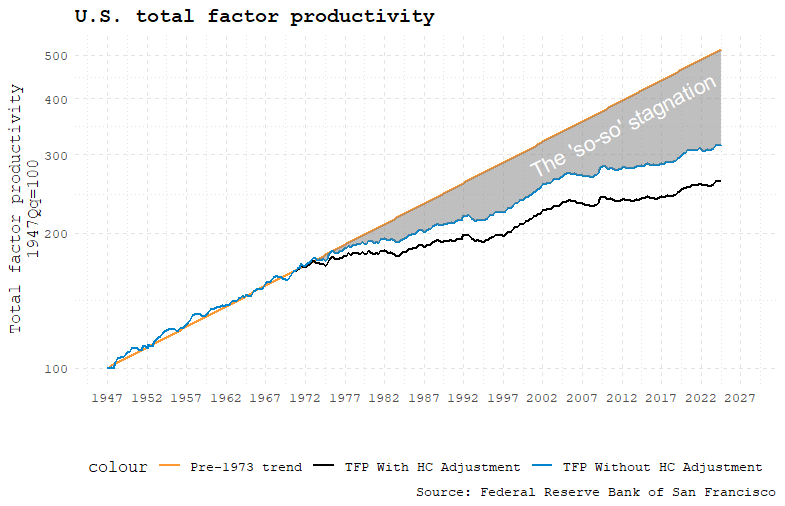

Is The Great Stagnation Actually Just a 'So-So' Stagnation? Human capital adjustment attributes lots of GDP growth to extra education, but if this education is mostly signaling, then we're getting more growth from new tech than we thought.

This argument rings true, but I hadn’t seen an analysis like this before. In short, most education institutions have programs that don’t produce meaningful gains of skills and talent. Said differently, more people getting credentials - like college degrees - doesn’t have any meaningful productivity boost. Remember, most gains from education programs happen when people are young (ages 3-6 are the most important!). There is little you can do for adult learning to move fundamentals.

AI—The Last Employee?: How big tech AI CAPEX spending will reshape future corporate cost structures.

This is the latest article in VC-land about the productivity potential of AI-enabled work. It’s a classic argument that extolls the productivity virtues of efficient technology companies and the increased efficiency possible with AI.

However, one of the reasons that smart and talented people start (and sometimes stay!) in the services sector is that people are the product. For technology companies, the technology is the product. So, people either build the product or sell it. If successful, you need fewer people. They also frequently use service companies to maintain a lean headcount.

Traditionally, the talent found a way to get paid mostly cash. In the last 15 years, technology companies have been able to attract the talent that would traditionally go to the services sector to tech companies because the equity rewards have been so unbelievably massive. Sometimes, this is warranted and works great - like in massive companies. Other times, it’s more suspect as many publicly traded tech companies obfuscate talent costs by using stock-based compensation, which makes the P&L look great but dilutes equity holders.

However, using equity to reward talent is a massive part of the technology equation; look no further than companies like Stripe, Databricks, and OpenAI, which are raising huge capital rounds for secondary buyouts of their employees.

The point is simple: any P&L analysis on technology productivity and labor costs is incomplete without factoring in equity-based compensation expectations.

Math Academy has the best description of math learning pedagogy that I’ve ever read. It’s all the rage among future-forward homeschoolers.

I Give the Worst Writing Advice in the World from Ted Gioia at The Honest Broker.

Because I found other ways of earning a living, I did become a little stubborn—editors and publishing insiders have found me "difficult to deal with." And I can't deny it (although I will argue that my 'cranky' vision of what I should write has been validated by the subsequent success I've had with the very same subjects they told me to avoid). But the simple fact remains that I walked away from a lot of promising opportunities when I was younger—and still do.

From any rational point of view, I totally mismanaged my writing career. The only advantages I gained were independence, slow and steady learning, and the courage of my convictions. Those are actually worth a lot—much more than most people realize—but I did pay a huge price for many years for my refusal to "work within the system." I'm hesitant to recommend this 'method' to anybody else, but for me it was the only honest and fulfilling approach.

How I Invest: Should I Have More International Diversification?

During the last month, from Riyadh to London to Singapore to Austin and on video conference meetings in between, I kept having the same discussion: Nvidia is now a $3.4B market cap company, up 180% YTD. If you were an active equities manager and didn’t hold Nvidia this year, you likely underperformed the broad market indexes. This can beg the question - what’s the point of active, sector specialist investors? Why have I done all this work to select a curated portfolio?

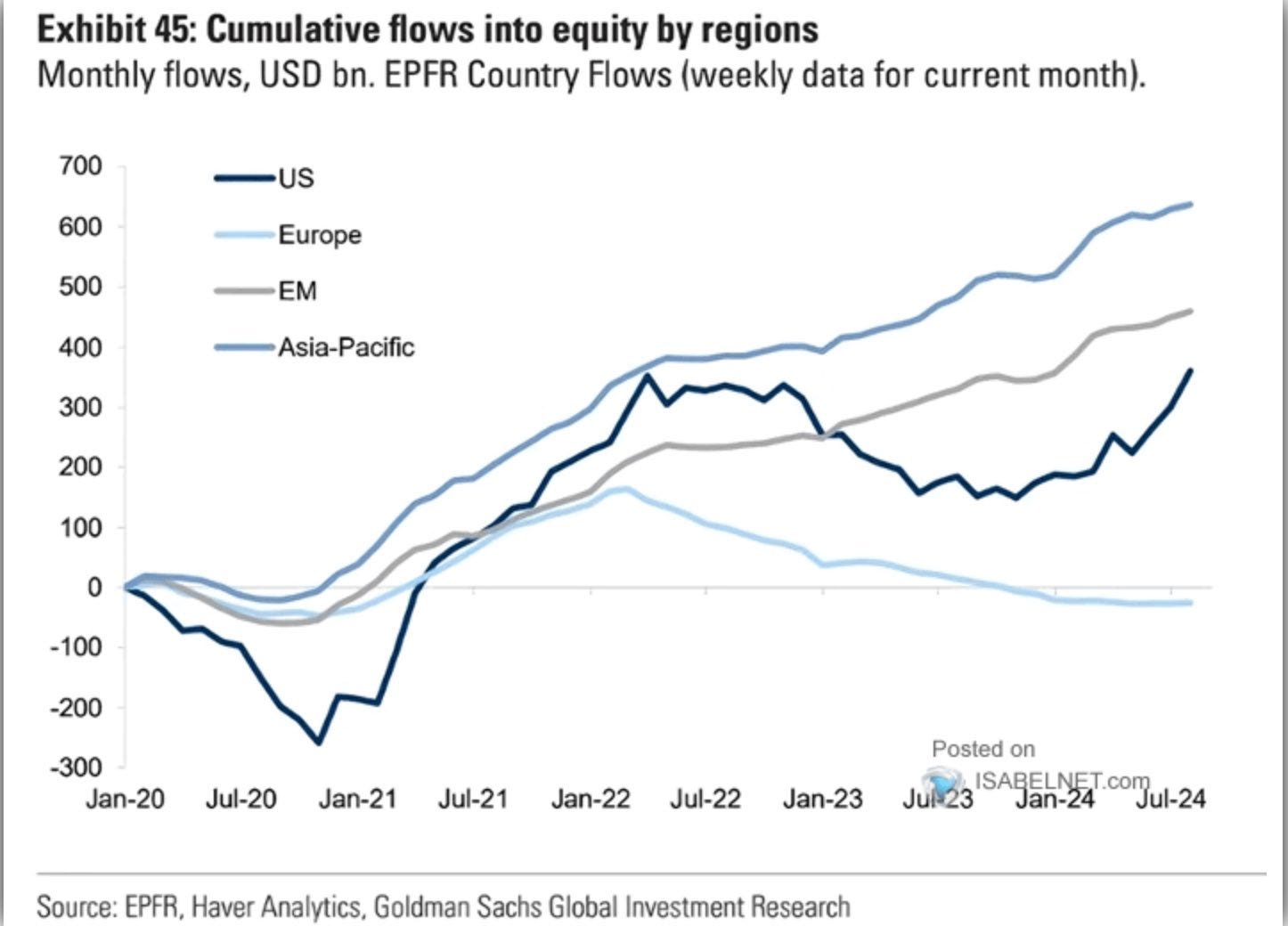

I don’t know. I’m not trying to play that game. But there is a question of broad portfolio diversification, particularly if you are deciding your allocation between US-listed equities and the rest of the world. As the US continues to outperform international equities, people are asking if this trend will continue or if it’d be smart to reallocate to less expensive, decade-long underperforming international stocks.

The argument for an American premium is that America is home to the world’s largest technology companies, there is a vast amount of tech innovation, tech innovation will drive returns long-term, and the regulatory environment, while not perfect, is better than anywhere else. Also, most US companies have huge international operations and sales so you get covert international exposure.

I don’t know. No one does. I’m probably under allocated to international.

Song of the Week: Mouthful of Diamonds

Here on YouTube.

Phantograms produce a 2D image that is distorted in a particular way to appear three-dimensional to a viewer at a particular vantage point, standing above or recessed into a flat surface.

Like the phenomena, the band has music and lyrics with layers of meaning and depth.

“Mouthful of Diamonds” by Phantogram

You've got a mouthful of diamonds

And a pocketful of secrets

I know you're never telling anyone

Because the patterns, they control your mind

Those patterns take away my time

Hello, Goodbye. Selfie of the Week

Happy Thanksgiving to all and a very happy 90th to my grandmother today!

Thanks for reading, friends. Please always be in touch.

As always,

Katelyn