Try Again

w.230 | Berkshire 2024, Returns of Top VC Funds, State of Tech Hiring, SaaS Exits, Public Interviews

Dear Friends,

Sadly, I missed the pilgrimage to Omaha for the annual Berkshire Hathaway meeting this year, but it seemed like a great time. I did watch the opening video simulcast on CNBC and appreciated the trip down memory lane and seeing the standing ovation at the end. Shout out to all my value investor friends and Omaha regulars.

We have a content-rich offering of data, articles, and analysis this week. We are in prime time before spilling into the summer, so let’s get at it.

Today's Contents:

Good Reads: Sensible Investing

Views I Discussed in Public this Week

Song of the Week: Try Again

Good Reads: Sensible Investing

Best clips from Berkshire Hatchway yesterday.

“Hi, my name is Andrew, and if you had more days with Charlie, what would you do with him?” Answer here. Advice is simple; spend time with the people who you want around you, and you will not have regrets or feel the need to wish for more time.

Warren Buffett slipping up and accidentally calling Greg Abel “Charlie” may be one of the most charming and perfect honors that I’ve seen of Charlie Munger, who recently passed away.

Warren Buffett on valuations today: “I don’t think anyone at this table has any idea of how to use it [$189B in cash] effectively, and therefore we don’t use it. We only swing at pitches we like… today things aren’t attractive. We’re not using it at 5.4%, but I wouldn’t use it at 1% either. But don’t tell the Federal Reserve that.

I don’t mind at all, given current conditions, building our cash position. When I look at the equity markets and the composition of what’s going on in the world, we find cash quite attractive.”

Warren Buffett on trust in partnerships:

Big Winners and Bold Concentration: Unveiling the Secret Portfolio Returns of Leading Venture Funds. Analysis from Primary Ventures. There are many good takeaways in the data, but their summary is worth considering in full:

Ultimately, this dataset has left us thinking deeply about the following:

How early can you truly identify your winners, and how does that impact your concentration strategy/portfolio construction?

How can you ensure that you'll be able to earn the right to concentrate?

You need to take big swings

You can't be afraid to lose money

Rising seed prices are likely to impact even the best fund returns by a couple of turns

One Year Later: How Early Tech Talent Has Adapted to Big Tech Layoffs. Tech majors cast a wider net in their job search in 2023:

Internet and software companies have significantly slowed early-career hiring. Job postings by internet and software companies on Handshake dropped steeply in 2022 and hovered around 40% of 2021 volume last year.

Tech majors are shifting their applications to other industries. The share of tech majors’ job applications submitted to internet and software companies dropped by more than 30% between November 2021 and September 2023, while the share of applications submitted to government jobs more than doubled.

Students from underrepresented backgrounds are increasingly likely to major in tech, but are less likely to apply to certain industries. Women tech majors submit fewer applications to tech companies, and Black and Latinx tech majors are less likely to apply to roles in finance and consulting.

Locations outside traditional tech “hubs” are attracting more tech applicants. Tech majors submitted a larger share of their applications to states like Michigan, Ohio, and Florida in 2023.

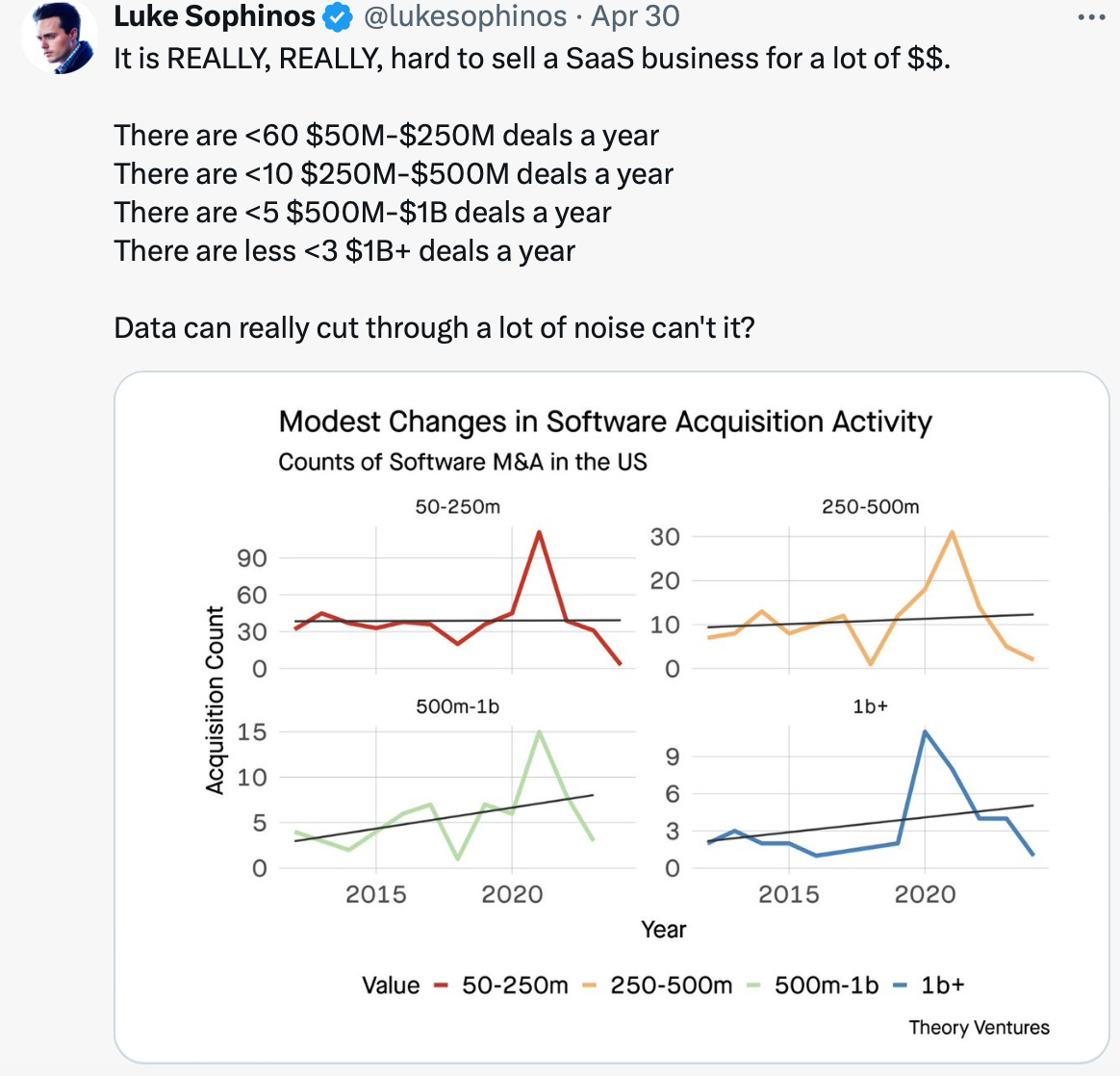

Good Reminder.

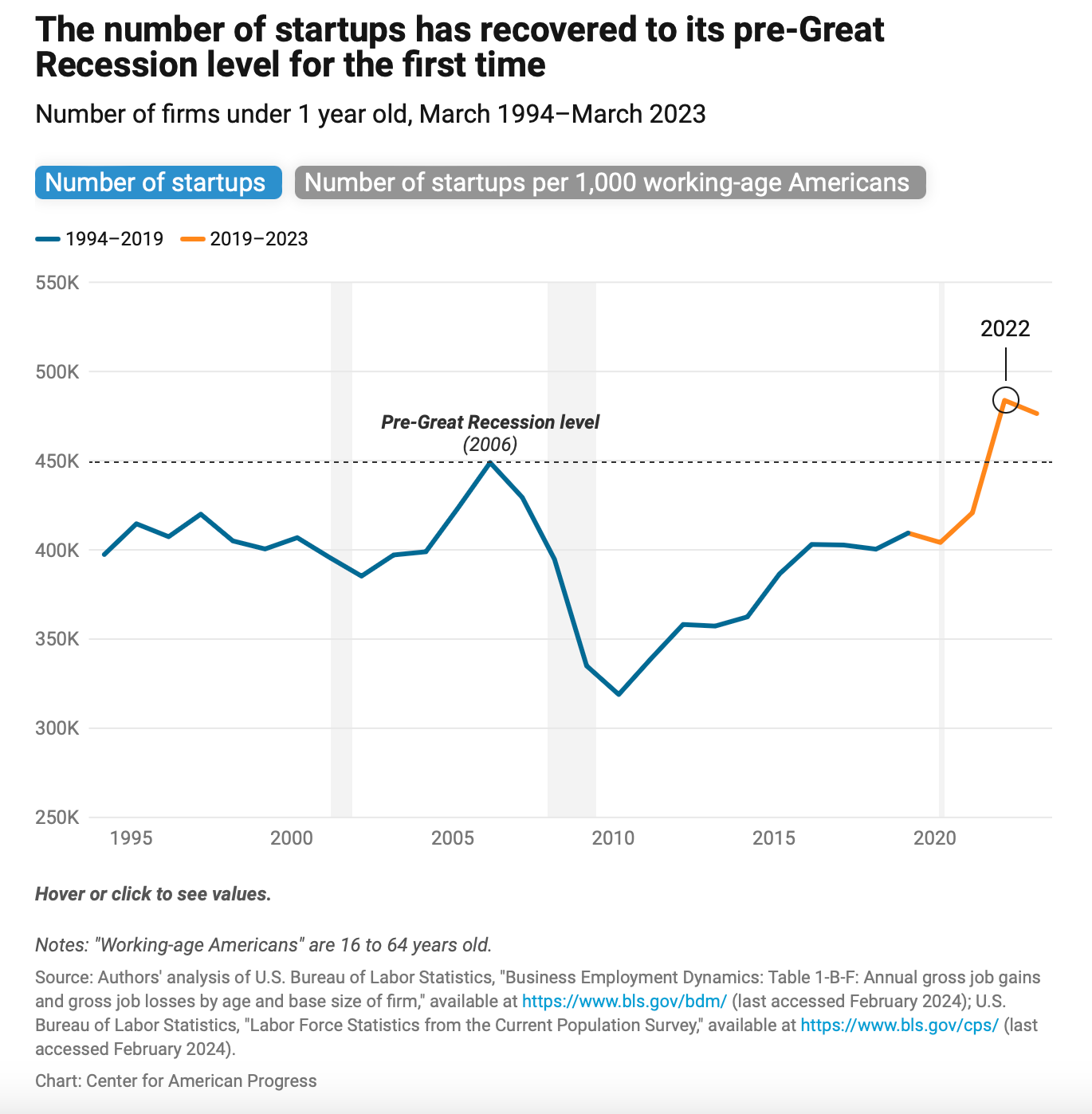

Entrepreneurship, Startups, and Business Formation Are Booming Across the U.S. Applications for new businesses, the number of startups, and the total number of businesses have skyrocketed across U.S. states and counties since 2021.

Fortunately, the U.S. Census Bureau measures a subset of applications that, based on historical patterns, are “likely employers,” meaning they are likely to become businesses with paid employees. Historically, a 1 percent increase in these likely employer business applications within a state leads to roughly a 1 percent increase in new businesses employing workers within two years.

Nationally, the total number of likely employer business applications from 2021 to 2023 was 5.2 million—a 1.3 million, or 34 percent, increase compared with the three years preceding the pandemic, 2017 to 2019. Every state and Washington, D.C., saw an increase in likely employer applications, with Wyoming seeing the highest, at a 93 percent increase, and Alaska seeing the lowest, at a 15 percent increase.

Views I Discussed in Public this Week

AI is Ushering EdTech into a New Era. Three investors share what they're most excited about in the space.

Published in Business Insider but here in PDF. I was one of the three quoted in the article. We represented three views. Brian Dixon and Ryan Craig have good takes, too, that I also agree with. TL/DR:

GenAI has the strong potential to personalize content and decrease costs. (Brian)

Better infrastructure upgrades (data, security, interoperability) are needed for education to benefit in the AI-Era. (Me!)

Everyone will need to learn how to use AI-powered tools and systems best. (Ryan)

The Future of Work is Fractional and Outcome-Based: Katelyn Donnelly, Avalanche VC

“The future in hiring is freelance, flexible, and fractional.”

– Katelyn Donnelly

On this episode of the On Work and Revolution podcast, host Debbie Goodman delves into the dynamic landscape of the future of work in EdTech with guest Katelyn Donnelly. They discuss the growing trend towards freelance and fractional work arrangements, highlighting the need for employers to rethink traditional hiring practices to attract top talent. Throughout the conversation, they explore innovative approaches to scaling startups, the role of technology in reshaping employment, and the imperative for individuals to cultivate entrepreneurial skills in navigating the evolving job market.

Song of the Week: Try Again

Video on YouTube.

This throwback song is an Aaliyah and Timbaland collaboration with a great beat and clean vocals. As an industry expert said: “An encouraging message with clean lyrics and an up-tempo beat make this song a winner in three different areas.”

I agree.

“Try Again” by Aaliyah

And if at first you don't succeed (Oh)

Then dust yourself off and try again

You can dust it off and try again, try againSelfie of the Week

I caught up with my old friend and co-investor Ross Baird last week. Ross is a true visionary and relentlessly pursues excellence and innovation. He is now the CEO and founder of Blueprint Local, a real estate private equity firm that manages Qualified Opportunity Zone funds and invests in commercial real estate projects across the Southeast, Texas, and Mid-Atlantic.

But a decade ago, he co-founded Village Capital, and we launched the first accelerators dedicated to EdTech in India and sub-Saharan Africa. These days, we are both happy to stay closer to home.

We went to Kemuri Tatsu-Ya, a casual izakaya & bar serving meat-centric shareable plates with Japanese & Texan influences. It’s as good as it sounds. Here is a review.

Thanks for reading, friends. Please always be in touch.

As always,

Katelyn