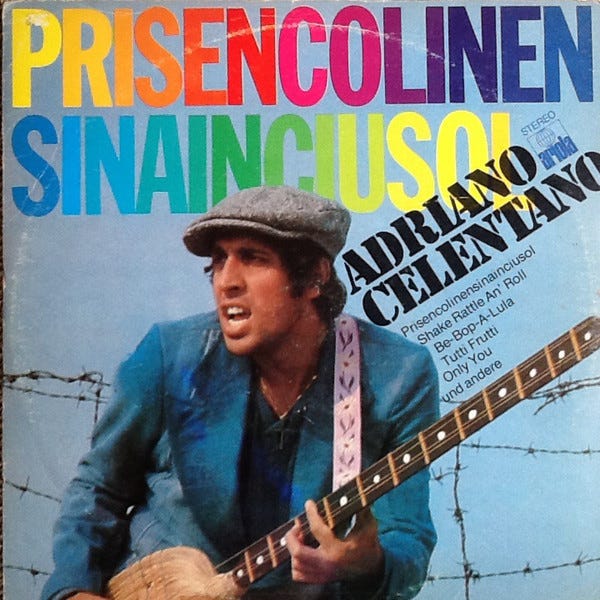

Prisencolinensinainciusol

w.254 | Watch Duty, Bubbles, Raising $50M, 'Lose-Lose' Market & Spotify

Dear Friends,

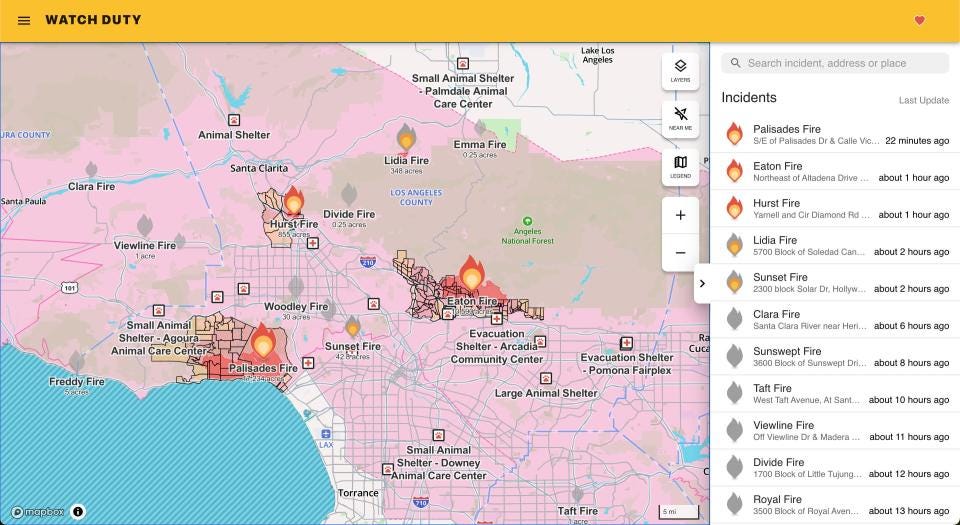

It was a terrible week watching the devastating fires in Los Angeles, which are still not under control. My thoughts and well-wishes are with my friends who have lost their homes and the many still battling uncertainty.

Once the fires have cleared, I hope the discussions on politics, policy, and government management will be productive. What went well, and what failed? What can we learn? At least the early snap judgments would suggest that we continue to see the impact of decaying government delivery capacity and long-term policy judgment.

There is a nice Fred Roger’s story about emotional handling times of disaster:

Fred Rogers often told this story about when he was a boy and would see scary things on the news: "My mother would say to me, 'Look for the helpers. You will always find people who are helping.' To this day, especially in times of disaster, I remember my mother's words, and I am always comforted by realizing that there are still so many helpers — so many caring people in this world."

The best website for information for citizens and first responders is Watch Duty, founded and run by a member of my Burning Man camp several years ago. It’s a non-profit, non-partisan, and non-government organization focused on disseminating public safety information in realtime from verified sources.

We will need more of this decentralized citizen action to build products, take action, and deliver. The government is rarely able to self-organize to procure a product like this. Philanthropy and foundations have similarly often underperformed. Seldom do those projects attract good enough talent or leadership, and the financing structure usually kills them on arrival. You need doers, builders, and deliverers. I wonder if ventures like Watch Duty might not be a model that society should consider as a new way to deliver and finance public goods.

In the meantime, I wish only the best to the firefighters and first responders attempting to control this situation, including the many from states beyond California who are venturing to Los Angeles at this time of need.

Today's Contents:

Sensible Investing: Trends

Song of the Week: Prisencolinensinainciusol

Sensible Investing: Trends

Are we in a bubble? Two reads:

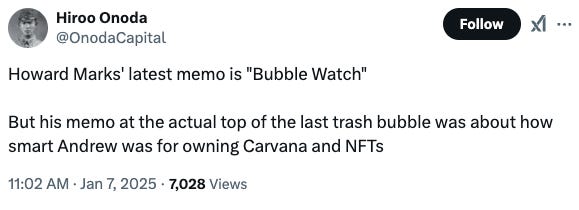

On Bubble Watch - Latest memo from Howard Marks with some nice tidbits of investment writing.

But if something’s new, meaning there is no history, there’s nothing to temper enthusiasm.

It’s not what you buy, it’s what you pay that counts.

Good investing doesn’t come from buying good things, but from buying things well.

There’s no asset so good that it can’t become overpriced and thus dangerous, and there are few assets so bad that they can’t get cheap enough to be a bargain.

BUT, as my friend commented: It’s absolute madness in pockets of the market with robotics, quantum computing, and drones being notable. BUT gotta remember his incentives. Being pessimistic makes him look smart. He’s in the asset-gathering game, not in the alpha game. I generally agree that there are pockets of madness in the market, but paying 22-24x for META and Google is not crazy either. These are the world’s best businesses.

I agree with him. I also agree with the dig below. Andrew is Howard’s son, who was into growth investing:

There Are Idiots: Seven pillars of market bubbles. This is a discussion of Bitcoin mostly. Charlatan is one of my favorite words. Up there with sycophant.

The corollary to “nobody knows anything” is that anyone claiming certain knowledge of future events is a charlatan. Charlatans come in many shapes and sizes: hyperbolic sell-side analysts, social media chatterers, and megalomaniac CEOs. A recent development is the rise of crypto charlatans, an invasive species currently slithering into equity markets.

How I Raised $50M from Tyler Denk, the founder of Beehiiv, a newsletter software company, on his company's financing journey — not a smooth ride. It feels like it’s cheating on Substack to share this, but it’s a great article. He writes a good newsletter (Big Desk Energy), and I recommend his playlist!

You Only Have to Get Rich Once. Hitting it big in the market is electrifying, but can you hold on to what you made? I recently discovered Jack Raines’ newsletter, Young Money, and now I see him everywhere. Excellent writing and ideas for people early in their careers. I enjoyed this article, which makes the same point I made a few weeks ago about getting wealth and diversifying rather than immediately doubling down.

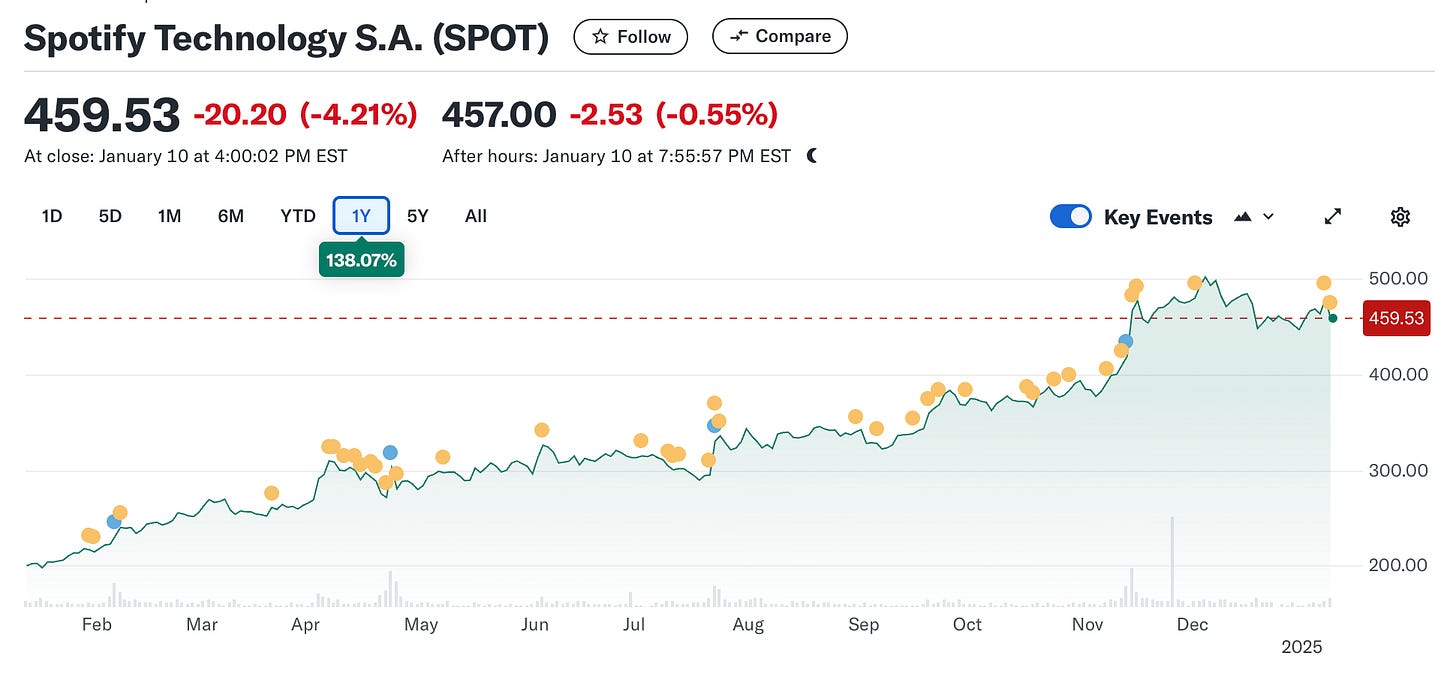

The Ugly Truth About Spotify Is Finally Revealed. A year-long investigation by an indie journalist is a call to action. TL/DR - “Spotify was filling some of its popular and relaxing mood playlists—such as those for “jazz,” “chill,” and “peaceful piano” music—with cheap fake-artist offerings created by the company.”

It has helped profitability, though. The stock price (up 138% in 1 year).

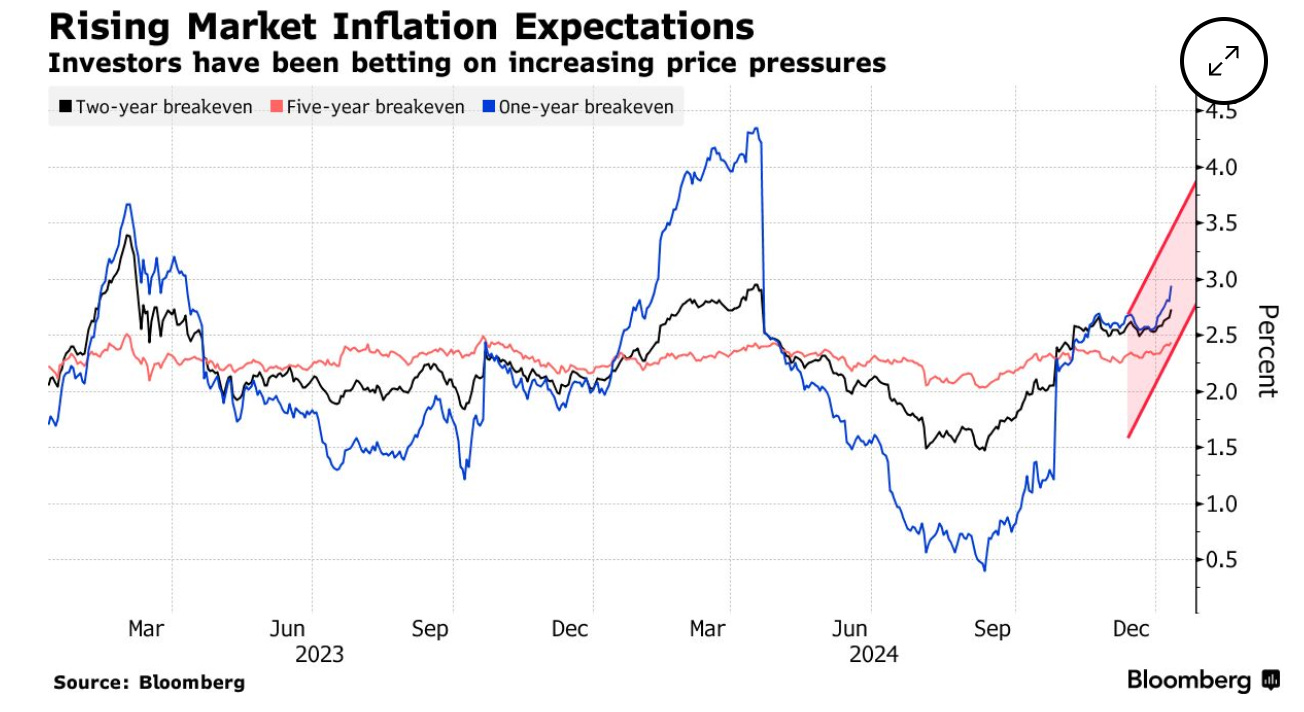

Blowout Jobs Report Fuels Wall Street Fear of ‘Lose-Lose’ Market. In the latest of ‘interest rates rule everything around me’, stocks and bonds are down on a positive jobs report for the US economy. Also, inflation isn’t going away.

18 Avalanches in 2025, written by me.

Song of the Week: Prisencolinensinainciusol

Here on YouTube.

This is the most hilarious song.

This 1970s song is intended to sound to its Italian audience as if sung in English and spoken with an American accent; however, the lyrics are deliberately gibberish.

Celentano intended to explore communication barriers and demonstrate how English sounds to people who do not understand the language.

“I thought that I would write a song which would only have the inability to communicate as its theme. And to do this, I had to write a song where the lyrics didn't mean anything."

He also took inspiration from the Bible's account of the Tower of Babel.

Prisencolinensinainciusol by Adriano Celentano

Prisencolinensinainciusol ol rait

Uei ai sint no ai

giv de sint laik de cius

nobodi oh gud taim lev feis goSelfie of the Week

These photos were taken in 2024 when my friend and I played around with Polaroids. I was learning to express myself visually using another medium because sometimes words aren’t the most powerful.

Thanks for reading, friends. Please always be in touch.

As always,

Katelyn