Take Me Home, Country Roads

w.198 | No Moat, Icahn, Downturn Tracker, Trying Too Hard, GenZ Behavior

Dear Friends,

I’ve spent the weekend in Omaha with many of my friends (and readers of this newsletter). It’s been wonderful to connect and reconnect. We all made the pilgrimage for Berkshire Hathaway’s annual shareholder meeting.

The weather behaved, spirits were high, and it felt like business as usual. There were no massive revelations from Warren and Charlie — they put on their usual good-humored show and took many questions from children attending with their parents. They are master class at sharply answering (or not quite answering) tough questions in clear, plainspoken terms and via entertaining stories that serve an educated audience. Both show tremendous respect for the audience and the questions; they never speak down to the gathered crowd.

The event is completely unique for its openness, inclusivity, and transparency. I was trying to think of a VC/Startups/Tech/Private Markets equivalent, and nothing comes close. Especially as Warren and Charlie continue to age, the future of this meeting and what an equivalent could be was on my mind.

Today's Contents:

Good Reads: Sensible Investing

Song of the Week: Take Me Home, Country Roads

Good Reads: Sensible Investing

We Have No Moat. And neither does OpenAI. This is a leaked document originating from a researcher within Google claiming that the open-source models are faster, more customizable, more private, and pound-for-pound more capable.

The document makes the case for how technology enables a decentralized paradigm with more people being able to own and control their data and technology without being limited to (or paying) a centralized company.

In both cases, access to a sufficiently high-quality model kicked off a flurry of ideas and iteration from individuals and institutions around the world. In both cases, this quickly outpaced the large players.

The solution for Google comes down to ownership:

The value of owning the ecosystem cannot be overstated. Google itself has successfully used this paradigm in its open source offerings, like Chrome and Android. By owning the platform where innovation happens, Google cements itself as a thought leader and direction-setter, earning the ability to shape the narrative on ideas that are larger than itself.

Icahn Enterprises: The Corporate Raider Throwing Stones From His Own Glass House. Report from Hindenburg Research. They say:

In brief, Icahn has been using money taken in from new investors to pay out dividends to old investors. Such ponzi-like economic structures are sustainable only to the extent that new money is willing to risk being the last one “holding the bag”.

Matt Levine, per usual, has the best take.

Look, I personally do not view the term “ponzi-like economic structure” as a pejorative — many of my favorite economic structures are Ponzi-like — and agree that this schematic structure seems Ponzi-like, but in a fun way.

Basically the accusation is that the shares trade for more than they are worth, so Icahn is selling more shares for more than they are worth in order to pay a big dividend to his shareholders. Which … I think is simply correct corporate finance? If your shares are trading for more than they are worth, you should sell as many shares as you can, and if you don’t have any good use for the money you should use it to pay a dividend. It is strange corporate finance, but it checks out. Icahn Enterprises does disclose its indicative net asset value (though Hindenburg quibbles with its calculations), so no one is exactly deceived here. If you buy the stock, you know. you’re paying a huge premium to the net asset value.

This feels like the endgame. This blog (quoted below) is pretty direct and proposes a (non)solution of moving to Crypto or Bitcoin. There were many questions on all aspects of this topic in Omaha this weekend: financial system stability, risk management in banking, federal debt crisis, and de-dollarization. The answers from Warren and Charlie felt like a mix of obfuscation, hand-wringing, and platitudes of reassurance that the United States is too big to fail. It was almost alarming in the obviousness of the approach to be non-alarmist.

If it wasn't abundantly clear to you already, we are in the middle of a systemic banking crisis the likes of which we have never experienced in this country. Despite this glaringly obvious fact, Jamie Dimon, Joe Biden, Janet Yellen and Jerome Powell have all had the gall to "reassure" the American people that the banking system is stable.

To make matters worse, the US is less than a month away from hitting the debt limit as tax receipts have come in well below expectations. On the heels of this reality, the Treasury announced today that they are launching the first treasury buyback program since 2000 at some point next year when a material block of treasuries is set to roll over. Signaling that demand for US debt is so low that the US is being forced to Japanify itself to prop up the market for treasuries.

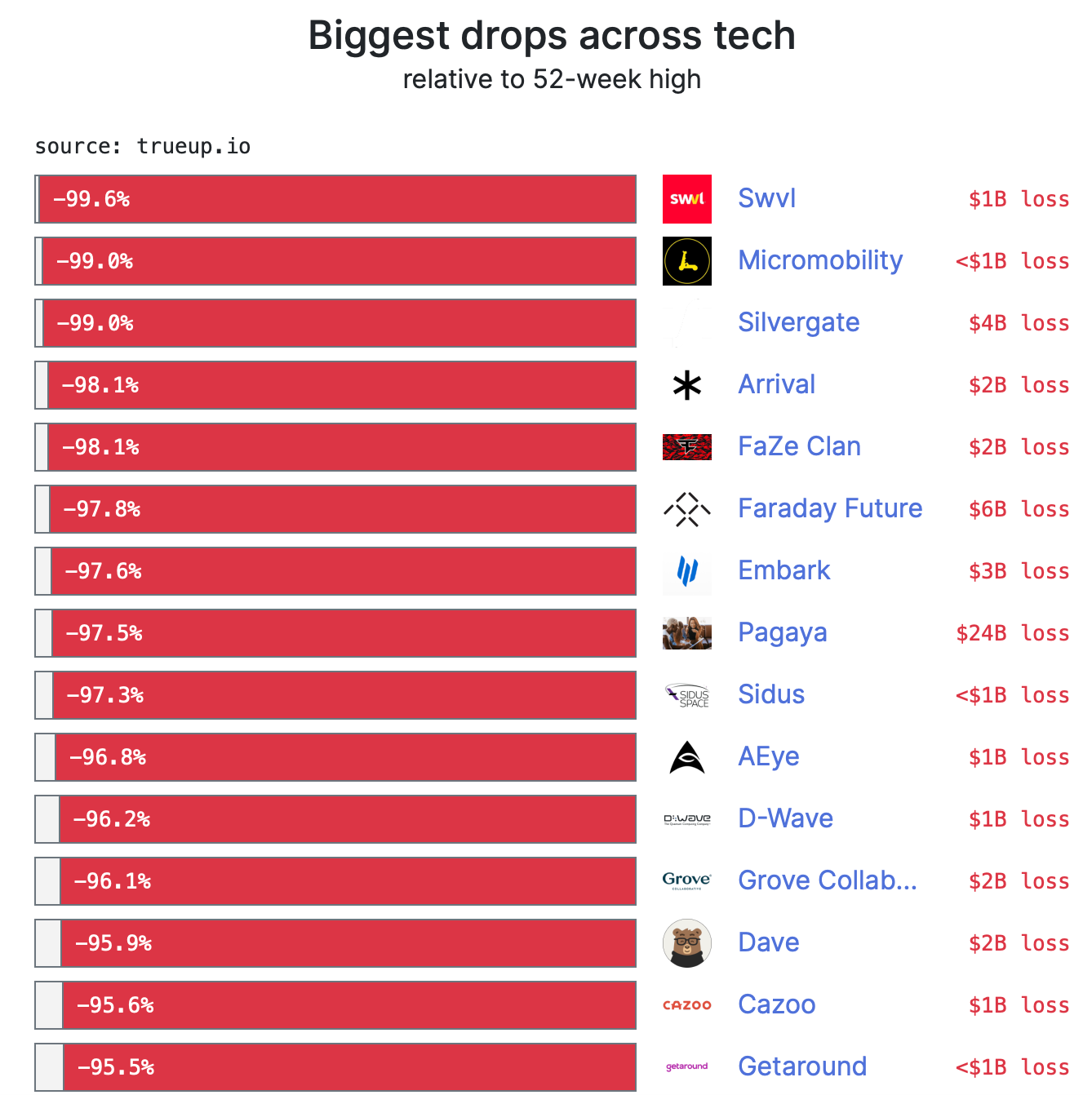

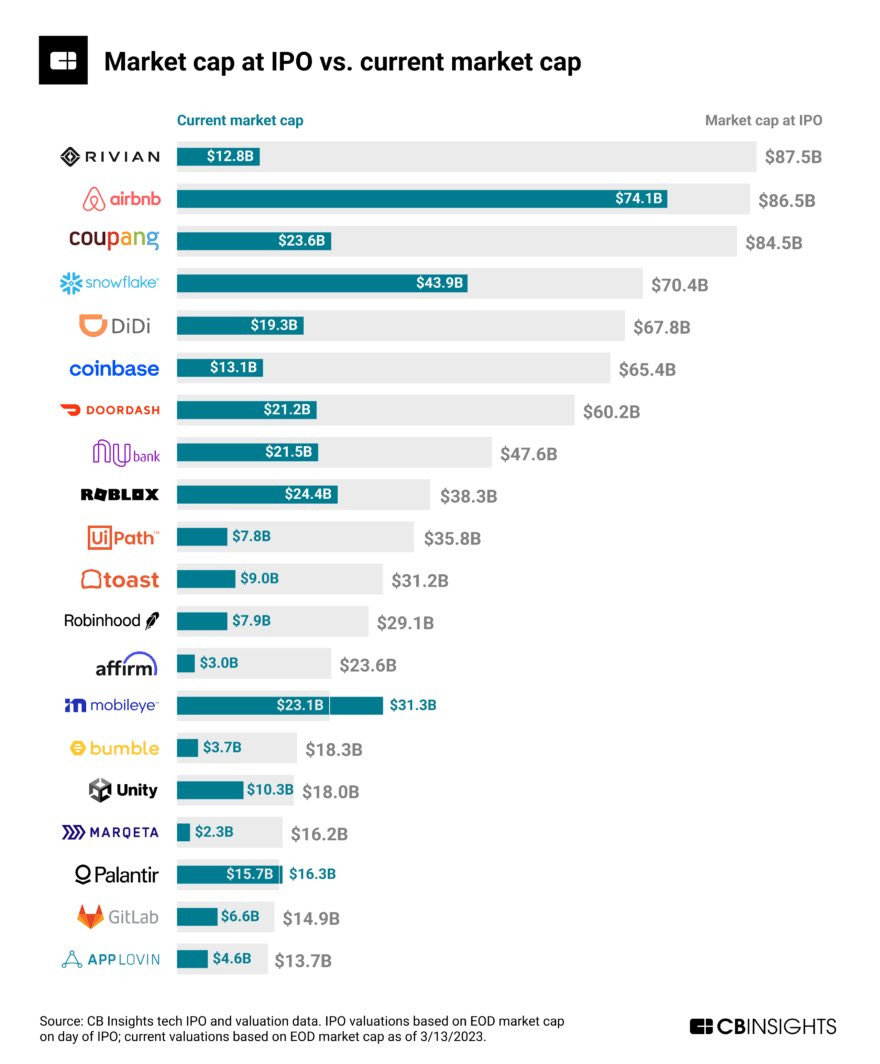

2022-23 Tech Downturn Tracker. Fun graphs that put some of the losses from all time highs in perspective.

Trying Too Hard. Speech from 1981. Smart truisms about investing and the promise of simple and consistent approaches. I appreciated this gem:

I’ve concluded this about growth stocks: There is no such thing as a growth stock. Only passing phases of growth in almost every company’s life. Phases whose beginning and end usually appear in disguise.

Seismic Waves of Gen Z Behavior from Digital Native.

Work is disaggregating, with more people eschewing “traditional” careers in favor of self-driven, online alternatives. In a poll of Gen Zs, 42% said they want to have their own business—10 percentage points higher than any other generation.

Song of the Week: Take Me Home, Country Roads

Video on YouTube.

Take Me Home is a classic country song that feels distinct for its time and place. I had already felt it would be appropriate for the pilgrimage to Omaha, but that was cemented when it was featured in the opening video for the meeting.

“Take Me Home, Country Roads” by John Denver

All my memories gather 'round her

Miner's lady, stranger to blue water

Dark and dusty, painted on the sky

Misty taste of moonshine, teardrops in my eyes

Country roads, take me home

To the place I belong

West Virginia, Mountain Mama

Take me home, country roads

Selfie of the Week

I have received strong positive feedback on the selfie of the week as a section. Glad people are enjoying it, and thanks for the reinforcement to keep it going! :)

Thanks for reading, friends. Please always be in touch.

As always,

Katelyn