When It's Cold I'd Like To Die

w.245 | Gaming, Nuclear Fission, Asset Allocation, Enough, Bogle

Dear Friends,

In this newsletter, we do not mention anything about the E-word—you know, the one that rhymes with erection but inspires more passion. In the first DS reader survey, the definitive feedback was to stick to trends, investing, and finance. I took that seriously, and life’s been better ever since.

I will not be in the US during the first week of November. In a few hours, I’m embarking on a global tour to make friends and share insights; I’ll be in various locales across the Middle East, Europe, and Southeast Asia.

Five years ago, I swore off red-eye flights—too much abuse on the body. Friends, I’m sad to say that I will have two overnight flights this week. But it will all be worth it, especially the latter leg as I’ll then be ‘in the most beautiful spot in the world’ with two of my best friends. But first, Saudi Arabia. Cheers to the journey.

Today's Contents:

Sensible Investing: Trends

How I Manage Money: Part 3

Enough and John Bogle

Song of the Week: When It’s Cold I’d Like To Die

Sensible Investing: Trends

Gaming Industry Report Q3 by Konvoy. If you are interested in that sort of thing.

Generative AI’s Act o1 by Sequoia is a good article for keeping up with technological developments.

Why Nuclear Fission, Why Now by CrossCut Ventures. In the last year, this trend has quickly gone from no-go to consensus to ‘why doesn’t everyone realize we already have a lot of nuclear?’

Why Stripe’s Acquisition of Bridge is a Stroke of Genius in Pirate Wires. Bridge, which provides stablecoin issuance and orchestration APIs, was bought by Stripe, a payments processing infrastructure company, for $1.1 billion. It’s a huge vote of confidence for the crypto/blockchain space and is a strong signal for the institutional adoption of the underlying technology. This crypto winter has seen serious progress with a lot less mainstream attention; this news is the mark of an inflection point that is still early.

Ruminating on Asset Allocation—New Howard Marks Memo. This was great timing, given our discussion about personal investing. It’s about the difference between stocks and bonds and risk-adjusted returns.

The essential difference between stocks and bonds . . . that is, between ownership and lending. Investors seem to think of stocks and bonds as two things that fall under the same heading. But the difference is enormous. In fact, ownership and lending have nothing in common:

Owners put their money at risk with no promise of a return. They acquire a piece of a business or other asset and are entitled to their proportional share of any residual that remains after the necessary payments have been made to employees, providers of raw materials, landlords, tax authorities, and, of course, lenders.

Lenders typically provide funds to help owners purchase or operate businesses or other assets and, in exchange, are promised periodic interest and the repayment of principal at the end. The relationship between borrower and lender is contractual, and the resulting return is known in advance as described above, again assuming the borrower makes the promised payments when due.

It’s one or the other. You can’t simultaneously emphasize preservation of capital and growth maximization or defense and offense. This is the fundamental, inescapable truth in investing. The questions listed on page one are just details, the options available for reaching your targeted risk posture.

The absolute level of risk in a portfolio shouldn’t be an unwitting consequence of the asset allocation process described above, or of the search for superior risk-adjusted returns. The absolute risk level must be consciously targeted. In fact, in my view, it’s the most important thing. For an investment program to be successful, the level of risk in the portfolio must be well compensated and fall within the desired range . . . neither too much nor too little.

How I Manage Money - Part 3

I began this discussion for two reasons. First, several readers commented that I must have an elaborate investment strategy based on posting all these market trend pieces. Second, a series of friends and collaborators had the chance for lifelong financial stability and didn’t diversify, which has impacted them in the long-run. In the future, I’ll explain how I got here but, today, I’ll share what I do with most excess savings.

The idea is to not have to think or care if any given stock (or market) is up 20% this week or down 50% next. I don’t know, and I don’t care. It’s not my job, and the short-term whiplash would be a tough way to live.

These are estimates. I’m removing all commitments I’ve made to Avalanche Funds (present and future). All alternatives are valued as cash contributions.

~90% is diversified through dollar cost averaging into Vanguard ETFs and interest-bearing money market accounts.

Which ETFs? Mainly:

VTI - Total Stock Market

VOO - S&P

VGT - IT Sector

VIG - US Dividend Appreciation

VIGI - International Dividend Appreciation

VB - Small Cap

VOOV - S&P Value

VWO - Emerging Markets

QQQM - Nasdaq Top 100

I could consolidate some of these. I’ve used Wealthfront for tax loss harvesting and rebalancing and think it generally does a great job. But I like doing it myself. Every other Wednesday, I have an automated system to buy more.

It’s been an incredible year to be an ETF owner.

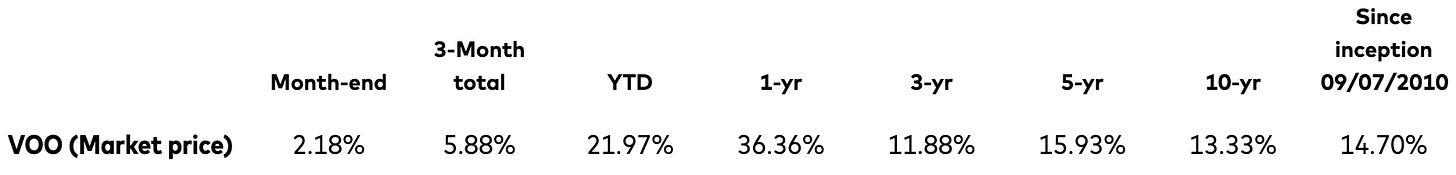

Let’s take VOO. The expense ratio is 0.03%, and Year-to-Date Returns are ~22%; in the last 12 months, it’s ~36%. This is pretty amazing performance.

Two exceptions to ETFs:

BRKB Berkshire Hathaway—Warren and Charlie have always been tremendous stewards of capital, and the overhead costs are low. Going to Berkshire's annual shareholders meeting is a highlight. This is kind of like an index, anyway.

ECML Euclidean Fundamental Value ETF - M/L AI-driven value to fund in an ETF. While the expense ratio is not low (.95%) and the performance over the last two years has mostly tracked the market, I’m happy to have the diversified exposure. I met the founder and manager, John Alberg, at Capital Camp and then spent an entire evening talking through the strategy, his background, etc., and left impressed. He’s a technologist, not a marketer, and that’s great. He ran the firm privately since 2008 and only launched the ETF in 2023.

Why Vanguard?

I’m going to talk about John Bogle later. However, the legacy of Vanguard’s commitment to the retail investor and its incentive alignment via its ownership structure is unique and powerful. Does Vanguard have the best technology interface? No. Are they generally honest brokers? Yes. Are they maybe a little slow on innovation? Yes. They don’t offer Bitcoin, for example. But this is fine because I’d rather trade that asset class elsewhere.

Other considerations worth discussing (to be examined later):

What about domestic vs international?

Tax optimized accounts and strategies?

What about fixed income vs. equity? How much cash? I still have more in the money market than I probably should. However, since it has a relatively high yield driven by the higher interest rates set by the Federal Reserve, I feel good about it. It feels nice to get the monthly distribution.

Life Partner, 529s, and other balance sheet items.

The other 10%. We will get into this in future editions, but

5% in alternatives with highly credible managers I know well.

5% is for experiments that include angel investing, crypto, real estate, and currency diversification. I like special situations.

Enough, and John Bogle

There’s no way to answer the questions of ‘how I invest money’ and ‘what I do every day’ without addressing the underlying values and ethics of ‘what is it all for?’

The external world can push to emphasize KPIs like absolute size of your bank account or attention economy clout. Both of these can lead to sad behavior and middling life outcomes.

I recently re-read John Bogle’s autobiography Enough: True Measures of Money, Business, and Life. The title was inspired by the exchange between Kurt Vonnegut and Joseph Heller (but at least Bogle cites the source—a poem in the New Yorker published in 2005). It’s a book about values and what has been important to him.

John ‘Jack’ Bogle is the founder of Vanguard and the inventor of the passive investing movement. All the chapters follow this pattern, which is clever; here are a few example chapters:

Too much complexity, not enough simplicity

Too much counting, not enough trust

Too much ‘success,’ not enough character

In the afterword of Enough, Bogle explains why he does what he does by describing how he’s led his life as a ‘battler.’ And he leaves us with this:

“Simply because I’m a battler by nature - born and raised to make my own way in life. Such a life demands the kind of passion evoked by the words of the great sculptor of Mount Rushmore, “Life is a kind of campaign. People have no idea what strength comes to one’s soul and spirit through a good fight.”

While I simply can’t image that my own soul and spirit will ever fade, I know deep down that time is not on my side. So I’ll continue to fight the battle until my mind and strength at last begin to dull. Only then, I hope, many moons from now, will I take time to revel in the memories of all the wonderful battles I’ve fought during my long life.

Resonates. Important to pick your battles wisely.

Song of the Week: When It’s Cold I’d Like To Die

Here on YouTube.

No one asked me what the emotive Moby song I referenced a few weeks ago was, but I’ve decided to share it anyway. It’s the type of song I’d listen to on a long flight. Like The Last Great Washington State, which was just recommended to me this week.

Even if you take the song on face literally, I’ve learned that I hate the cold.

When It’s Cold, I’d Like to Die is about giving up and not fighting anymore. The perfect juxtaposition against Jack Bogle’s will to battle.

Many people strongly associate this song with the last moments of The Sopranos episode ‘Join The Club’ when Tony Soprano is in a coma and doesn’t want to live anymore (according to analysis). I haven’t watched the series, but it is a cultural centerpiece.

But, back to Bogle. There are plenty of fights and battles out there, but make it worth it:

The great game of life is not about money; it is about doing your best to join the battle to build anew ourselves, our communities, our nation, and our world.

“When It’s Cold I’d Like To Die” by Moby and Mimi Goese

I don't want to swim the ocean

I don't want to fight the tide

I don't want to swim forever

When it's cold I'd like to dieSelfie of the Week

This week, I spoke at the SeedScout Summit and judged a pitch competition in Phoenix organized by Mat Sherman, who founded SeedScout and is now the head of Ad Sales at Product Hunt. I met Mat on Twitter in 2020, and we’ve been friends since. Mat is sharp and often outspoken. He is a fierce advocate for the underdog and a massive proponent of the Phoenix startup ecosystem.

Phoenix is poised to take flight with a series of new funds founded by serious people. While in town, I met with Greg Scoresby, who founded PHX Ventures and previously founded and ran CampusLogic, which he sold to Ellucian in 2022—a great, capital-efficient EdTech success story.

Thanks for reading, friends. Please always be in touch.

As always,

Katelyn

Really enjoyed this and agreed with so much of it. Go Vanguard and Nuclear! (Vanguard provides access to Vanguard-like Private Equity that is pretty interesting.) I can't keep up with you on anything pop-culture.