If I Ever Leave This World Alive

w.247 | Crypto, Starbucks, ParentTech, Nord Anglia, & Factorio

Dear Friends,

I have learned in recent years that it is better to focus on understanding truth and the reality of the world today - and respond pragmatically - than it is to fixate on the ways you might wish it was different.

It’s an exciting time to work because there is such a gap between where we are today and the future potential - for government, for AI & productivity across the economy, and for education institutions. All will come down to the details of implementation, and the opportunity to get it right (and do good for everyone) is enormous.

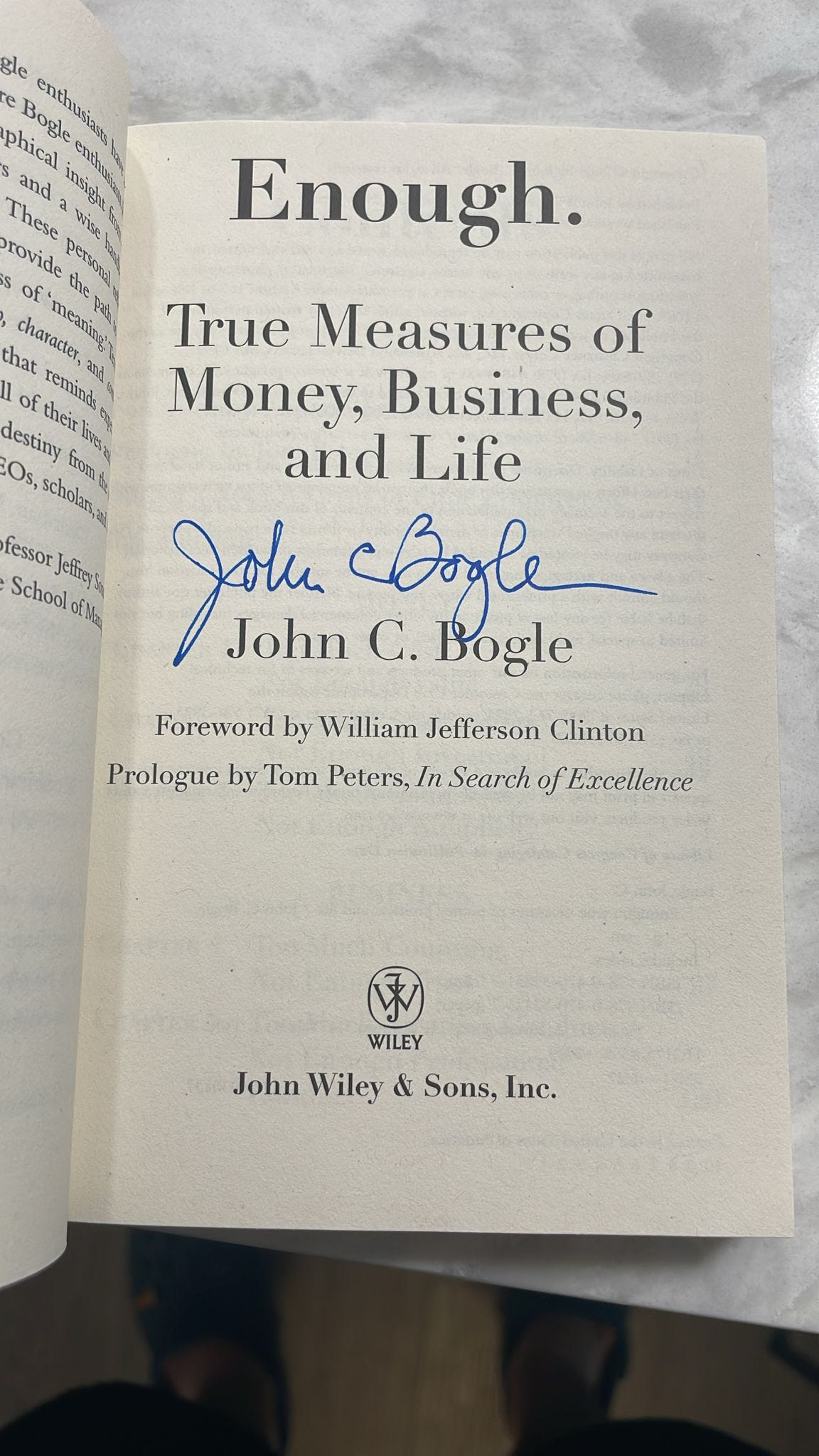

Also, thanks to everyone for sending all the fan mail. It’s been fun to see how different things grab different people. John Callovi gets the win this week with a photo of the front page of the book that he’s currently reading - a SIGNED COPY!

Today's Contents:

Sensible Investing: Trends

Katelyn Heart Factorio

How I Invest - Part 4

Song of the Week: If I Ever Leave This World Alive

Sensible Investing: Trends

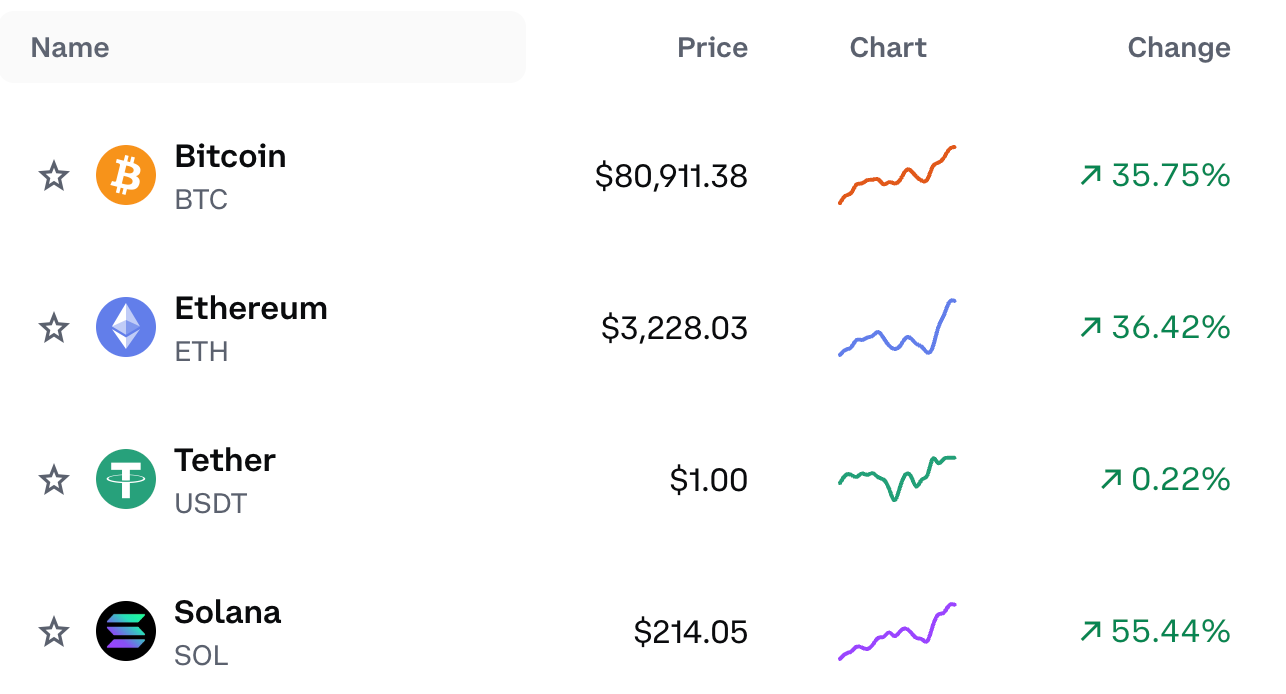

Crypto Prices are Ripping. If you wanted to trade on the election, the clearest thesis would have been/still is top currency names. Below is the change from last month.

At $14.5B, Nord Anglia is the World's Largest Education Company, as a chain of international private schools - operating over 80 schools in 33 countries and educating more than 85,000 students from ages 2 to 18. News is that Neuberger Berman Private Markets, EQT, and CPP Investments formed a consortium to acquire the company.

Many years ago, Nord Anglia was a potential acquisition target at my former employer, but direct delivery of education was deemed a bad business model. Running schools is not the easiest operation, but it is a necessary service with strong demand and, at the high end, a completely inelastic pricing opportunity.

ParentTech is Hot Now…Apparently. These are all information or coordination products. Selling to parents traditionally has been challenging. Parents are cash-strapped and often like to buy used, and then once you’ve been through the journey, you don’t usually have to do it again. As someone in a group chat said, “TAM tends to be limited to the first-born children of college-educated professionals.”

AI x Parenting by a16z

Can today’s startups help parents raise happy, healthy Adults? by p72 ventures

But Can ParentTech Solve This: How Starbucks Became a Sugary Teen Emporium (link to PDF in Bloomberg). It’s a bit bleak:

Starbucks said it doesn’t share what percentage of its sales are attributable to customers under 18, but the menu is increasingly catering to Gen Z. Colddrinks, which are generally favored by younger customers, according to Starbucks, have consistently accounted for about 70% of the chain’s beverage sales for at least the last three years.

“The younger you go, the colder the beverage,” then-Chief Marketing Officer Brady Brewer said in 2022 of the large industry trend (he’s now the company’s head of international).

Katelyn Heart Factorio

How ‘Factorio’ Seduced Silicon Valley — and Me. (Link to PDF in FT). Tech workers cannot resist the cult video game that asks players to single-handedly restage the Industrial Revolution.

For systems-builders and problem-solvers, Factorio is a sort of utopia, without bosses, without paperwork, where you’re always free to do the best work you’re capable of; and it’s the product of Kovařík creating this utopia in his own life.

This well-written article is about my favorite computer game. They nail all the salient points about how the game was founded (seeking ownership), how it’s an amazing education and training tool, and its love among tech companies. It’s back in the news because they just released a new expansion set.

9 Lessons I Learned from Over 100 Hours of Playing (and Beating) Factorio. I wrote this reflection a few years ago and just decided to publish it.

How I Invest - Part 4

I might make this section semi-permanent and drop the counting. There’s always more to say and so many nuances. Why not make this a democratic process? What do you think?

For this edition, I’ll answer the question, 'How did I get here?’ This is tangential to 'Who am I?’ The latter is the bigger question, but the former provides the primary source of explanatory material.

One of the more annoying remarks people still make to me is, ‘Well, I bet you never thought you’d be an investor!’ This is surprising since this is the only consistent thing I’ve thought about, refined, and improved upon over the last two decades.

No one is born a venture capitalist, but everyone is born an investor. We all start from the same place of zero knowledge and are either self-taught or taught by our parents. Even though some might begin with assets to their name, how you spend your time and the quality of your judgment over time compounds.

Personal finance and wealth have always been about freedom and independence. As we discussed in our last conversation about Jack Bogle, if what you have is what you want, you can find the number where you have enough.

At least to me, wealth that is not self-generated feels different because a gift does not imbue self-confidence like wealth earned and wealth self-managed. Family wealth provides different freedom because it can come with strings: expectations, terms, and conditions. While plenty of exceptions exist, I’ve seen too many examples of heredity wealth as a poisoned chalice.

Four people - all DS readers! - are responsible for most of my education.

Generally in chronological order of their influence on me:

Emma Rasiel taught a class called Wall Street Demystified that I took as a sophomore at Duke. The reading list included A Random Walk Down Wall Street, When Genius Failed, and a less-than-flattering one on Jim Cramer. Strangely, I can’t find a trace of it anywhere, but I still remember the point: CNBC is entertainment and a distraction.

Emma’s class on financial valuation and bond math had a policy of no half credit for showing work: ‘If you get it wrong on the trading floor or in real life, there will be no partial credit.’ I appreciated that discipline and direct feedback.

Emma also organized a campus-wide event in the fall, i.e., Trading Competition. The prize for winning with the highest returns was an automatic second-round interview for a summer internship at Morgan Stanley for sales & trading. I won this competition in the fall of my junior year and had THE BEST time working on the trading floor in the summer of 2007.

Ed Tower is a Professor Emeritus of Economics at Duke University. His formal bio includes the line, “He loves free trade, flexible exchange rates, and Jack Bogle.” He discovered an anomaly in Vanguard International Mutual Funds, and we worked on my senior thesis together, which was on Time Zone Arbitrage Trading Strategies.

Ed is a Boglehead and inspired my loyalty to Vanguard. I KNEW once I wrote the last edition that Ed would email me about his new active Vanguard investing papers. And he did. Here’s the news from the Bogleheads conference:

The bogleheads offered a prize consisting of the book, "Enough", to anyone who could say the most innovative thing about Jack. My entry was that everyone talks about Jack's contribution to investors in Vanguard funds. But here is another angle. By cutting expenses and causing the industry to follow his lead, he cut the implicit tax on the saving-investment process, helping to build the capital stock, and with more capital to work with, this drove up wages. so the non investing working class should thank Saint Jack. I won the prize!

Here is Ed’s winning submission about active management.

Charlie Stone was a Princeton history student who graduated a year ahead of me and then worked for the Duke Endowment during my senior year. He was best friends in high school with one of my close Duke friends. I remember going to his apartment off campus and marveling at the stacks upon stacks of flashcards that he had around in preparation for the CFA exam.

Charlie is a true student of the craft of value investing and hosts a crew at the annual general meeting of Berkshire Hathaway, which has become a staple for me as well.

He would never tell you he co-founded Europe’s leading emerging value hedge fund, Alfreton. When I told him I was starting an avalanche, he emailed me the subject line ‘First Snowball.’

Anonymous Wealth Advisor. One of my favorite friends who practices his craft far better than any I’ve met. His advice is pretty simple: Optimize for taxes. Diversify. Never sell. Don’t time the market. Hates crypto, though.

There is always the little voice in my head as I fill out the dual-factor authentication to log into my Vanguard account.

Akin to having a guardian angel, his latest text bomb (August): “Also, pls tell me you bought the market and have not sold!!!!

Me: I did!! I learned from the best. Just keep buying.

With friends like these, it’s impossible to lose.

Song of the Week: If I Ever Leave This World Alive

Here on YouTube.

Flogging Molly is a Celtic band known for its wide range of punk to folk upbeat charms. This song is a standout reflective piece from their seven albums.

I picked this song before we knew the results of the election. How you live your life and what you want to leave behind is irrelevant to the politics of the day. These are more important considerations posed by the song.

How can you leave this world and be alive?

The lyrics transcend the finality of death, presenting a vow of endless presence and sincerity. The narrative voice doesn’t speak with finality but with the surety of continuing past physical constraints.

One’s legacy is in the memories of people you have impacted and share respect, understanding, and trust.

“If I Ever Leave This World Alive” by Flogging Molly

If I ever leave this world alive

I`ll thank you for the things you did in my life

If I ever leave this world alive

I`ll come back down and sit beside your feet tonight

Where ever I am you`ll always beSelfie of the Week

The answer to ‘What is the most beautiful place on earth?’ is coastal North Devon and Exmoor. My friend Charlie (from above) paid my long-time colleague, co-worker, and friend Michael Barber a visit to recount accomplishments, remark on the state of the world, and conduct character assassinations on adversaries, real and imaginary.

It’s definitively bad to be labeled ‘ineffective,’ but to be ‘fundamentally unserious’ is worse. However, to be ‘ungenerous’ is irredeemable.

What’s Michael Barber doing now that he’s stepped down as chairman of Delivery Associates? Among other things writing ‘Deliverology in the Middle Ages’ and getting a masters in Medieval History from Exeter, and giving interviews to the Minneapolis Star Tribute on Delivery (I’m glad they’ve taken an interest!).

For me, coastal estates, private gardens, and libraries with leather-bound books will have to wait. Onward to Singapore, the best-managed city-state in the world.

Thanks for reading, friends. Please always be in touch.

As always,

Katelyn