Hi friends,

We all see different signs of life reverting to what we remember from the pre-pandemic era. My reflection from this week? People are on vacation and are taking vacation more seriously than in prior summers. A release built-up over the last two years, perhaps. Everyone needed a holiday and a little time in the sun. Every week I send this email out I get more and more 'out-of-office' or 'on holiday' responses.

After reading widely, listening to many podcasts, and attending webinars, my prediction is that the corporate earnings coming out in July continue to look bad (a consensus view), and while we may experience a few days that feel like rebounds, these instances are bear market bounces. There is a lot of uncertainty in the markets and in business decision-making. It will take until at least September when the majority of people are back from holiday, to have significant decisions get made and actions get announced. Parents will have decided where and how they will educate their children. Businesses will decide how aggressive they are going to be on M&A, how much capital they will deploy, and how they will cut costs. Consumers will decide how to react to inflation, where to live, and how to save (or not); workers may even decide to return to participating in the labor force. And the technology and venture capital ecosystems will decide what gets life-extending funded and which companies have to fend for themselves.

From September to December, a new normal will emerge. What is will be exactly, nobody knows. But, I'd like to make some predictions. So, during August, I am going to focus more on writing Obviously The Future columns and compile insights on associated megatrends. I'll explain more next week. I'd love constructive criticism and critique and will aim to make the exercise participatory. Stay tuned!

Today's Contents:

Good Reads: Sensible Investing

Good Reads: Trends

Weekly Song: You Make My Dreams

Good Reads: Sensible Investing

"US Series I Bonds Seem Like a Great Deal" Here again. This was the most clicked on link in Declarative Statements last week. My friend Lauren sent me a thoughtful bullet point list on why these may not be as great as they seem. See below. Takeaway lesson? There are no easy winners in this market.

You can only purchase $10,000 per year (with the option to purchase another $5,000 per year directly from a federal tax refund, if you have one).

The interest is computed off a fixed-rate + semiannual inflation rate. Currently, the fixed-rate on a new I-bond purchased is 0%. So the current rate is 0% + inflation (currently 4.81% semiannually for a total of 9.62%). On the surface, that sounds pretty good!

The inflation rate changes and updates twice per year, which has been a good thing this year…but when inflation starts to go down, so too will the corresponding interest rate

One of the most important components of this is that you don’t actually receive the interest as income; the interest simply accrues with the value of the bond. So you don’t receive the interest until the bond matures or you cash out of the bond.

I-bonds have 30 year maturities. You can sell an I-bond anytime after 12 months of purchasing it, but if you sell it within 5 years of purchasing it you will lose the last 3 months' worth of interest. After 5 years, it is fully salable.

My biggest question mark is what you receive when you sell an I-bond. The price you sell the bond at is determined by the secondary market for the I-bond at the time. Presumably, if you are selling an I-bond, it is probably because inflation has gone down and it is no longer attractive. I am sure that does not help the secondary market value of the I-bond because who would want to buy it? Secondly, the only thing making one I-bond more valuable than another is the fixed-rate that is tacked on top of the inflation rate. And if you are buying an I-bond today, your bonds fixed rate is 0%. If that fixed rate ever changes on new I-bonds even slightly (to 0.2% or 0.5%), then your I-bonds' fixed rate of 0% does not look attractive at all, further hurting the secondary market value.

Pakistan's Economy is in Deep Crisis. Thread by Atif Mian. If Pakistan becomes the next Sri Lanka, that's a much bigger deal given the size of the population and the regional significance. One of the points he makes is that Pakistan is at the mercy of foreign assistance: Energy is mostly imported, medicine are mostly imported, even in food unfortunately. Pakistan is no longer self-sufficient.

In the coming years of scarcity, the question of 'how self-sufficient are you and your economy' will become increasingly important.

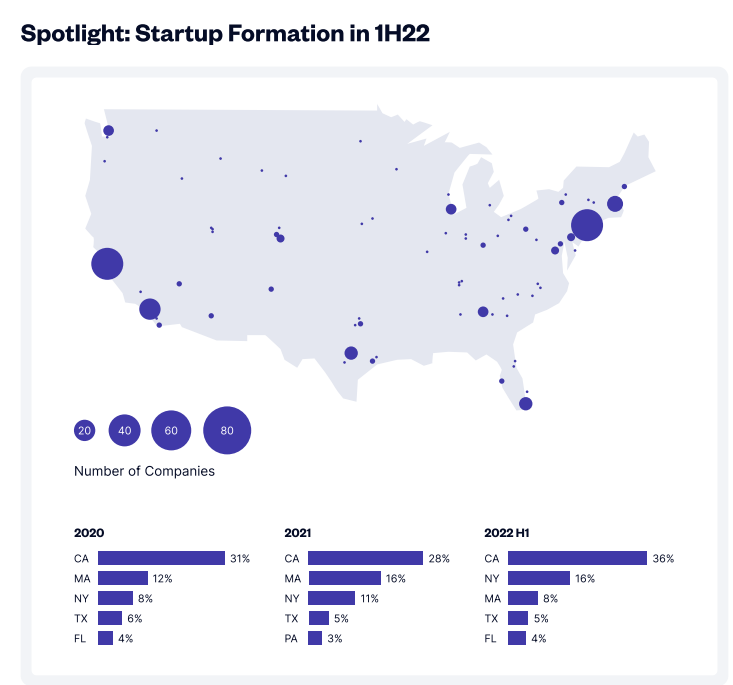

AngelList 2Q22 report. Here. Super comprehensive. TL/DR: Q2 saw the largest ever quarterly decline in VC performance on AngelList:

2.3% decline in fundraising activity

5.5% decline in positive activity (markups)

Median seed valuations flat

Series A valuations up

I find company formation location interesting (see below). CA is large, but it's maybe more split between SF and LA. NY has overtaken Boston. I would expect Seattle, Chicago, and Atlanta to be fairly close to Austin and Miami.

Alluvial Capital Q2 2022 Letter to Partners: Here. Alluvial is a well-regarded public micro cap firm. I appreciate the contrarian nature of the investment thesis.

I don’t worry about falling stock prices. I don’t enjoy them by any means, but they don’t keep me up at night. What I do worry about is permanent loss of capital. There are a variety of ways to achieve a permanent loss, but at the heart of each is the same error: over-paying. There’s a school of thought, a very popular one at present, that says investors should spend all their time identifying the market’s highest quality companies and ignore all the rest. And that once these paragons of virtue are found, nearly any price can be paid for their shares and a good outcome assured. I am not a subscriber. I am willing to invest in average or even sub-par businesses, provided they are priced so modestly that a large margin of safety exists. A company does not have to dominate its industry, invent the next iPhone, or become a global household name for shareholders to earn an outstanding return.

Good Reads: Trends

U.S. Fintech & Payments Crash Course: If you’re new to the world of fintech and payments, or you’re hiring people who are new to the industry, this post will help with onboarding. Here.

Potential Fabrication in Research Images Threatens Key Theory of Alzheimer's Disease. Here. H/T William McQuillian: Two of the biggest pieces of research on Alzheimer’s - done by different groups - look to have doctored research results. One is the most cited paper in Alzheimer's research. Literally, hundreds of millions, perhaps billions in funding, would have been funded off the back of these fake results if true. It was two neuroscientists who are also prominent short sellers who figured out the lies.

Ex-Coinbase Manager Arrested in US Crypto Insider-Trading Case. Here in Bloomberg. The premise of the charge is that a manager bought tokens prior to the listing on the exchange. It makes it seem like those tokens are securities and he's being charged for securities fraud. Coinbase has come out swinging with its Chief Legal Officer blogging that Coinbase does not list securities. End of story. But it's all murky, and that's the problem.

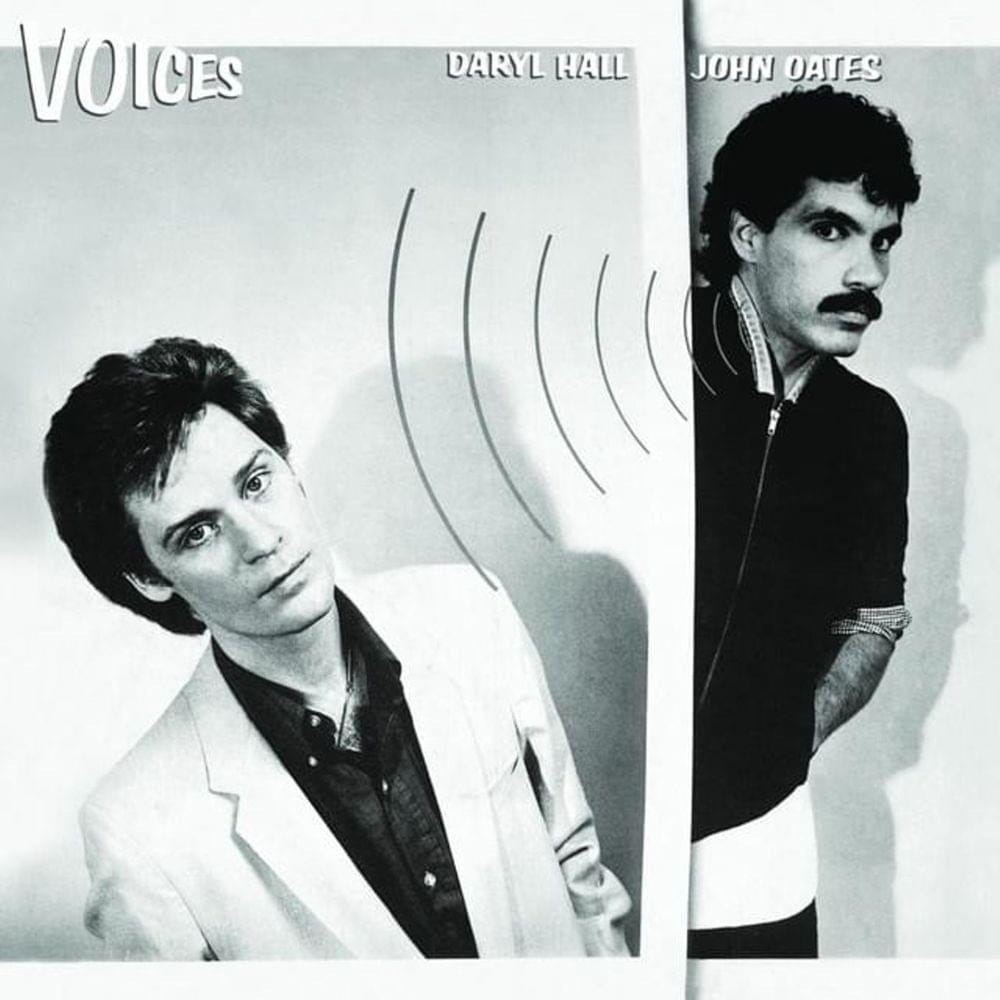

Weekly Song: You Make My Dreams

This song has been featured in so many movies and TV shows over the years, but the most iconic to me is the scene from 500 Days of Summer with Joseph Gordon-Levitt. You can see the song in featured in the film here. It's classic, upbeat, and energizing. I love it. The whole 500 Days of Summer soundtrack is great.

Zoey Deschanel (lead actress in 500 Days of Summer) and I share similar hair color (but not personality). In 2014, on an impulse, I decided I should cut my hair to try out her iconic bangs for myself. It did not stick, but it could have been worse. See for yourself:

"You Make My Dreams" by Halls & Oats

On a night when bad dreams become a screamer

When they're messin' with a dreamer

I can laugh it in the face

Twist and shout my way out

And wrap yourself around me

'Cause I ain't the way you found me

And I'll never be the same, oh yeah

Well, 'cause you (ohh-ohh, ohh-ohh-ohh)

You make my dreams come true

(You-ooh, you-you-ohh-ohh) Oh yeah (you-ooh)

Well, well, well, you (ohh-ohh, ohh-ohh-ohh)

You make my dreams come true

(You-ooh, you-you-ohh-ohh) oh yeah (you-ooh)

Well listen to this, oh

I'm down on the daydream

Oh, that sleepwalk should be over by now, I know

Thanks for reading, friends. Please always be in touch.

As always,

Katelyn