Dear Friends,

‘Extrovert week’ was intense, as expected. For a while on Wednesday night, I could not string together coherent thoughts. But I’m happy to say that I’ve recovered fully and feel energized for the follow-ups and inbox re-engagement.

I’ll do a full debrief on my takeaways from ASU-GSV in the next edition, but I have to share a major Thank You to Deborah Quazzo and the whole team who put on the largest EdTech investment conference in the world for over 7,100 registered attendees (and probably a couple thousand more unofficial participants). Everything ran smoothly, everyone was happy, and I gained immense value and learning from my time there.

Today's Contents:

Good Reads: Sensible Investing

Song of the Week: Sunshine

Good Reads: Sensible Investing

A Few Things I Believe About AI. Taking time for a 10,000-foot perspective from Dan Shipper.

Dan articulated much of what I’d been stewing on with more clarity. The biggest opportunity with artificial intelligence lies in its combination with human intelligence. And developing human intelligence at scale is a topic that I’m deeply obsessed with. Yes, a machine could orchestrate knowledge, but this is also one of the most important tasks of knowledge work.

One of the points to consider is whether the AI world is better for startups than incumbents. I had been thinking the opposite, but that perspective may be focused too narrowly on the education industry. Common wisdom in education is that distribution and GTM are the biggest differentiators, not product quality. But the innovator’s dilemma and the difficulty for large companies to align incentives with their most innovative and productive employees could cause them to stumble.

Key notes from the piece:

Knowledge orchestration is the most important bottleneck for AI applications.

Knowledge orchestration is the process around knowledge. But what about the knowledge itself? What kind of knowledge is most valuable?

Startups that are horizontally integrated over a process will be dominant

The more of a process you can see and store in your database, the more you can improve it. Therefore, there’s a significant incentive for startups to horizontally integrate and bundle to enhance performance in an AI-first world.

This world is good for incumbents, but better for startups

You could argue that companies that are in the best position to collect this kind of data are incumbents. After all, Google has everything from your emails, to your documents, to your code, to your web analytics. But there will be significant privacy concerns for incumbents who try to share data between apps in their ecosystems, and there will also be significant internal political resistance to doing so. In short, incumbents are not organizationally architected for this world.

Startups that are architected with this intention from the beginning, who know it is a priority to both own an entire end-to-end process, and centrally store the data from that process so it can be used to make models better, will have an advantage.

Sequoia’s Report on Generative AI. I can’t believe I hadn’t seen this before. And this one on recruiting the AI-enabled hybrid workforce.

Why I Am Not Investing in a Buyout for a Long Time to Come. The investment model of private equity has become too popular to deliver superior returns.

Interesting opinion piece in the FT by one of the founders of Cambridge Associates.

From the research I have seen over the years, buyouts, net of fees and leverage, have not outperformed public markets. One 2020 paper found that private equity funds had returned about the same as public equity indices since at least 2006.

Inflated returns, denial of volatility, high prices and fees, excessive leverage, absence of covenants on buyout debt — all this together represents fantasy thinking. It is what happens when a successful investment model becomes too popular. By now it should be very clear that current investment “alternatives” such as buyouts are no longer alternative. This should be a red flag. No investor can expect to earn above average returns by copying others.

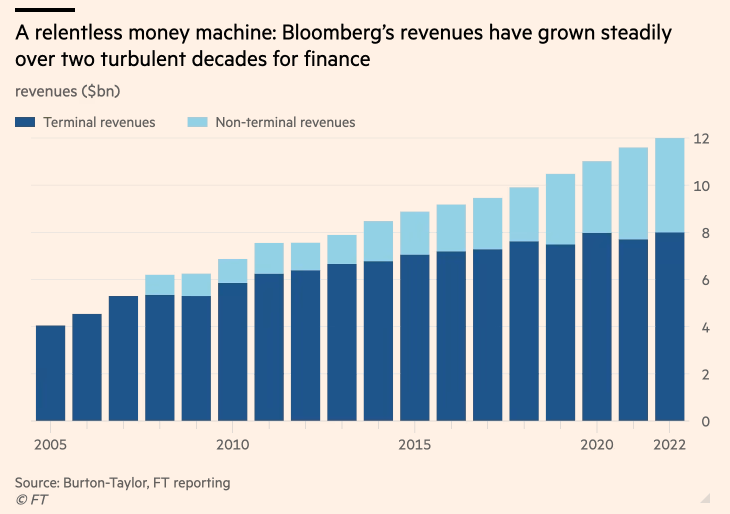

Bloomberg is contemplating life without its founder. Michael Bloomberg is lining up succession and one of the largest charitable donations in history.

Phenomenal profile of Michael Bloomberg and Bloomberg LLC in the Financial Times. Sadly, it’s behind the paywall but I’ve quoted one short section below:

To many people outside finance, Bloomberg is a media company. That is a little like describing Disney as a theme-park operator or Google as an email provider. Out of Bloomberg’s more than $12bn of annual revenue, only about $500mn comes from media, according to people familiar with the matter. The vast majority of its profits come from banks and investment companies renting “the terminal”, its clunky-but-powerful data and analytics portal. From this beachhead, Bloomberg has expanded into trading infrastructure, legal analytics, regulatory technology, public policy and more. It has claimed one-third of the roughly $37bn global financial data and analytics market for more than a decade.

Bloomberg, the company, has made Bloomberg, the man, vastly wealthy. His $94bn fortune — as estimated by Forbes since Bloomberg News’ billionaires index doesn’t track its owner — means that only Warren Buffett has ever made more money out of the business of money. If data really is the oil of the 21st century, then Michael Bloomberg is today’s John D Rockefeller.

In February, Michael Bloomberg turned 81. People with knowledge of the company’s internal dynamics and its founder suggest he is likely to transfer ownership of his empire to a trust that will finance Bloomberg Philanthropies for perpetuity. That would be one of the largest charitable donations in history.

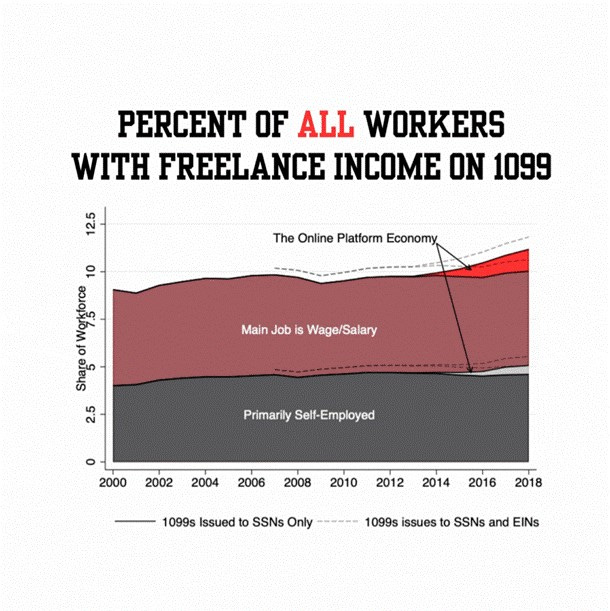

Is Gig Work Changing the Labor Market? Key Lessons from Tax Data.

Two key findings:

High- and low-income workers do different types of gig work; and,

Apart from driving-based app work, the prevalence of gig work as a primary job has remained relatively constant over time.

Song of the Week: Sunshine

Official video on YouTube.

Atmosphere is a duo composed of rapper Slug (Sean Daley) and DJ/producer Ant (Anthony Davis) from Minneapolis. God Loves Ugly (released in 2002) was a frequent play on the way to high school although Sunshine was released in 2007.

It’s a nice pick-me-up at the end of a long week. Just enjoy the sunshine.

“Sunshine” by Atmosphere

And there's that bike that I forgot that I possessed

Never really seen exercise as friendly

But I think something's telling me to ride that ten speed

The brakes are broken, it's alright

The tires got air and the chain seems tight

Hopped on and felt the summertime

It reminds me of one of them Musab lines like

Sunshine sunshine, it's fine

I feel it in my skin, warmin' up my mind

Sometimes you gotta give in, to win

I love the days when it shines

Whoa, let it shine

Selfie of the Week

Me with my friend Matthew Rascoff. Matthew is the vice provost for digital education at Stanford. Sadly, Stanford stole him from Duke two years ago; back then, I got to work with him on the Learning Innovation venture of my alma mater. Matthew is the sharpest leader I’ve met who is shaping innovation and future strategy for a top-tier university. I’m in awe of everything he has accomplished in political, challenging environments.

What a treat to be able to catch up, albeit briefly, in San Diego this week.

Thanks for reading, friends. Please always be in touch.

As always,

Katelyn

Thank you Katelyn!