Dear Friends,

Yes, it’s technically a long weekend, but those don’t exist for me. I have six-and-a-half hours of back-to-back calls on Monday (although I’ll note that I have a no external call rule on two days of the week, which has been working well since I started last month).

I find it funny when people say ‘hope you have a great long weekend.’ I think you just have to play along, right? Yeah, it’s going to be great!

There’s no rest, but I’m not complaining :)

Today's Contents:

Good Reads: Sensible Investing

Startup Cassandra: The Critters Strike Back

Book Review: The Code Breaker

Song of the Week: You’re So Vain

Good Reads: Sensible Investing

The Maze Is In The Mouse: What ails Google, and how it can turn things around. This is sort of a ‘same stuff, different day’ article that could be written about any giant company that had amazing monopoly power in a massive market for a long time. What is new is that people have woken up and now see this clearly in Google, and it’s a well-written article with specifics, not generalizations, e.g.,

(1) no mission, (2) no urgency, (3) delusions of exceptionalism, (4) mismanagement.

Overall, it is a soft peacetime culture where nothing is worth fighting for. The people who are inclined to fight on behalf of customers or new ideas or creativity soon learn the downside of doing so.

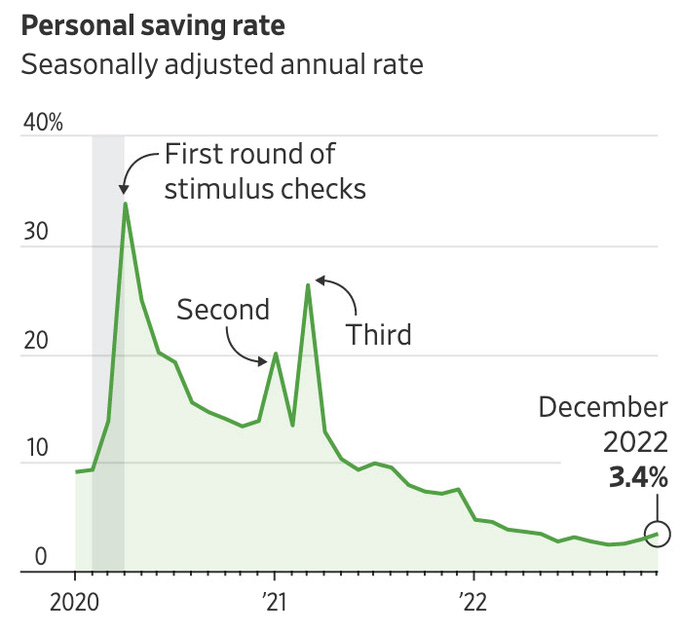

What’s Going On With Inflation and Consumer Health?

The consumer isn't tapped out (yet). Axios writes that inflation remains because Americans keep spending.

Economists and investors can’t decide if we are having a soft landing with full employment and strong consumer spending or if this is a blip as we are headed to tougher economic times with persistent inflation and higher interest rates. I don’t know. Nobody knows. But, I think interest rates will continue to rise, consumers will start to run out of cash, and labor markets will remain tight as demographic challenges make it so. What does that all add up to? TBD.

The Critters Strike Back / An Open Letter From a Founder to VCs

** Note: I did not write this. It was an anonymous submission by ‘Startup Cassandra’, a venture-backed founder who has published in DS before. I love challenging, articulate viewpoints. I’m happy to share and spark the debate. And, while we are on the subject, I was a nationally ranked high school debater and competed globally in college. Please debate me. There is nothing I enjoy more. But, it has got to be rigorous and smart. This is.

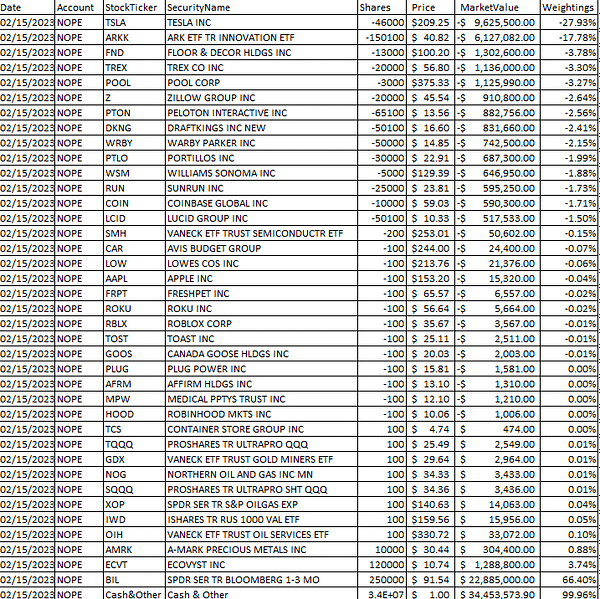

While you can’t time the markets, I think the ride may be a bit bumpier (see charts above) than Startup Cassandra. I can understand the annoyance of founders at VCs making statements about blanket extinction events of their own creation.**

Dear Founders and Investors,

Some of you may remember me from February 2022, where I issued a warning to all startups: Batten Down The Hatches.

In retrospect, that call turned out to be rather prescient, and much of what was warned has come to pass. At my startup, I laid off 60% of our team 2 months after making that post. We are still iterating towards product-market fit. The bubble in venture land has most definitely popped, and euphoria has been replaced with fear.

Well, I’m back one year later to tell you that the pendulum has swung too far.

Things in venture land have gotten far too bearish, and the lemmings aka beta-chasing VCs who bought at the top, are now likely to sit on their hands at the bottom. Don’t be that guy/gal.

Exhibit A:

The Venn diagram of people investing in startups at 100x ARR in 2021 and now calling for “extinction events” is a circle (checks notes: he did invest in Coinbase).

You can imagine my rage reading a VC refer to startups.

Exhibit B:

What recent startup might he have passed on had he been looking at their Income Statement for the first four years of their existence? Figma.

VC stands for Venture Capital, not Private Equity.

Biased here as a VC-backed founder, but Venture Capitalists evaluating Seed and Series A companies solely based on their Income Statements is patently absurd. Apparently, many VCs need a founder to remind them that they are in the business of taking RISK. Your mandate is to find portfolio-defining companies, i.e., the 100 and 1000x baggers. Companies that return 100-1000x typically do not have 'income statements' or ‘conventional business plans’ in their early years because they are usually building something new. That takes time (typically 2-3 years). More so, most great companies are born either out of genius, desperation (hail marys), or luck. There is simply no way to evaluate that in the early years based on conventional metrics.

Sure, you could only invest in companies that have ‘real business models’ and ‘real revenue,’ but don't blame Cassandra when you wake up three years from now and realize that your entire portfolio consists of e-commerce brands and 'tech-enabled' services, i.e., companies that have 0 shot of returning your fund.

What will happen to the platform plays, the moonshots, and the insane ideas that you pass on today? Most of them will die, but a few of them will return somebody else's fund and then some.

But, but, rates are at 5%! ZIRP isn't coming back!! It was all just a dream!!!

Come take a seat on mommy Cassandra's lap and let me explain some things to you, again.

In my Feb 2022 post, I outlined two important concepts in investing: Reflexivity and Lag.

Reflexivity:

Markets are reflexive. Investors don't base their decisions on reality, but rather on their perceptions of reality instead. The actions that result from these perceptions have an impact on reality, or fundamentals, which then affects investors' perceptions and thus prices.

The economy may be strong today but the mere fact that investors view the future as being bleak makes the future bleak.

Lag:

What happens in the public markets typically shows up in private markets i.e. VC with a 6-12 month lag.

Remember that Reflexivity cuts both ways, and what happens in the public markets shows up in VC land in 6-12 months.

I hate to break it to you, but the time to go max levered long in the public markets was three months ago.

Exhibit C:

TL;DR We are in the early stages of a bull market; get jiggy with it.

So repeat after me: I am a venture capitalist, not a private equity investor.

Now repeat it again, write it down, and put it under your pillow when you go to sleep tonight, dear VCs because I can guarantee you that your LPs know the difference.

Yes, rates are at 5%. We're also on the cusp of having self-driving cars; 40% of the code at my startup is now written by AI (for free!); peace could break out in Ukraine; and crypto might even finally find a legitimate use case (lol).

Or maybe rates go to 10%. Anything can happen, and nobody knows anything.

One thing has been true since the dawn of time, however: pessimists sound smart, and optimists make money. Choose wisely.

— Startup Cassandra

Book Review: The Code Breaker: Jennifer Doudna, Gene Editing, and the Future of the Human Race

Here on Amazon.

A signed copy of this book landed in my lap this week, and I have a strong desire to ‘complete the task’ once it’s handed down. Walter Isaacson is readable, and the subject matter is interesting and relevant, so I highly recommend it.

The Code Breaker is part biography of Jennifer Doudna, a Nobel Prize-winning scientist who published the first findings on how to edit DNA using RNA. It contains a good amount of the history of the science behind gene editing and a lot of human interest in the personalities of the scientists involved. Themes that flow through the book include:

The importance and prevalence of both extreme competition and some collaboration among scientists and labs to produce scientific breakthroughs. Jennifer Doudna and her lab at Berkeley raced against Feng Zhang and the Broad Institute and probably still do. As Isaacson notes, “almost every person in any saga tends to remember their own role as being a little more important than the other players see it.” He writes, “Competition gets a bad rap.”

The sometimes under-reported but important contributions of women to the field, including Rosalind Franklin, whose x-rays illuminated the initial structure of DNA.

The relationship between academic work that is often paid for by the public but then monetized by for-profit biotech startups. Just this week, Aera Therapeutics, co-founded by Feng Zhang, debuted from stealth with almost $200M in private funding. It seems both Zhang and Doudna sit as the scientific advisor of several genetic engineering companies.

James Watson, credited with discovering the structure of DNA with Francis Crick, proves controversial in this era. That said, the early descriptions of the pair are amusing. “They admired each other’s immodesty. “A youthful arrogance, ruthlessness, and an impatience with sloppy thinking came naturally to both of us.” “They despised authority but craved its affirmation. They found the scientific establishment ridiculous and plodding, yet they knew how to insinuate themselves into it. They imagined themselves quintessential outsiders, yet felt most comfortable sitting in the inner quadrangles of Cambridge colleges. They were self-appointed jesters in a court of fools.”

Ethics of Gene Editing. Michael Sandel, a moral philosophy professor from Harvard who Isaacson refers to as ‘the contemporary successor to John Rawls in defining the concept of justice is referenced at least four times. We’ll get to him next week because by pure coincidence his book The Tyranny of Merit was in my queue next and is half finished.

Song of the Week: You’re So Vain

Here on YouTube with Carly Simon and Taylor Swift singing together.

It’s a fun song. It was Valentine’s Day this week. It’s a reliable sentiment, and what’s funny is that Carly has refused to name who the song is about, and it could be any of Mick Jagger, Warren Beatty, James Taylor, David Bowie, David Cassidy, and Cat Stevens. Maybe all of them!

“You’re So Vain” by Carly Simon

You're so vain (you're so vain)

I bet you think this song is about you

Don't you, don't you?

Selfie of the Week

It was my sister’s 30th this week so we did an obligatory getaway to the beach.

Thanks for reading, friends. Please always be in touch.

As always,

Katelyn